Answered step by step

Verified Expert Solution

Question

1 Approved Answer

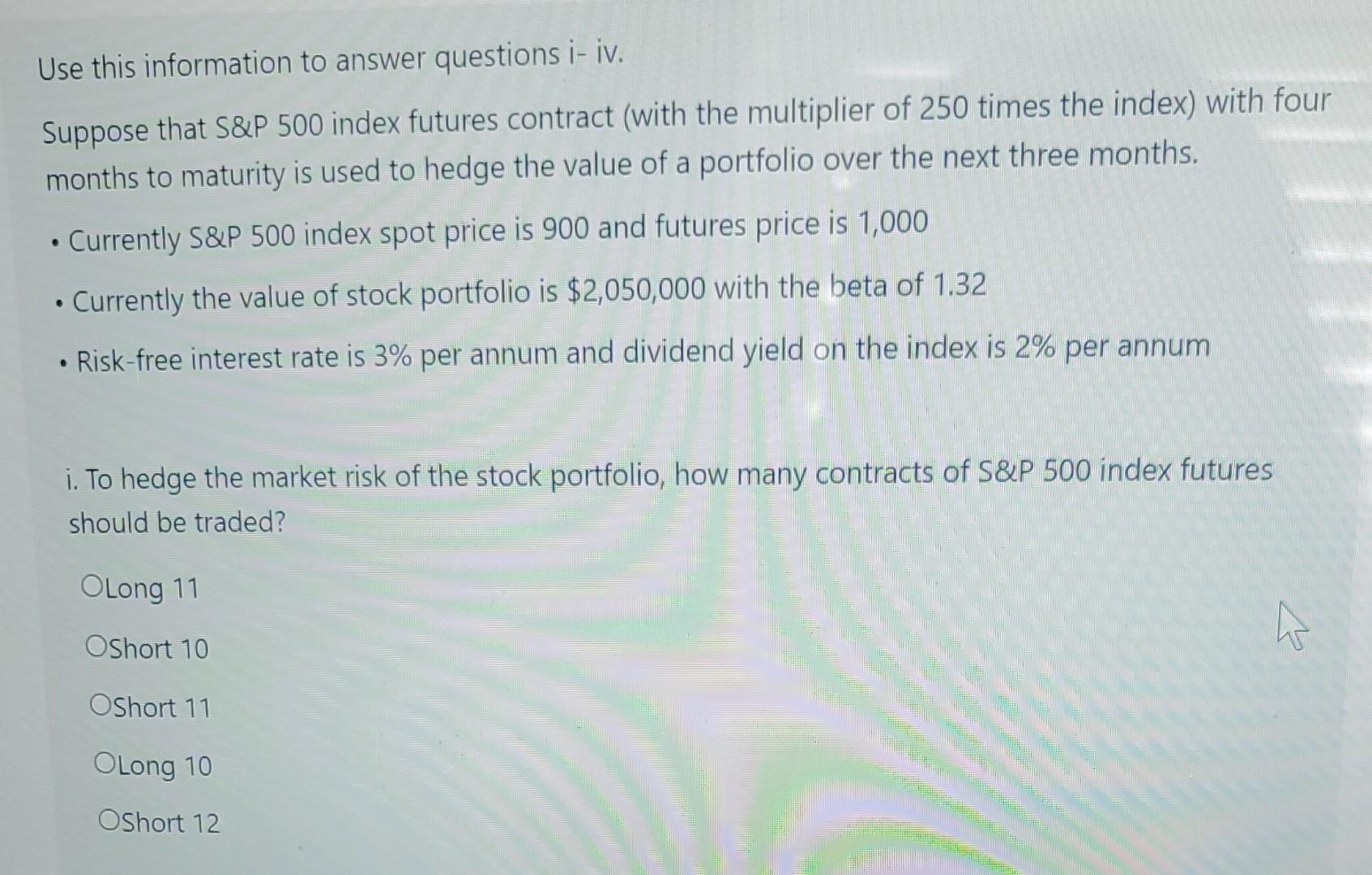

Use this information to answer questions i- iv. Suppose that S&P 500 index futures contract (with the multiplier of 250 times the index) with four

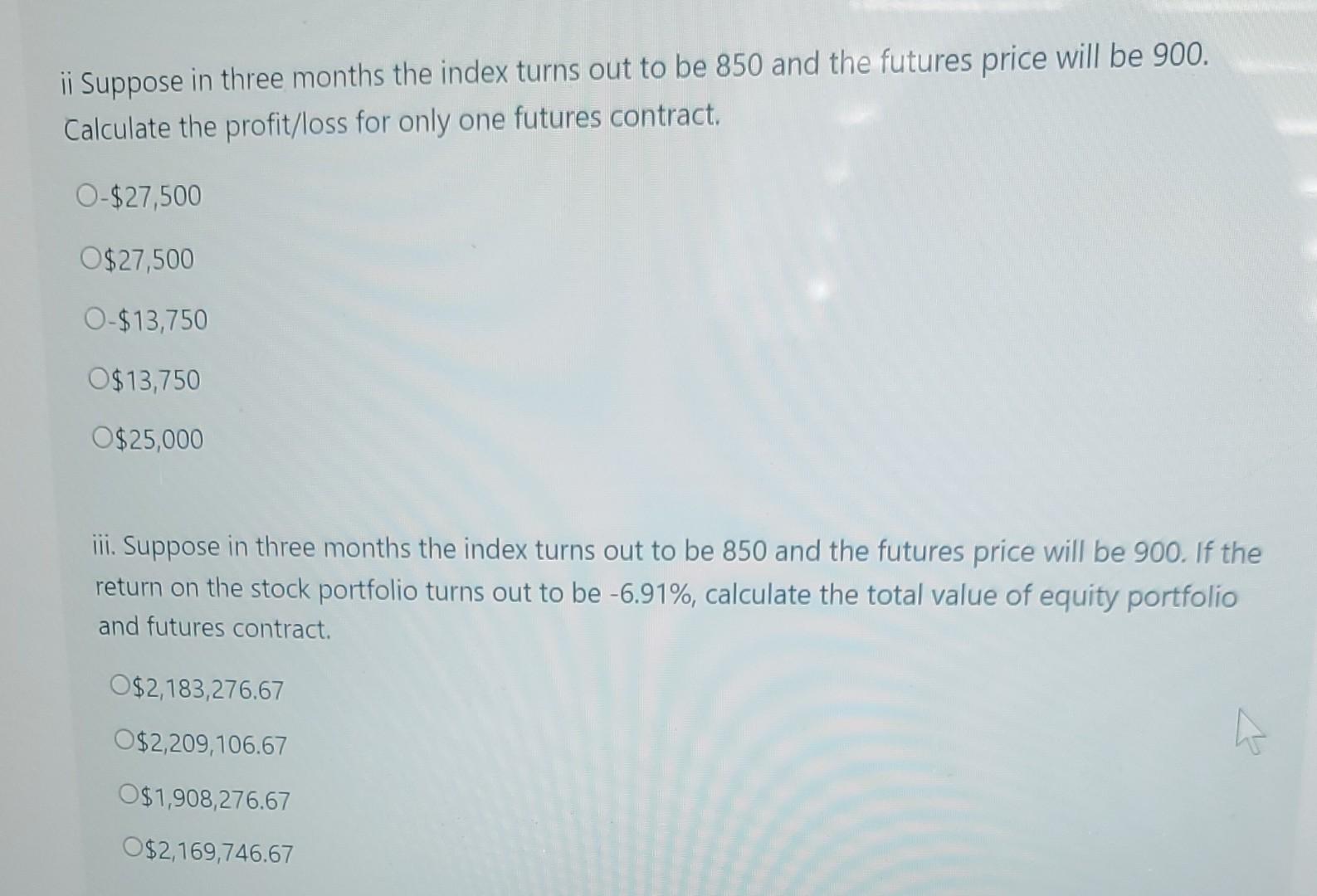

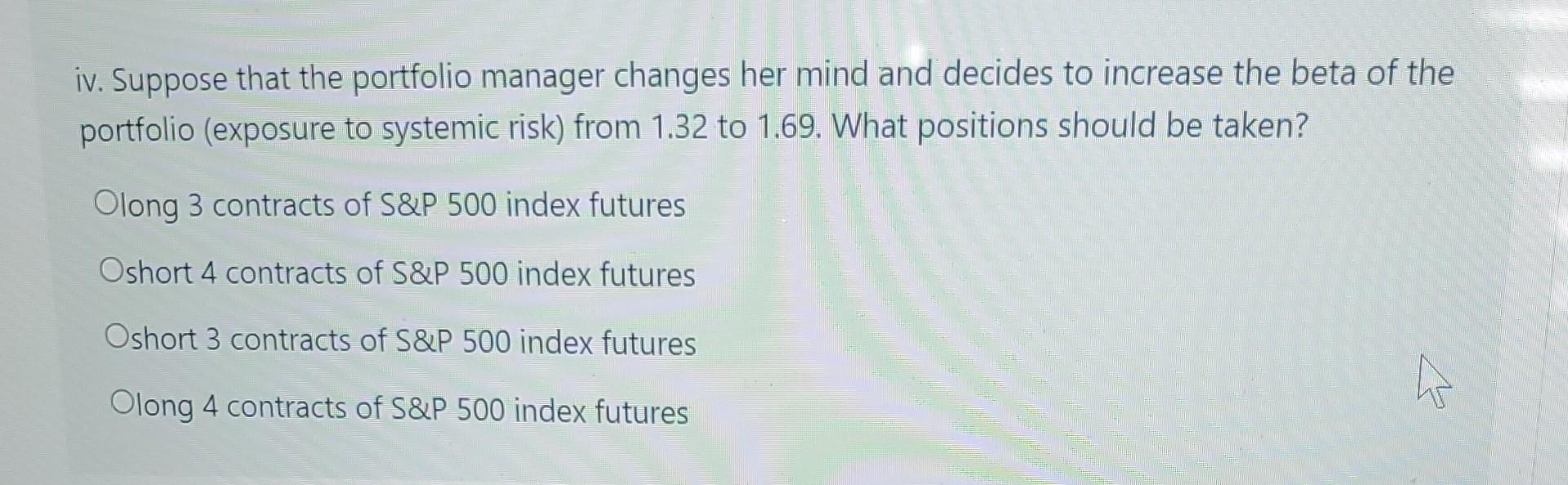

Use this information to answer questions i- iv. Suppose that S\&P 500 index futures contract (with the multiplier of 250 times the index) with four months to maturity is used to hedge the value of a portfolio over the next three months. - Currently S\&P 500 index spot price is 900 and futures price is 1,000 - Currently the value of stock portfolio is $2,050,000 with the beta of 1.32 - Risk-free interest rate is 3% per annum and dividend yield on the index is 2% per annum i. To hedge the market risk of the stock portfolio, how many contracts of S\&P 500 index futures should be traded? Long 11 Short 10 Short 11 Long 10 Short 12 ii suppose in three months the index turns out to be 850 and the futures price will be 900 . Calculate the profit/loss for only one futures contract. $27,500 $27,500 $13,750 $13,750 $25,000 iii. Suppose in three months the index turns out to be 850 and the futures price will be 900 . If the return on the stock portfolio turns out to be 6.91%, calculate the total value of equity portfolio and futures contract. $2,183,276.67 $2,209,106.67 $1,908,276.67 $2,169,746.67 iv. Suppose that the portfolio manager changes her mind and decides to increase the beta of the portfolio (exposure to systemic risk) from 1.32 to 1.69. What positions should be taken? long 3 contracts of S\&P 500 index futures short 4 contracts of S\&P 500 index futures short 3 contracts of S\&P 500 index futures long 4 contracts of S\&P 500 index futures

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started