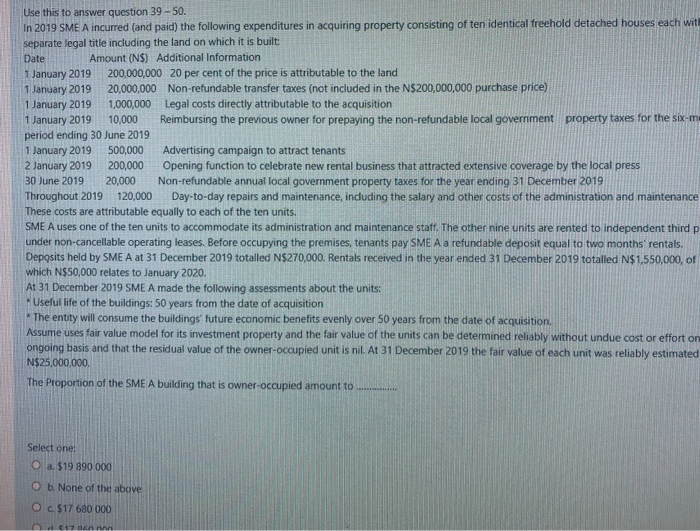

Use this to answer question 39-50. In 2019 SME A incurred (and paid) the following expenditures in acquiring property consisting of ten identical freehold detached houses each wit separate legal title including the land on which it is built: Date Amount (NS) Additional Information 1 January 2019 200,000,000 20 per cent of the price is attributable to the land 1 January 2019 20,000,000 Non-refundable transfer taxes (not included in the N$200,000,000 purchase price) 1 January 2019 1,000,000 Legal costs directly attributable to the acquisition 1 January 2019 10,000 Reimbursing the previous owner for prepaying the non-refundable local government property taxes for the six-m period ending 30 June 2019 1 January 2019 500,000 Advertising campaign to attract tenants 2 January 2019 200,000 Opening function to celebrate new rental business that attracted extensive coverage by the local press 30 June 2019 20,000 Non-refundable annual local government property taxes for the year ending 31 December 2019 Throughout 2019 120,000 Day-to-day repairs and maintenance, including the salary and other costs of the administration and maintenance These costs are attributable equally to each of the ten units. SME A uses one of the ten units to accommodate its administration and maintenance staff. The other nine units are rented to independent third p under non-cancellable operating leases. Before occupying the premises, tenants pay SME A a refundable deposit equal to two months' rentals. Deposits held by SME A at 31 December 2019 totalled N$270,000. Rentals received in the year ended 31 December 2019 totalled N$1,550,000, of which N$50,000 relates to January 2020. At 31 December 2019 SME A made the following assessments about the units: *Useful life of the buildings: 50 years from the date of acquisition The entity will consume the buildings future economic benefits evenly over 50 years from the date of acquisition. Assume uses fair value model for its investment property and the fair value of the units can be determined reliably without undue cost or effort on ongoing basis and that the residual value of the owner-occupied unit is nil. At 31 December 2019 the fair value of each unit was reliably estimated N$25,000,000 The Proportion of the SME A building that is owner-occupied amount to Select one: O a. $19 890 000 O b. None of the above O c $17 680 000 Enn Use this to answer question 39-50. In 2019 SME A incurred (and paid) the following expenditures in acquiring property consisting of ten identical freehold detached houses each wit separate legal title including the land on which it is built: Date Amount (NS) Additional Information 1 January 2019 200,000,000 20 per cent of the price is attributable to the land 1 January 2019 20,000,000 Non-refundable transfer taxes (not included in the N$200,000,000 purchase price) 1 January 2019 1,000,000 Legal costs directly attributable to the acquisition 1 January 2019 10,000 Reimbursing the previous owner for prepaying the non-refundable local government property taxes for the six-m period ending 30 June 2019 1 January 2019 500,000 Advertising campaign to attract tenants 2 January 2019 200,000 Opening function to celebrate new rental business that attracted extensive coverage by the local press 30 June 2019 20,000 Non-refundable annual local government property taxes for the year ending 31 December 2019 Throughout 2019 120,000 Day-to-day repairs and maintenance, including the salary and other costs of the administration and maintenance These costs are attributable equally to each of the ten units. SME A uses one of the ten units to accommodate its administration and maintenance staff. The other nine units are rented to independent third p under non-cancellable operating leases. Before occupying the premises, tenants pay SME A a refundable deposit equal to two months' rentals. Deposits held by SME A at 31 December 2019 totalled N$270,000. Rentals received in the year ended 31 December 2019 totalled N$1,550,000, of which N$50,000 relates to January 2020. At 31 December 2019 SME A made the following assessments about the units: *Useful life of the buildings: 50 years from the date of acquisition The entity will consume the buildings future economic benefits evenly over 50 years from the date of acquisition. Assume uses fair value model for its investment property and the fair value of the units can be determined reliably without undue cost or effort on ongoing basis and that the residual value of the owner-occupied unit is nil. At 31 December 2019 the fair value of each unit was reliably estimated N$25,000,000 The Proportion of the SME A building that is owner-occupied amount to Select one: O a. $19 890 000 O b. None of the above O c $17 680 000 Enn