use this table

use this table

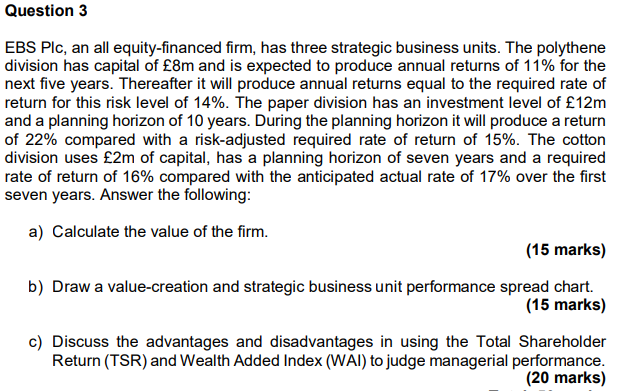

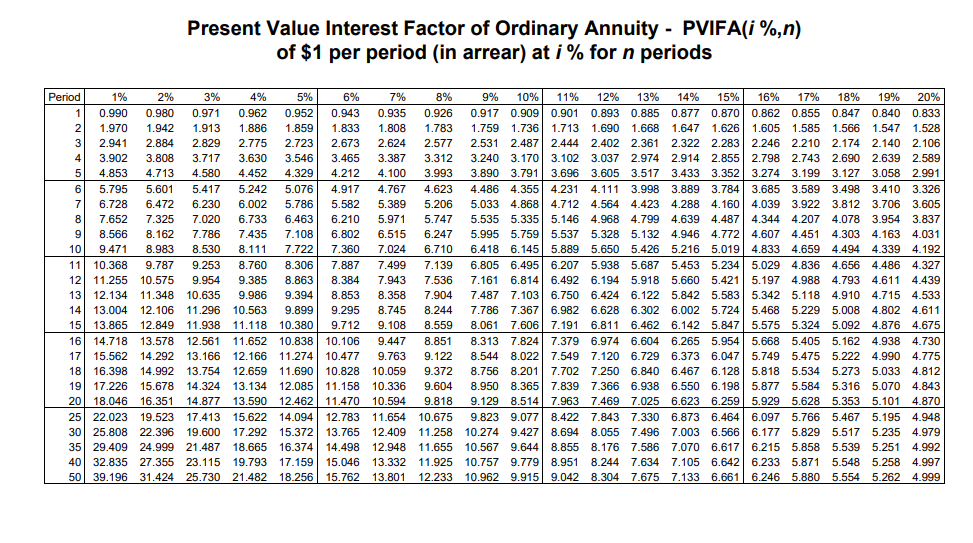

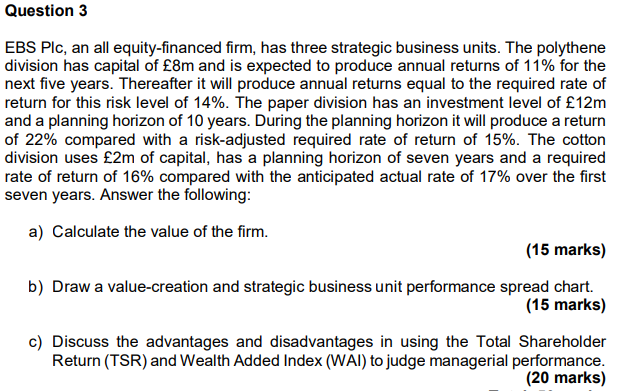

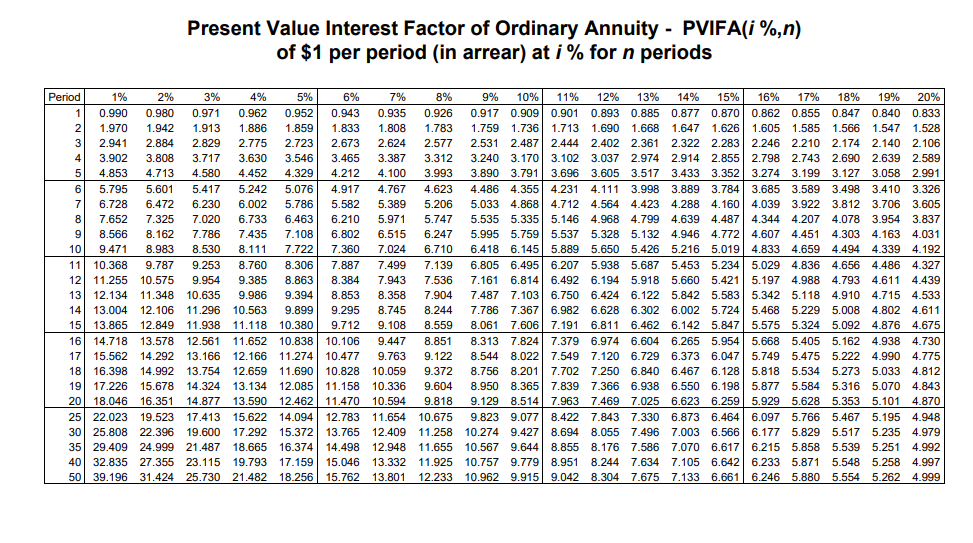

Question 3 EBS Plc, an all equity-financed firm, has three strategic business units. The polythene division has capital of 8m and is expected to produce annual returns of 11% for the next five years. Thereafter it will produce annual returns equal to the required rate of return for this risk level of 14%. The paper division has an investment level of 12m and a planning horizon of 10 years. During the planning horizon it will produce a return of 22% compared with a risk-adjusted required rate of return of 15%. The cotton division uses 2m of capital, has a planning horizon of seven years and a required rate of return of 16% compared with the anticipated actual rate of 17% over the first seven years. Answer the following: a) Calculate the value of the firm. (15 marks) b) Draw a value-creation and strategic business unit performance spread chart. (15 marks) c) Discuss the advantages and disadvantages in using the Total Shareholder Return (TSR) and Wealth Added Index (WAI) to judge managerial performance. (20 marks) Present Value Interest Factor of Ordinary Annuity - PVIFA(i %,n) of $1 per period (in arrear) at i % for n periods Period 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 11 10.368 12 11.255 13 12.134 14 13.004 15 13.865 16 14.718 17 15.562 16.398 17.226 2018.046 25 22.023 30 25.808 35 29.409 40 32.835 50 39.196 2% 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 13.578 14.292 14.992 15.678 16.351 19.523 22.396 24.999 27.355 31.424 3% 4% 5% 0.971 0.962 0.952 1.913 1.886 1.859 2.829 2.775 2.723 3.717 3.630 3.546 4.580 4.452 4.329 5.417 5.242 5.076 6.230 6.002 5.786 7.020 6.733 6.463 7.786 7.435 7.108 8.530 8.111 7.722 9.253 8.760 8.306 9.954 9.385 8.863 10.635 9.986 9.394 11.296 10.563 9.899 11.938 11.118 10.380 12.561 11.652 10.838 13.166 12.166 11.274 13.754 12.659 11.690 14.324 13.134 12.085 14.877 13.590 12.462 17.413 15.622 14.094 19.600 17.292 15.372 21.487 18.665 16.374 23.115 19.793 17.159 25.730 21.482 18.256 6% 7% 8% 35 0.926 1.833 1.808 1.783 2.673 2.624 2.577 3.465 3.387 3.312 4.212 4.100 3.993 4.917 4.767 4.623 5.582 5.389 5.206 6.210 5.971 5.747 6.802 6.515 6.247 7.360 7.024 6.710 7.887 7.499 7.139 8.384 7.943 7.536 8.853 8.358 7.904 9.295 8.745 8.244 9.712 9.108 8.559 10.106 9.447 8.851 10.4779.763 9.122 10.828 10.059 9.372 11.158 10.336 9.604 11.470 10.594 9.818 12.783 11.654 10.675 13.765 12.409 11.258 14.498 12.948 11.655 15.046 13.332 11.925 15.762 13.801 12.233 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 1.759 1.736 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528 2.531 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.1993.127 3.058 2.991 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 5.535 5.335 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 7.161 6.814 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4.793 4.611 4.439 7.487 7.103 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 8.061 7.606 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 8.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 8.544 8.022 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 8.756 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 8.950 8.365 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843 9.129 8.514 7.963 7.469 7.025 6.623 6.259 5.929 5.628 5.3535.101 4.870 9.823 9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 10.274 9.427 8.694 8.055 7.496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 10.567 9.644 8.855 8.176 7.586 7.070 6.617 6.215 5.858 5.539 5.251 4.992 10.757 9.779 8.951 8.244 7.634 7.105 6.642 6.233 5.871 5.548 5.258 4.997 10.962 9.915 9.042 8.304 7.675 7.133 6.661 6.246 5.880 5.554 5.262 4.999 Question 3 EBS Plc, an all equity-financed firm, has three strategic business units. The polythene division has capital of 8m and is expected to produce annual returns of 11% for the next five years. Thereafter it will produce annual returns equal to the required rate of return for this risk level of 14%. The paper division has an investment level of 12m and a planning horizon of 10 years. During the planning horizon it will produce a return of 22% compared with a risk-adjusted required rate of return of 15%. The cotton division uses 2m of capital, has a planning horizon of seven years and a required rate of return of 16% compared with the anticipated actual rate of 17% over the first seven years. Answer the following: a) Calculate the value of the firm. (15 marks) b) Draw a value-creation and strategic business unit performance spread chart. (15 marks) c) Discuss the advantages and disadvantages in using the Total Shareholder Return (TSR) and Wealth Added Index (WAI) to judge managerial performance. (20 marks) Present Value Interest Factor of Ordinary Annuity - PVIFA(i %,n) of $1 per period (in arrear) at i % for n periods Period 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 11 10.368 12 11.255 13 12.134 14 13.004 15 13.865 16 14.718 17 15.562 16.398 17.226 2018.046 25 22.023 30 25.808 35 29.409 40 32.835 50 39.196 2% 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 13.578 14.292 14.992 15.678 16.351 19.523 22.396 24.999 27.355 31.424 3% 4% 5% 0.971 0.962 0.952 1.913 1.886 1.859 2.829 2.775 2.723 3.717 3.630 3.546 4.580 4.452 4.329 5.417 5.242 5.076 6.230 6.002 5.786 7.020 6.733 6.463 7.786 7.435 7.108 8.530 8.111 7.722 9.253 8.760 8.306 9.954 9.385 8.863 10.635 9.986 9.394 11.296 10.563 9.899 11.938 11.118 10.380 12.561 11.652 10.838 13.166 12.166 11.274 13.754 12.659 11.690 14.324 13.134 12.085 14.877 13.590 12.462 17.413 15.622 14.094 19.600 17.292 15.372 21.487 18.665 16.374 23.115 19.793 17.159 25.730 21.482 18.256 6% 7% 8% 35 0.926 1.833 1.808 1.783 2.673 2.624 2.577 3.465 3.387 3.312 4.212 4.100 3.993 4.917 4.767 4.623 5.582 5.389 5.206 6.210 5.971 5.747 6.802 6.515 6.247 7.360 7.024 6.710 7.887 7.499 7.139 8.384 7.943 7.536 8.853 8.358 7.904 9.295 8.745 8.244 9.712 9.108 8.559 10.106 9.447 8.851 10.4779.763 9.122 10.828 10.059 9.372 11.158 10.336 9.604 11.470 10.594 9.818 12.783 11.654 10.675 13.765 12.409 11.258 14.498 12.948 11.655 15.046 13.332 11.925 15.762 13.801 12.233 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 1.759 1.736 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528 2.531 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.1993.127 3.058 2.991 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 5.535 5.335 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 7.161 6.814 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4.793 4.611 4.439 7.487 7.103 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 8.061 7.606 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 8.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 8.544 8.022 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 8.756 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 8.950 8.365 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843 9.129 8.514 7.963 7.469 7.025 6.623 6.259 5.929 5.628 5.3535.101 4.870 9.823 9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 10.274 9.427 8.694 8.055 7.496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 10.567 9.644 8.855 8.176 7.586 7.070 6.617 6.215 5.858 5.539 5.251 4.992 10.757 9.779 8.951 8.244 7.634 7.105 6.642 6.233 5.871 5.548 5.258 4.997 10.962 9.915 9.042 8.304 7.675 7.133 6.661 6.246 5.880 5.554 5.262 4.999

use this table

use this table