Answered step by step

Verified Expert Solution

Question

1 Approved Answer

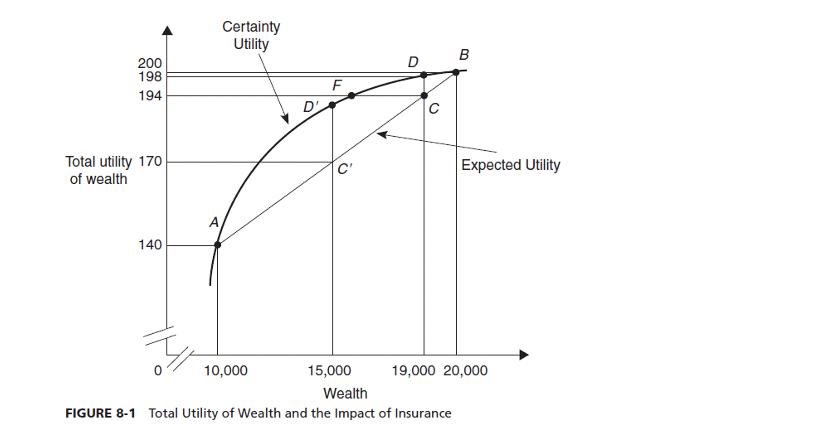

Use utility of wealth function in the book, 8-1 (see below) Please explain the difference between the certainty utility line and the expected utility line

Use utility of wealth function in the book, 8-1 (see below)

Use utility of wealth function in the book, 8-1 (see below)

Please explain the difference between the certainty utility line and the expected utility line b. Calculate your E(U), given an 80% change of being healthy and 20% of being sick, knowing that your income falls to $10,000 and your utility is 140 if you get sick. c. Calculate your E(W), given an 80% change of being healthy and 20% of being sick. d. Given that your Certainty Utility Function is U = 200Y-0.00154 and Y is your income, what is your Certainty Utility with insurance (if you are risk averse) What insurance premium will you pay to guarantee a utility of 197? Please provide a calculation.

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

b Expected Utility Probability of sick Utility when si...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started