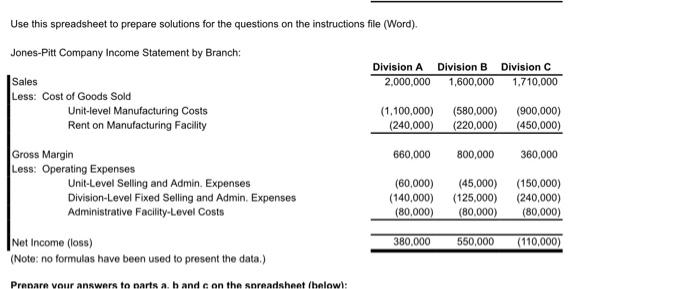

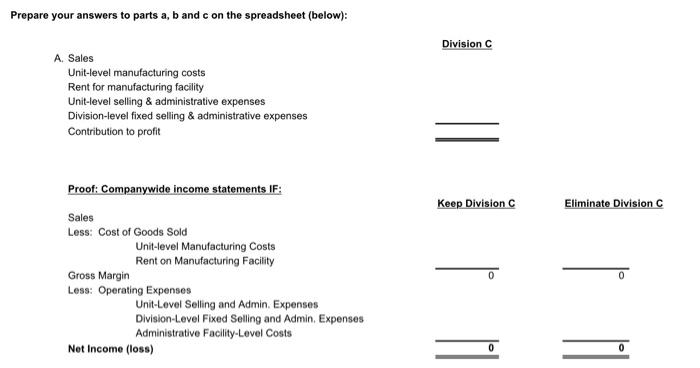

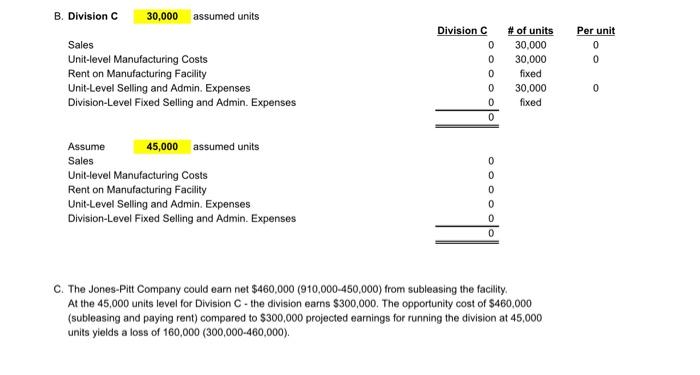

Use this spreadsheet to prepare solutions for the questions on the instructions file (Word). Jones-Pitt Company Income Statement by Branch: Division A Division B Division C Sales 2,000,000 1,600,000 1.710,000 Less: Cost of Goods Sold Unit-level Manufacturing Costs (1.100,000) (580,000) (900,000) Rent on Manufacturing Facility (240,000) (220,000) (450,000) Gross Margin 660,000 800,000 360,000 Less: Operating Expenses Unit-Level Selling and Admin. Expenses (60,000) (45,000) (150,000) Division-Level Fixed Selling and Admin. Expenses (140,000) (125,000) (240,000) Administrative Facility-Level Costs (80,000) (80.000) (80,000) 380,000 550,000 (110,000) Net Income (loss) (Note: no formulas have been used to present the data) Prepare your answers to parts a, b and c on the spreadsheet (below: Prepare your answers to parts a, b and c on the spreadsheet (below): Division C A. Sales Unit-level manufacturing costs Rent for manufacturing facility Unit-level selling & administrative expenses Division-level fixed selling & administrative expenses Contribution to profit Proof: Companywide income statements if: Keep Division C Eliminate Division C 0 Sales Less: Cost of Goods Sold Unit-level Manufacturing Costs Rent on Manufacturing Facility Gross Margin Less: Operating Expenses Unit-Level Selling and Admin Expenses Division-Level Fixed Selling and Admin Expenses Administrative Facility-Level Costs Net Income (loss) 0 0 B. Division C 30,000 assumed units Sales Unit-level Manufacturing Costs Rent on Manufacturing Facility Unit-Level Selling and Admin. Expenses Division-Level Fixed Selling and Admin. Expenses Per unit 0 0 Division C 0 0 0 0 0 0 # of units 30,000 30,000 fixed 30,000 fixed 0 Assume 45,000 assumed units Sales Unit-level Manufacturing Costs Rent on Manufacturing Facility Unit-Level Selling and Admin. Expenses Division-Level Fixed Selling and Admin. Expenses 0 0 0 0 0 C. The Jones-Pitt Company could earn net $460,000 (910,000-450,000) from subleasing the facility, At the 45,000 units level for Division - the division earns $300,000. The opportunity cost of $460,000 (subleasing and paying rent) compared to $300,000 projected earnings for running the division at 45,000 units yields a loss of 160,000 (300,000-460,000). Use this spreadsheet to prepare solutions for the questions on the instructions file (Word). Jones-Pitt Company Income Statement by Branch: Division A Division B Division C Sales 2,000,000 1,600,000 1.710,000 Less: Cost of Goods Sold Unit-level Manufacturing Costs (1.100,000) (580,000) (900,000) Rent on Manufacturing Facility (240,000) (220,000) (450,000) Gross Margin 660,000 800,000 360,000 Less: Operating Expenses Unit-Level Selling and Admin. Expenses (60,000) (45,000) (150,000) Division-Level Fixed Selling and Admin. Expenses (140,000) (125,000) (240,000) Administrative Facility-Level Costs (80,000) (80.000) (80,000) 380,000 550,000 (110,000) Net Income (loss) (Note: no formulas have been used to present the data) Prepare your answers to parts a, b and c on the spreadsheet (below: Prepare your answers to parts a, b and c on the spreadsheet (below): Division C A. Sales Unit-level manufacturing costs Rent for manufacturing facility Unit-level selling & administrative expenses Division-level fixed selling & administrative expenses Contribution to profit Proof: Companywide income statements if: Keep Division C Eliminate Division C 0 Sales Less: Cost of Goods Sold Unit-level Manufacturing Costs Rent on Manufacturing Facility Gross Margin Less: Operating Expenses Unit-Level Selling and Admin Expenses Division-Level Fixed Selling and Admin Expenses Administrative Facility-Level Costs Net Income (loss) 0 0 B. Division C 30,000 assumed units Sales Unit-level Manufacturing Costs Rent on Manufacturing Facility Unit-Level Selling and Admin. Expenses Division-Level Fixed Selling and Admin. Expenses Per unit 0 0 Division C 0 0 0 0 0 0 # of units 30,000 30,000 fixed 30,000 fixed 0 Assume 45,000 assumed units Sales Unit-level Manufacturing Costs Rent on Manufacturing Facility Unit-Level Selling and Admin. Expenses Division-Level Fixed Selling and Admin. Expenses 0 0 0 0 0 C. The Jones-Pitt Company could earn net $460,000 (910,000-450,000) from subleasing the facility, At the 45,000 units level for Division - the division earns $300,000. The opportunity cost of $460,000 (subleasing and paying rent) compared to $300,000 projected earnings for running the division at 45,000 units yields a loss of 160,000 (300,000-460,000)