Question

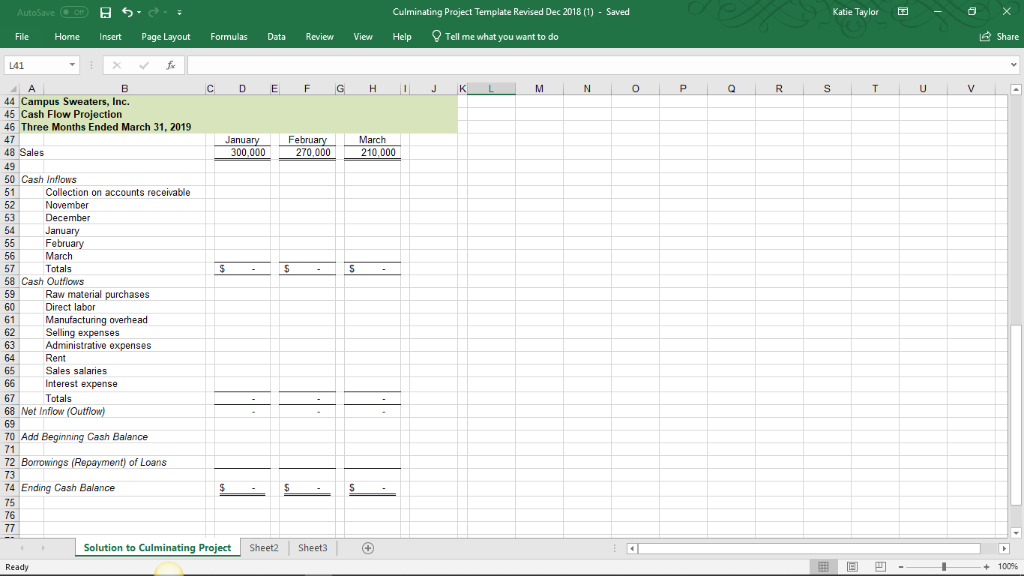

Use this Excel Culminating Project Template (SEE SCREENSHOT BELOW) to help you get started with your budget You are the president of Campus Sweaters, Inc.

Use this Excel Culminating Project Template (SEE SCREENSHOT BELOW) to help you get started with your budget

You are the president of Campus Sweaters, Inc. Campus Sweaters manufacturers wool pullover v-neck sweaters of various sizes and colors. You are preparing the budgets for the first quarter of 2016 (January, February, and March). You have the following historical and projected sales in units:

| Actual or Projected | Month | Units |

|---|---|---|

| Actual | November | 9,000 |

| Actual | December | 8,000 |

| Projected | January | 11,000 |

| Projected | February | 10,000 |

| Projected | March | 6,000 |

| Projected | April | 7,000 |

| Projected | May | 7,000 |

| Projected | June | 7,000 |

It takes ten skeins of yarn to make one sweater. Each skein costs $1.30. Past experience shows you need to have enough sweaters on-hand to fill the next month and one half of sales (approximately forty-five days). Also, you need enough yarn to manufacture the next months production.

You will have 12,000 sweaters in finished inventory and 80,000 skeins of yarn in raw materials inventory as of December 31, 2015. You purchased $90,000 of yarn in December that must be paid for in January. The Company incurred $7,500 of overhead cost during December 2015, and $13,500 of selling expenses in the last half of December. These also must be paid in January. The company policy is to pay prior month's charges on account on the tenth day of the following month unless otherwise designated.

Income Statements

| Actual or Projected Sales | Actual | Actual | Projected | Projected | Projected |

|---|---|---|---|---|---|

| Month | November | December | January | February | March |

| Sales | $240,000 | $270,000 | $300,000 | $270,000 | $210,000 |

| Cost of sales | 144,000 | 162,000 | 180,000 | 162,000 | 126,000 |

| Gross margin | 96,000 | 108,000 | 120,000 | 108,000 | 84,000 |

| Operating Expenses: | |||||

| Selling | 24,000 | 27,000 | 30,000 | 27,000 | 21,000 |

| Administration | 35,000 | 45,000 | 50,000 | 45,000 | 30,000 |

| Rent | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 |

| Sales salaries | 20,000 | 20,000 | 20,000 | 20,000 | 20,000 |

| Totals | 89,000 | 102,000 | 110,000 | 102,000 | 81,000 |

| Operating Income | 7,000 | 6,000 | 10,000 | 6,000 | 3,000 |

| Interest Expense | 0 | 0 | ? | ? | ? |

| Net Income | $7,000 | $6,000 |

A worker, using a knitting machine, can make five sweaters in an hour. The cost of direct labor per hour, including fringe, is $20.00. You incurred $13,000 of direct labor cost between December 16 and December 31, 2015 which will be paid on January 7, 2016. The manufacturing overhead rate is $5.00 per direct labor hour. All sweaters are sold wholesale to retail outlets at $30.00 each.

Salaries and wages are paid as follows: The pay period from the first to the fifteenth of the month is paid on the twenty-second day of each month; the pay period from the sixteenth to the thirty-first is paid on the seventh day of the following month.

Rent is paid in advance on the first day of each month. Fifty percent of the selling expenses are paid in the month incurred, and fifty percent in the following month. All manufacturing overhead and administrative costs are paid on the tenth day of the following month.

The cash in the bank on December 31, 2015 was forecast at $30,000. There were no outstanding borrowings. The company has a $500,000 line of credit at 12% per annum at the Old Rusty Bucket State Bank of Oreana. All borrowings, and any subsequent repayments, must be made on the fifteenth day of the month. All loan takedowns must be repaid by December 31, 2016. Repayments can be made when extra cash is available, but are due on the fifteenth day of any month. The company has the policy to have at least $25,000 in the bank account at the end of each month even if they have to borrow it. However, more may be required depending on cash needs during the first week of the following month.

20% of the sales are collected in the month of sale. Seventy percent are collected in the next month, and five percent are collected in the third month.

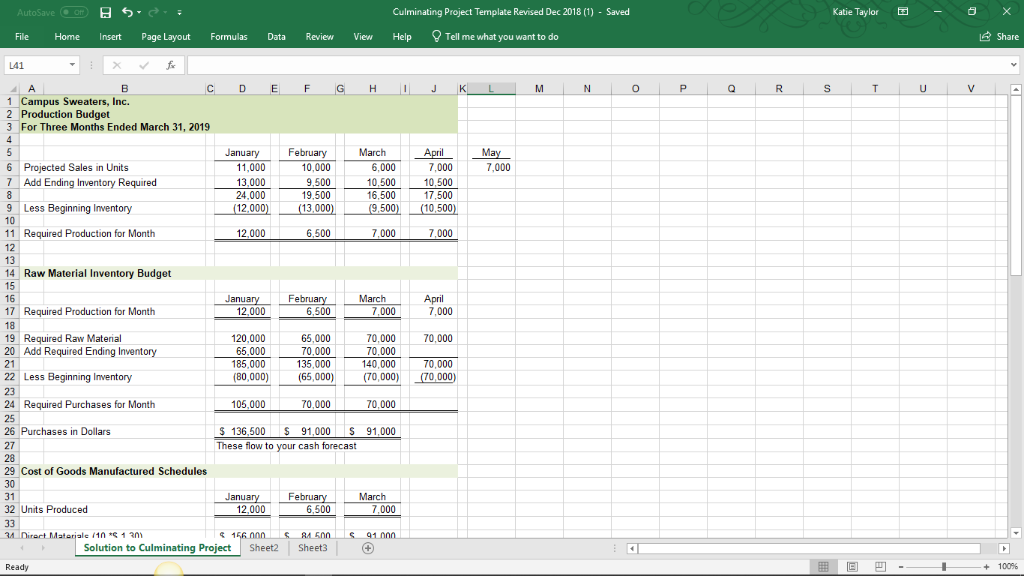

These are for the month of January

Required Production in units 12,000

Required purchases in units 105,000

Required purchases in dollars $136,500

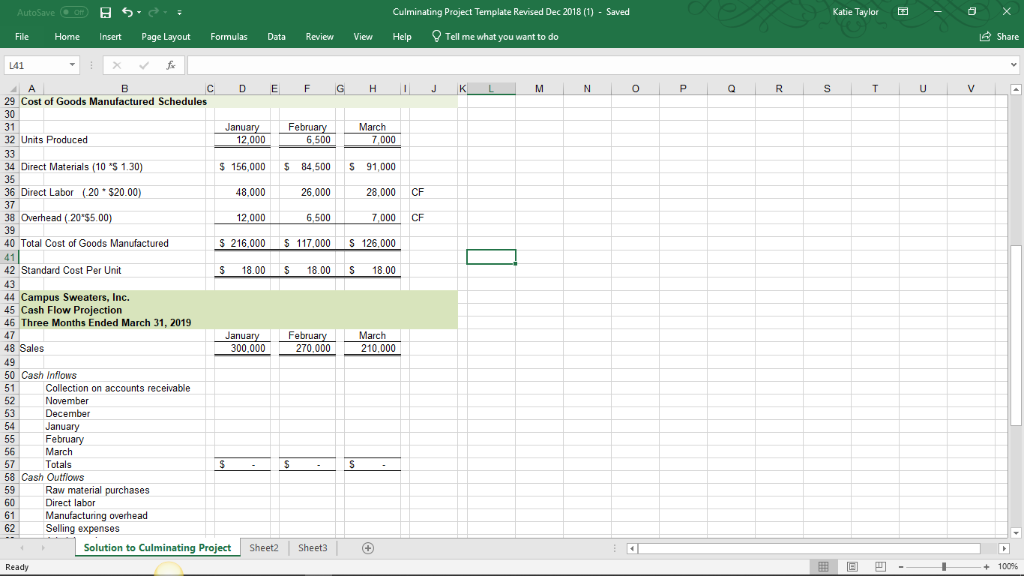

Total Cost of Goods Manufactured $216,000

>Use the information above to complete the following activities:

Step 01: Prepare a production budget for Campus Sweaters, Inc. for each of the following months: January, February, March 2016. -DONE

Step 02: Prepare a raw materials budget for each month.-DONE

Step 03: Prepare a raw materials budget in dollars for each month.-DONE

Step 04: Prepare a cost of goods manufactured schedule for each month.-DONE

Step 05: Prepare a cash budget for each month (Cash Flow Projection).--I NEED HELP ON THIS STEP ONLY.

I JUST NEED STEP 5 COMPLETED. I PROVIDED THE WORK TO STEPS 1-4 IN THE SCREENSHOTS.

MY PROFESSOR SAID THE CASH INFLOWS ARE $261,000 AND CASH OUTFLOWS ARE $238,000. PLEASE MAKE SURE THESE ARE CORRECT IN THE ANSWER YOU PROVIDE.

AutoSave Of Katie Taylor X Culminating Project Template Revised Dec 2018 (1) -Saved Tell me what you want to do LShare File Home Insert Page Layout Formulas Data Review View Help L41 D E F G K A E C H IJ M N Q R S T u V 44 Campus Sweaters, Inc. 46 Three Months Ended March 31, 2019 47 January 300.000 February March 48 Sales 270.000 210.000 49 Cash Inflows accounts receivable November December 52 53 64 January Februar 57 Totals 58 Cash Qutflows 59 Raw material purchases Direct oo ing overhead 62 Selling expenses Administrative expenses 63 64 Rent Sales salanes In expense 67 Totals 68 Net Inflow (Outflow) 69 70 Add Beginning Cash Balance 72 Borrowings (Re nent) of Loans 73 74 Ending Cash Balance 75 76 77 Solution Culminating Project Sheet2 Sheet3 E -. +100% Ready AutoSave Of Culminating Project Template Revised Dec 2018 (1) - Saved Katie Taylor X Tell me what you want to do LShare File Home Insert Page Layout Formulas Data Review View Help L41 D E F G J A E C H K N Q S T u V 1 Campus Sweaters, Inc. 2Eor Three Months Ended March 31, 2019 4 April 5 February 10 000 March May January 11,000 6.000 6 Projected Sales 7.000 Units 7,000 7 Add Ending Inventory Required 13,000 9.500 10.500 10,500 19,500 24.000 FOO Less Beginning Inventory 10 (12,000) (13,000) (9,500) 11 Required Production for Month 12,000 6,500 7,000 7,000 12 13 Raw Material Inventory Budget 15 16 January 12.000 February 6.500 March April 7,000 17 Required Production for Month 7,000 18 6 70,000 120,000 aterial 20 Add Reguired Ending Inventory 0 02 185,000 135.000 140,000 70.000 (70,000) 21 22 Less Beginning Inventory (65.000) (70.000) (80,000) 23 24 Required Purchases for Month 105.000 70,000 70.000 91 000 S 91.000 26 Purchases in Dollars. S136,500 S 27 These flow to your cash forecast 28 29 Cost of Goods Manufactured Schedules 30 31 January 12,000 February March Units Produced 00 7,000 33 34 Diract Matarjale 10 *S1 30n 156.000 8A 500 1.000. (4 Solution Culminating Project Sheet2 Sheet3 +100% Ready AutoSave off Katie Taylor X Culminating Project Template Revised Dec 2018 (1) Saved Tell me what you want to do LShare File Home Insert Page Layout Formulas Data Review View Help L41 J G K A C D E F H N Q R S T u V 29 Cost of Goods Manufactured Schedules 31 January 12.000 February 6.500 March 7.000 32 Units Produced 33 $ 156,000 S 91.000 34 Direct Materials (10 "S 1.30) S 84,500 36 Direct Labor (20 $20.00) 48.000 26.000 28.000 CF 37 38 Overhead (20 $5.00) CF 12.000 6,500 7,000 39 216,000 S 117.000 S 126,000 40 Total Cost of Goods Manufactured 42 Standard Cost Per Unit 18.00 18.00 S 18.00 43 44 Campus Sweaters, Inc. 45 Cash Flow Projection Three Months Ended March 31, 2019 47 February 270.000 March January 300 000 48 Sales 210,000 19 50 Cash Inflows 51 Collection on accounts receivable 53 December 54 January February March 57 Totals Cash 59 Raw material purchases 60 Direct labor Manufacturing overhead Selling expenses 61 62 Solution Culminating Project Sheet2 Sheet3 E -. +100% ReadyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started