Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use this to fill in the text boxes. V A property is available for a purchase price of $850,000. This is a desirable property for

Use this to fill in the text boxes.

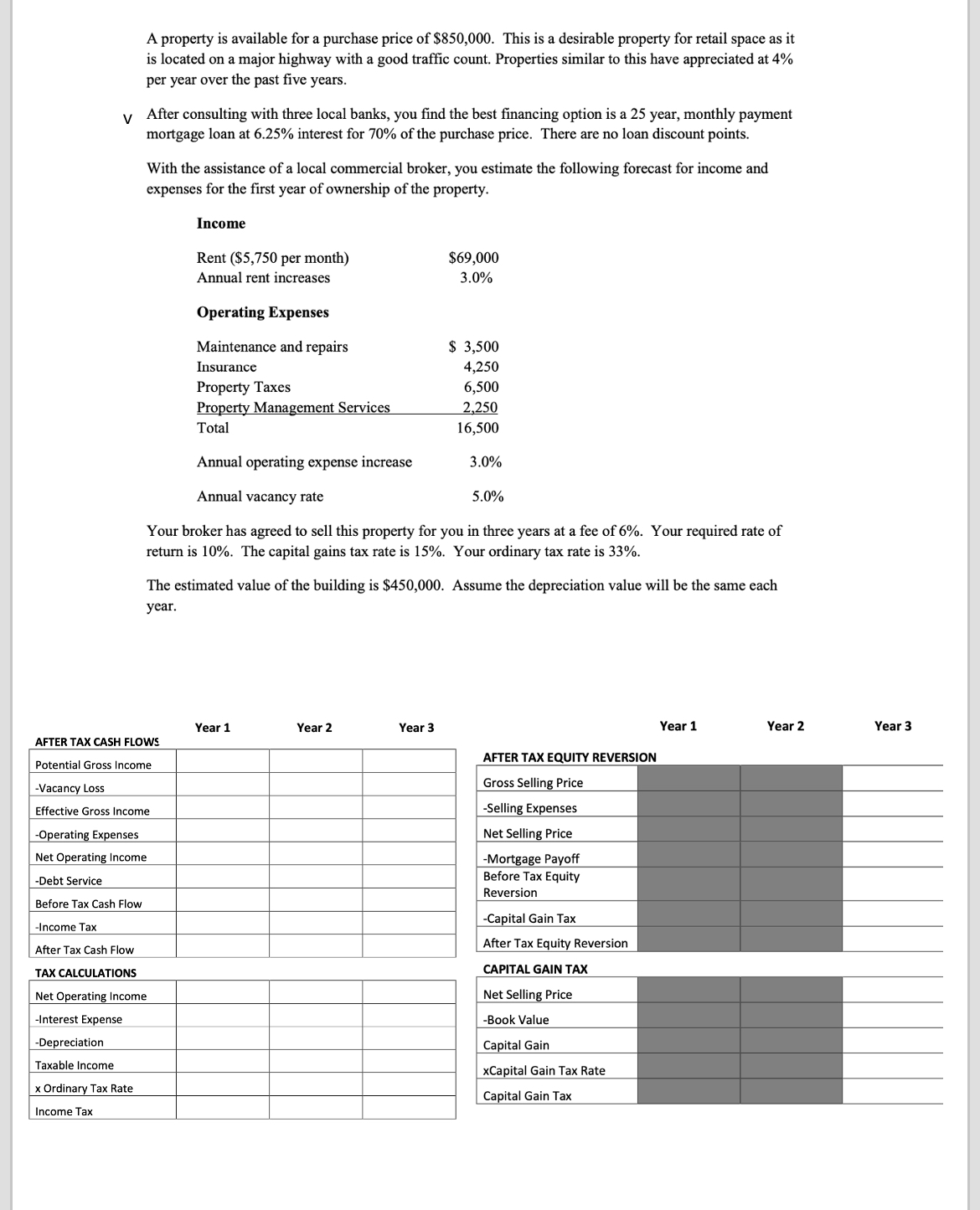

V A property is available for a purchase price of $850,000. This is a desirable property for retail space as it is located on a major highway with a good traffic count. Properties similar to this have appreciated at 4% per year over the past five years. After consulting with three local banks, you find the best financing option is a 25 year, monthly payment mortgage loan at 6.25% interest for 70% of the purchase price. There are no loan discount points. With the assistance of a local commercial broker, you estimate the following forecast for income and expenses for the first year Of ownership Of the property. Income Rent ($5,750 per month) Annual rent increases Operating Expenses Maintenance and repairs Property Taxes Property Management Services Total Annual operating expense increase Annual vacancy rate $69,000 3.0% $ 3,500 4,250 6,500 2,250 16,500 3.0% 5.0% Your broker has agreed to sell this property for you in three years at a fee of6%. Your required rate of return is 10%. The capital gains tax rate is 15%. Your ordinary tax rate is 33%. The estimated value of the building is $450,000. Assume the depreciation value will be the same each year. Year 1 AFTER TAX CASH FLOWS Potential Gross Income -Vacan Loss Effective Gross Income -O ratin Ex enses Net Operating Income -Debt Service Before Tax Cash Flow -Income Tax After Tax Cash Flow TAX CALCULATIONS Net Operating Income -Interest Expense -Depreciation Taxable Income x Ordinary Tax Rate Income Tax Year 2 Year 3 Year 1 AFTER TAX EQUITY REVERSION Gross Selling Price -Selling Expenses Net Sellin price -Mortgage Payoff Before Tax Equity Reversion -Ca ital Gain Tax After Tax Equity Reversion CAPITAL GAIN TAX Net Sellin Price -Book Value Ca ital Gain xCa ital Gain Tax Rate Ca ital Gain Tax Year 2 Year 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started