Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USE THIS LINK!!!!!!!!!!! https://www.federalreserve.gov/releases/H15/default.htm the correct link Name Interest Rates and Bond Valuation Worksheet PartI: Go to the Federal Reserve's Web site to examine historical

USE THIS LINK!!!!!!!!!!!

https://www.federalreserve.gov/releases/H15/default.htm the correct link

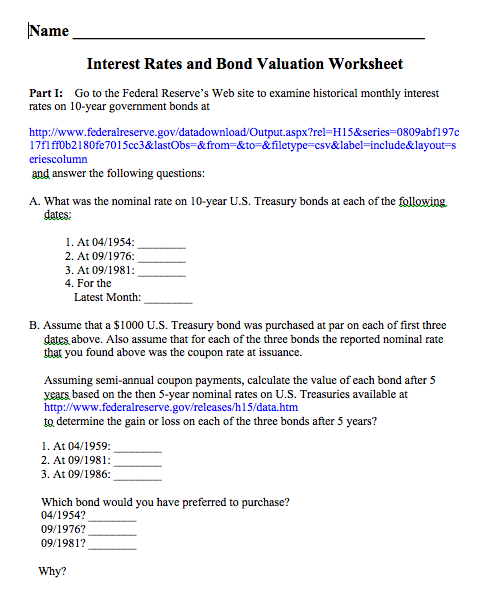

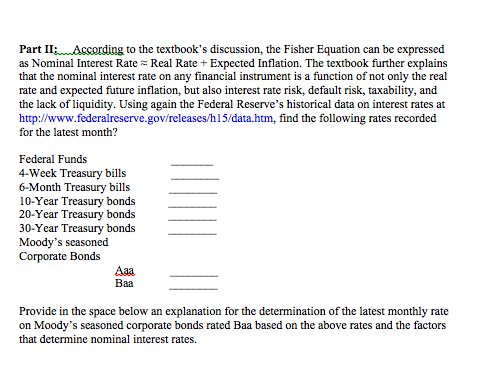

Name Interest Rates and Bond Valuation Worksheet PartI: Go to the Federal Reserve's Web site to examine historical monthly interest rates on 10-year government bonds at http:/www.federalreserve.govidatadownload Output.aspx?rel-HlS&series 0809abf197c 17f1 ff0b21 80fe701 5cc3&lastObs-&from-&to=&filetype-csv&label: include&layout s eriescolumn and answer the following questions: A. What was the nominal rate on 10-year U.S. Treasury bonds at each of the following. dates: 1. At 04/1954: 2. At 09/1976: 3. At 09/1981: 4. For the Latest Month: B. Assume that a $1000 U.S. Treasury bond was purchased at par on each of first three dates above. Also assume that for each of the three bonds the reported nominal rate that you found above was the coupon rate at issuance. Assuming semi-annual coupon payments, calculate the value of each bond after 5 year based on the then 5-year nominal rates on U.S. Treasuries available at http://www.federalreserve.gov/releases/h15/data.htm to determine the gain or loss on each of the three bonds after 5 years? 1. At 04/1959: 2. At 09/1981: 3. At 09/1986: Which bond would you have preferred to purchase? 04/1954? 09/1976? 09/1981? Why? Name Interest Rates and Bond Valuation Worksheet PartI: Go to the Federal Reserve's Web site to examine historical monthly interest rates on 10-year government bonds at http:/www.federalreserve.govidatadownload Output.aspx?rel-HlS&series 0809abf197c 17f1 ff0b21 80fe701 5cc3&lastObs-&from-&to=&filetype-csv&label: include&layout s eriescolumn and answer the following questions: A. What was the nominal rate on 10-year U.S. Treasury bonds at each of the following. dates: 1. At 04/1954: 2. At 09/1976: 3. At 09/1981: 4. For the Latest Month: B. Assume that a $1000 U.S. Treasury bond was purchased at par on each of first three dates above. Also assume that for each of the three bonds the reported nominal rate that you found above was the coupon rate at issuance. Assuming semi-annual coupon payments, calculate the value of each bond after 5 year based on the then 5-year nominal rates on U.S. Treasuries available at http://www.federalreserve.gov/releases/h15/data.htm to determine the gain or loss on each of the three bonds after 5 years? 1. At 04/1959: 2. At 09/1981: 3. At 09/1986: Which bond would you have preferred to purchase? 04/1954? 09/1976? 09/1981? Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started