Answered step by step

Verified Expert Solution

Question

1 Approved Answer

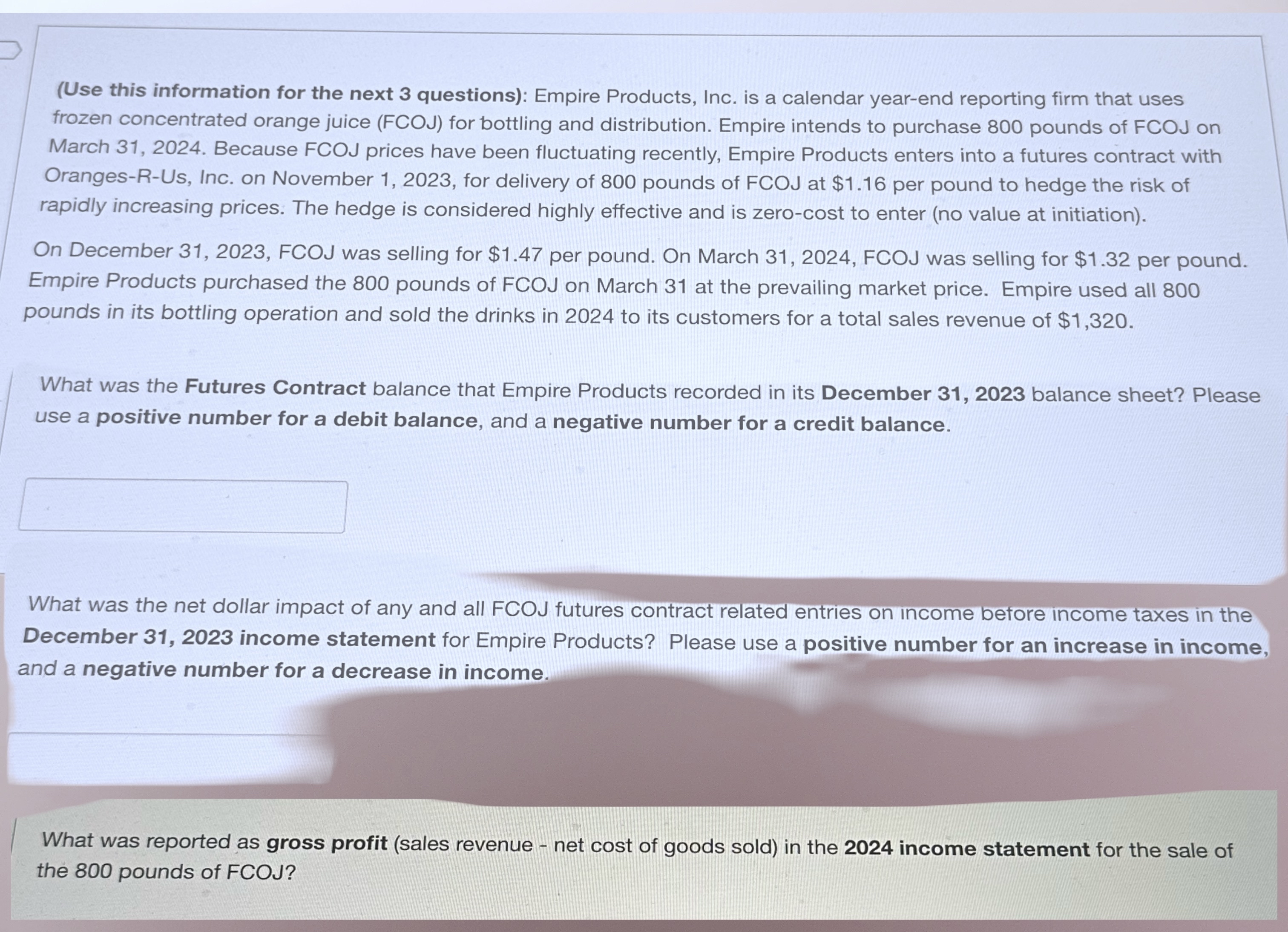

( Use this information for the next 3 questions ) : Empire Products, Inc. is a calendar year - end reporting firm that uses frozen

Use this information for the next questions: Empire Products, Inc. is a calendar yearend reporting firm that uses frozen concentrated orange juice FCOJ for bottling and distribution. Empire intends to purchase pounds of FCOJ on March Because FCOJ prices have been fluctuating recently, Empire Products enters into a futures contract with OrangesRUs Inc. on November for delivery of pounds of FCOJ at $ per pound to hedge the risk of rapidly increasing prices. The hedge is considered highly effective and is zerocost to enter no value at initiation

On December FCOJ was selling for $ per pound. On March FCOJ was selling for $ per pound. Empire Products purchased the pounds of FCOJ on March at the prevailing market price. Empire used all pounds in its bottling operation and sold the drinks in to its customers for a total sales revenue of $

What was the Futures Contract balance that Empire Products recorded in its December balance sheet? Please use a positive number for a debit balance, and a negative number for a credit balance.

What was the net dollar impact of any and all FCOJ futures contract related entries on income before income taxes in the December income statement for Empire Products? Please use a positive number for an increase in income, and a negative number for a decrease in income.

What was reported as gross profit sales revenue net cost of goods sold in the income statement for the sale of the pounds of FCOJ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started