Answered step by step

Verified Expert Solution

Question

1 Approved Answer

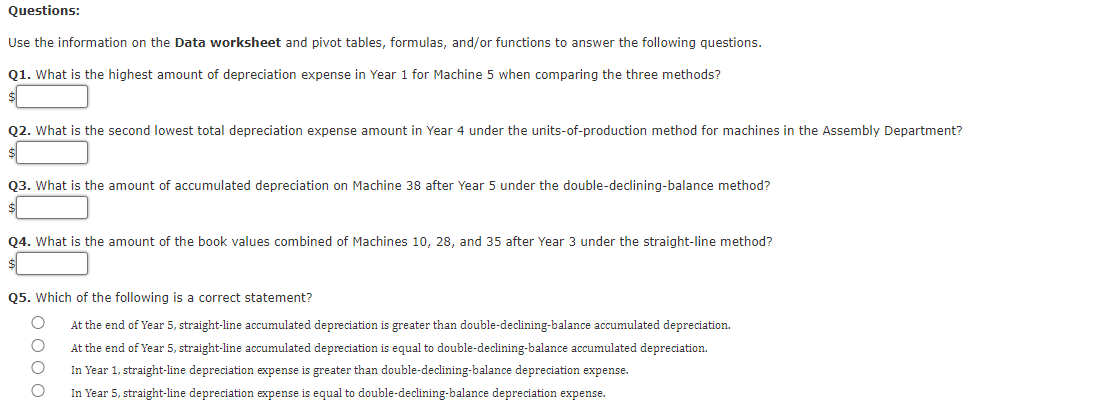

Use this spreadsheet link: https://ungprod-my.sharepoint.com/:x:/g/personal/dgash0172_ung_edu/Eee4cEX66oRIrOyv8XI5ZQYB0nUyCdcGiaowUqs2fsIi1Q?e=x1U4Yk To answer these questions: Questions: Use the information on the Data worksheet and pivot tables, formulas, and/or functions to answer

Use this spreadsheet link: https://ungprod-my.sharepoint.com/:x:/g/personal/dgash0172_ung_edu/Eee4cEX66oRIrOyv8XI5ZQYB0nUyCdcGiaowUqs2fsIi1Q?e=x1U4Yk

To answer these questions:

Questions: Use the information on the Data worksheet and pivot tables, formulas, and/or functions to answer the following questions. Q1. What is the highest amount of depreciation expense in Year 1 for Machine 5 when comparing the three methods? Q2. What is the second lowest total depreciation expense amount in Year 4 under the units-of-production method for machines in the Assembly Department? Q3. What is the amount of accumulated depreciation on Machine 38 after Year 5 under the double-declining-balance method? Q4. What is the amount of the book values combined of Machines 10, 28, and 35 after Year 3 under the straight-line method? Q5. Which of the following is a correct statement? 0000 At the end of Year 5, straight-line accumulated depreciation is greater than double-declining-balance accumulated depreciation. At the end of Year 5, straight-line accumulated depreciation is equal to double-declining-balance accumulated depreciation. In Year 1, straight-line depreciation expense is greater than double-declining-balance depreciation expense. In Year 5, straight-line depreciation expense is equal to double-declining-balance depreciation expense.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer your questions Ill need to refer to the Data worksheet and perform calculations based on t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started