Answered step by step

Verified Expert Solution

Question

1 Approved Answer

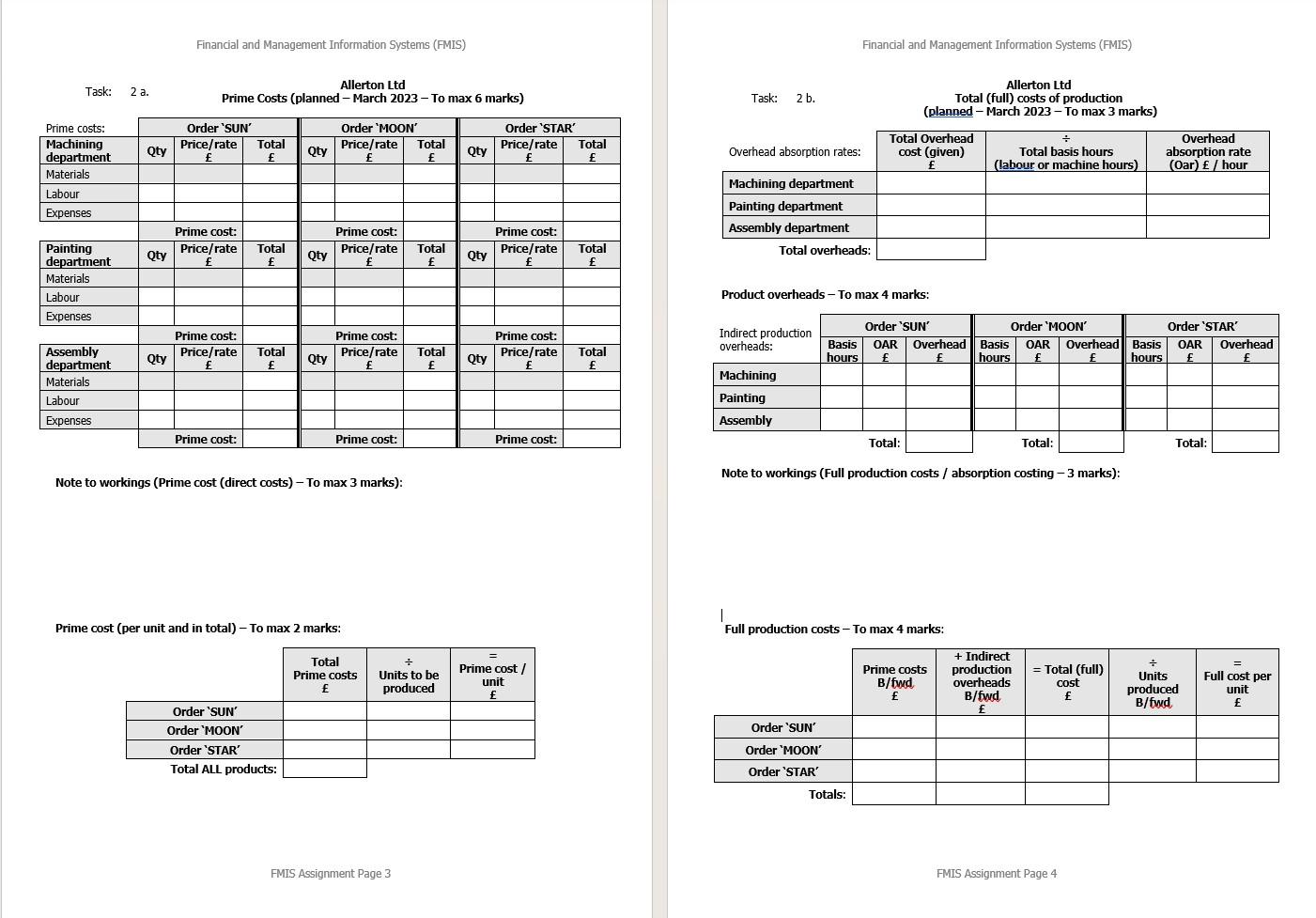

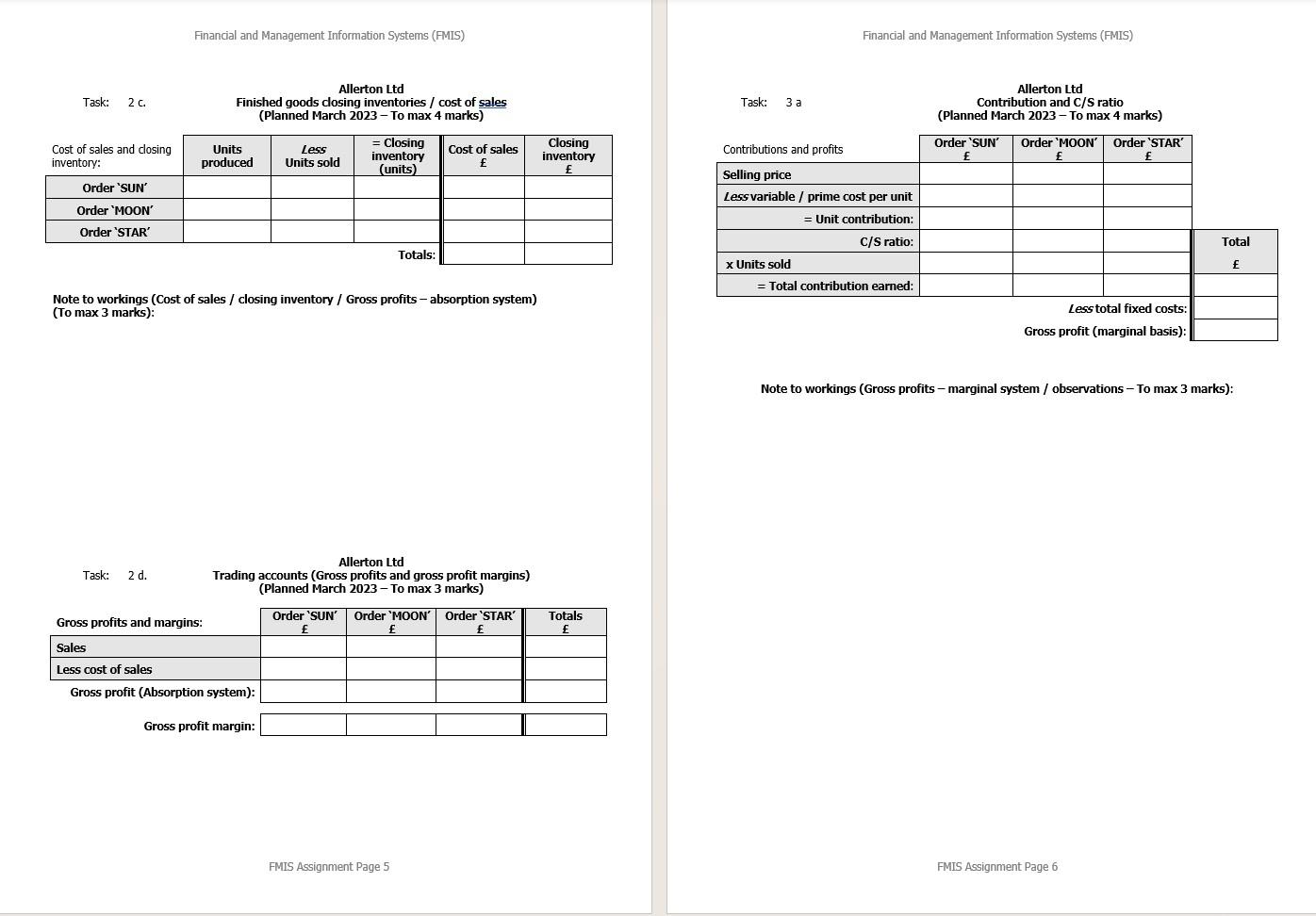

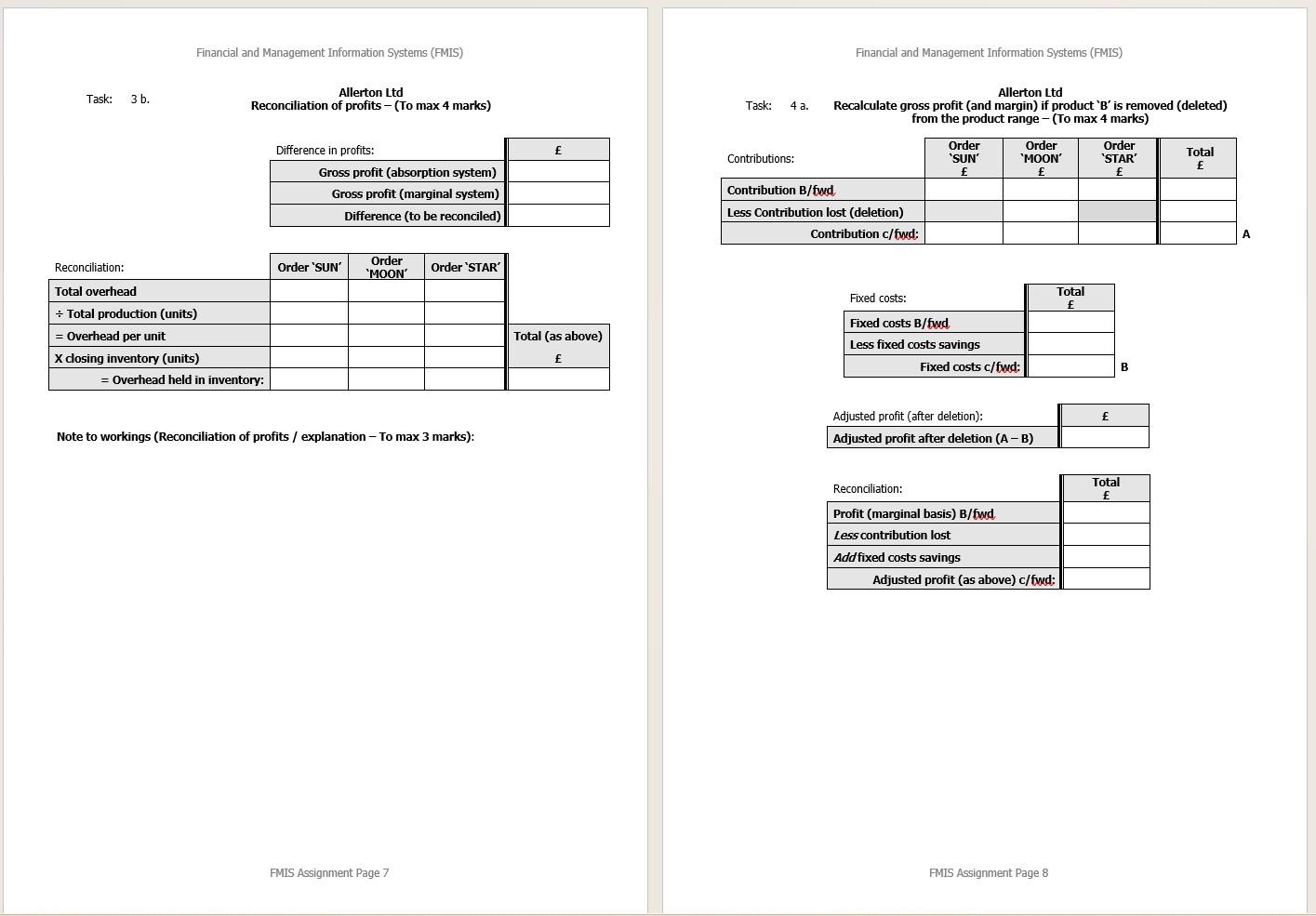

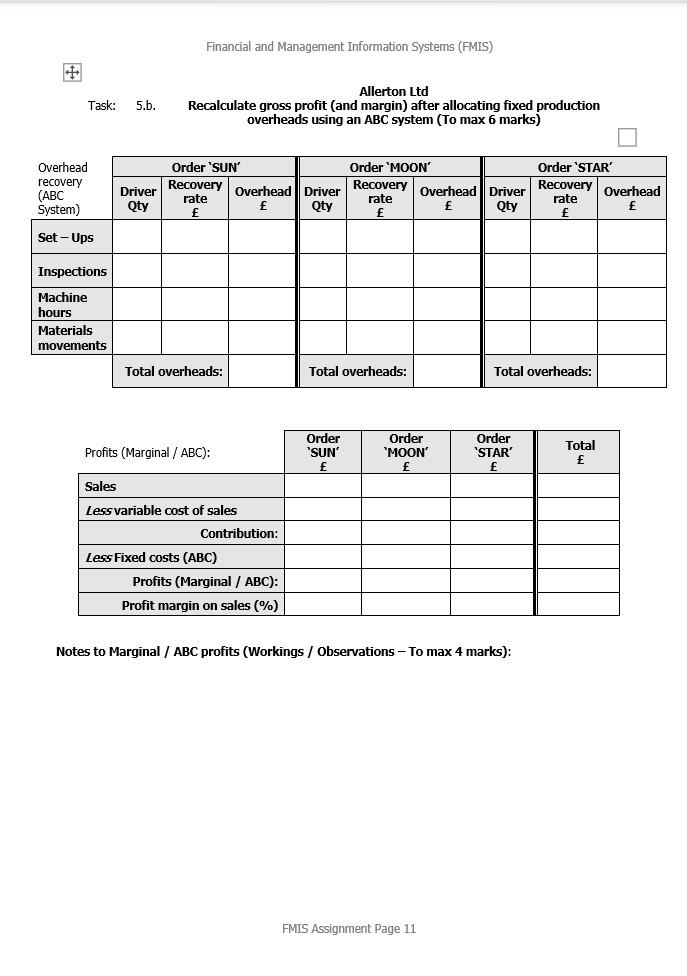

use this to answer the above questions Financial and Management Information Systems (FMIS) Financial and Management Information Systems (FMIS) Task: 2 a. Product overheads -

use this to answer the above questions

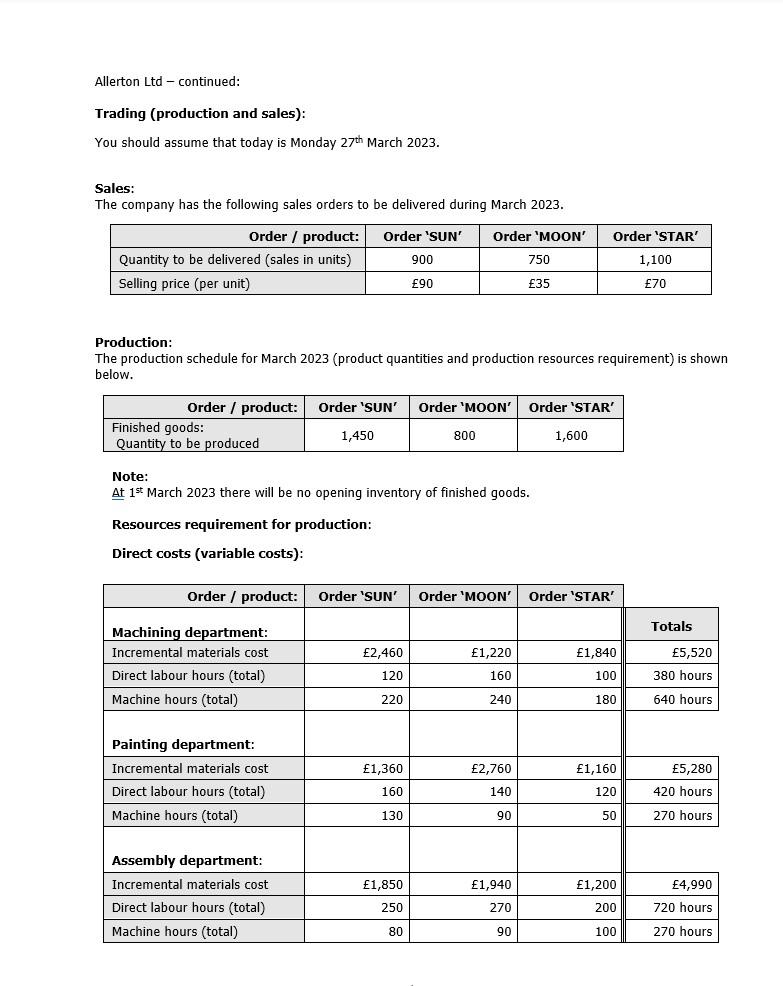

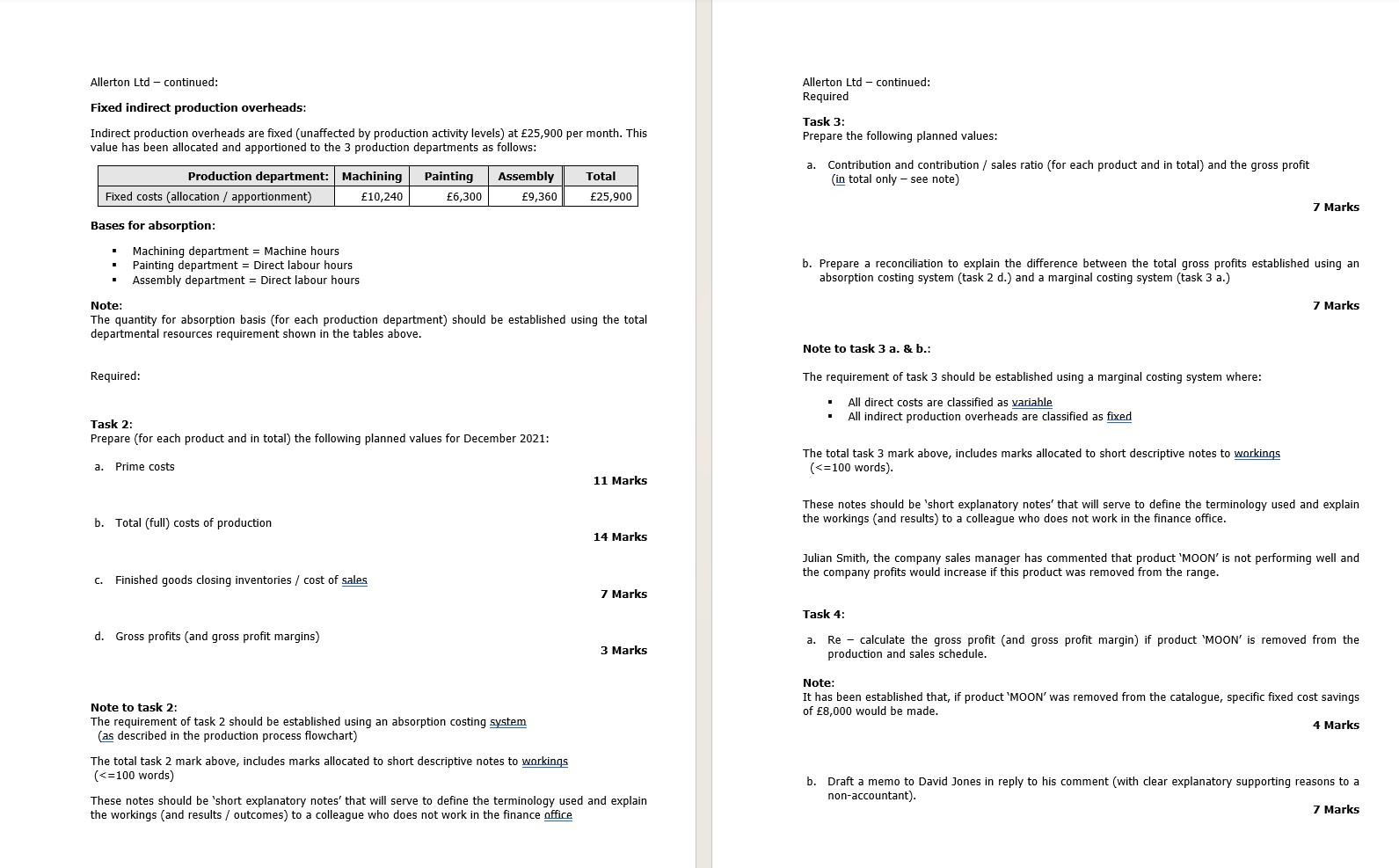

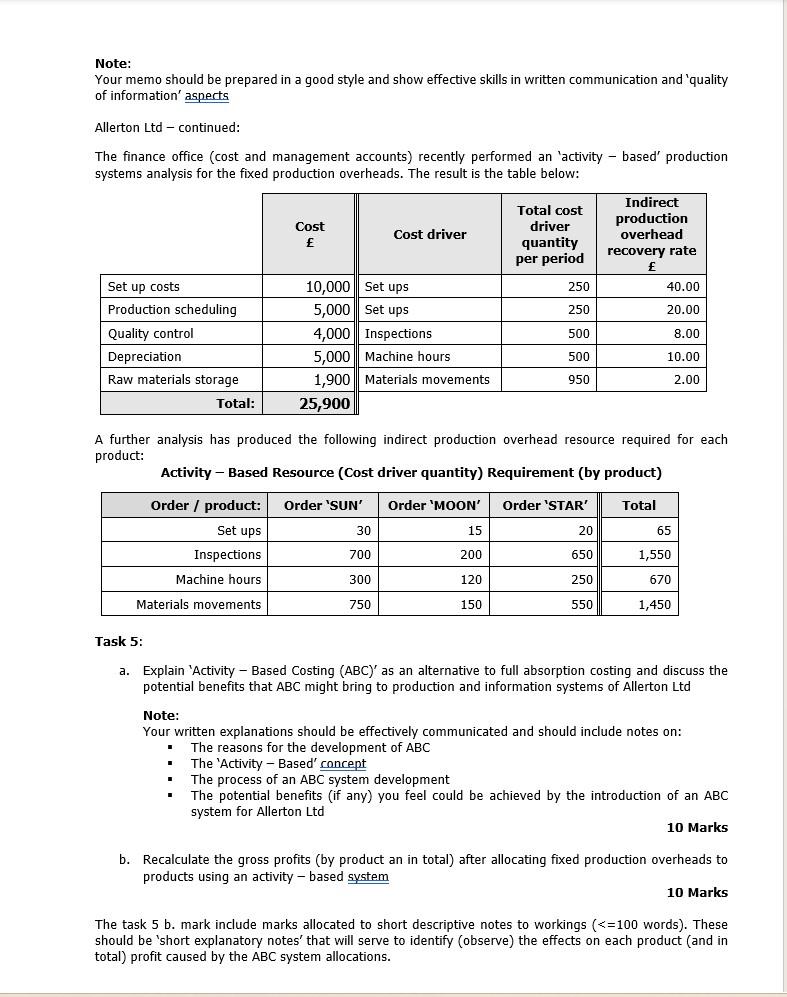

Financial and Management Information Systems (FMIS) Financial and Management Information Systems (FMIS) Task: 2 a. Product overheads - To max 4 marks: Note to workings (Full production costs / absorption costing - 3 marks): Note to workings (Prime cost (direct costs) - To max 3 marks): | Prime cost (per unit and in total) - To max 2 marks: Full production costs - To max 4 marks: FMIS Assignment Page 3 FMIS Assignment Page 4 Financial and Management Information Systems (FMIS) Financial and Management Information Systems (FMIS) Task: 2 c. Allerton Ltd Finished goods closing inventories / cost of sales Allerton Ltd Task: 3 a Contribution and C/S ratio (Planned March 2023 - To max 4 marks) (Planned March 2023 - To max 4 marks) Note to workings (Cost of sales / closing inventory / Gross profits - absorption system) (To max 3 marks): Note to workings (Gross profits - marginal system / observations - To max 3 marks): Task: 2d. Allerton Ltd (Planned March 2023 - To max 3 marks) Financial and Management Information Systems (FMIS) Financial and Management Information Systems (FMIS) Alask:3b.Teconciliationofprofits-(Tomax4marks)fromtheproductrange-(Tomax4marks)AlertonLtd4a.TaskAllertonLtdRecalculategrossprofit(andmargin)ifproductBisremoved(deleted) Note to workings (Reconciliation of profits / explanation - To max 3 marks): Financial and Management Information Systems (FMIS) Allerton Ltd Task: 5.b. Recalculate gross profit (and margin) after allocating fixed production overheads using an ABC system (To max 6 marks) Notes to Marginal / ABC profits (Workings / Observations - To max 4 marks): Allerton Ltd - continued: Trading (production and sales): You should assume that today is Monday 27th March 2023. Sales: The company has the following sales orders to be delivered during March 2023. Production: The production schedule for March 2023 (product quantities and production resources requirement) is shown below. Note: At 1st March 2023 there will be no opening inventory of finished goods. Resources requirement for production: Direct costs (variable costs): Allerton Ltd - continued: Allerton Ltd - continued: Required Fixed indirect production overheads: Task 3: Indirect production overheads are fixed (unaffected by production activity levels) at 25,900 per month. This Prepare the following planned values: value has been allocated and apportioned to the 3 production departments as follows: a. Contribution and contribution / sales ratio (for each product and in total) and the gross profit (in total only - see note) Bases for absorption: - Machining department = Machine hours - Painting department = Direct labour hours b. Prepare a reconciliation to explain the difference between the total gross profits established using an - Assembly department = Direct labour hours absorption costing system (task 2 d.) and a marginal costing system (task 3 a.) Note: The quantity for absorption basis (for each production department) should be established using the total departmental resources requirement shown in the tables above. Note to task 3 a. 8 b.: Required: The requirement of task 3 should be established using a marginal costing system where: - All direct costs are classified as variable Task 2: - All indirect production overheads are classified as fixed Prepare (for each product and in total) the following planned values for December 2021: The total task 3 mark above, includes marks allocated to short descriptive notes to workings a. Prime costs (

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started