Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USE XXX= 323 Mr. ABC wanted to start a new business in men's Formal wears. He had contacted the manufacture in Italy. The manufacture can

USE XXX= 323

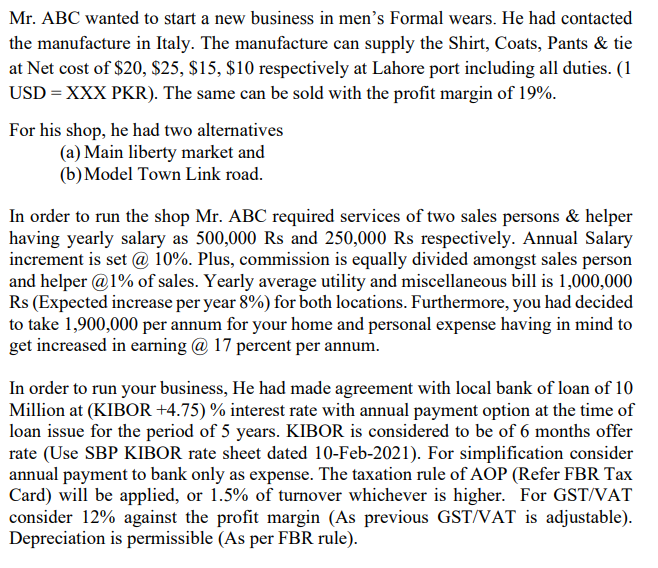

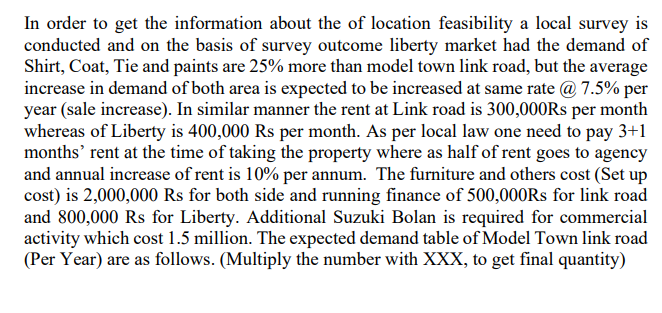

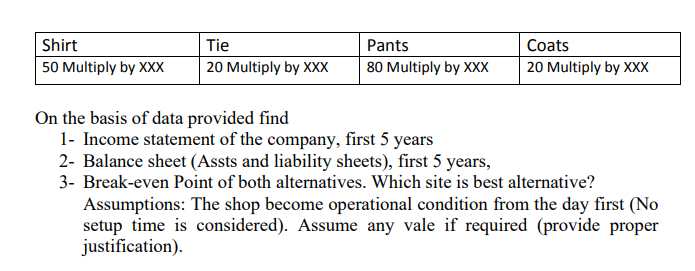

Mr. ABC wanted to start a new business in men's Formal wears. He had contacted the manufacture in Italy. The manufacture can supply the Shirt, Coats, Pants & tie at Net cost of $20, $25, $15, $10 respectively at Lahore port including all duties. (1 USD = XXX PKR). The same can be sold with the profit margin of 19%. For his shop, he had two alternatives (a) Main liberty market and (b) Model Town Link road. In order to run the shop Mr. ABC required services of two sales persons & helper having yearly salary as 500,000 Rs and 250,000 Rs respectively. Annual Salary increment is set @ 10%. Plus, commission is equally divided amongst sales person and helper @1% of sales. Yearly average utility and miscellaneous bill is 1,000,000 Rs (Expected increase per year 8%) for both locations. Furthermore, you had decided to take 1,900,000 per annum for your home and personal expense having in mind to get increased in earning @ 17 percent per annum. In order to run your business, He had made agreement with local bank of loan of 10 Million at (KIBOR +4.75) % interest rate with annual payment option at the time of loan issue for the period of 5 years. KIBOR is considered to be of 6 months offer rate (Use SBP KIBOR rate sheet dated 10-Feb-2021). For simplification consider annual payment to bank only as expense. The taxation rule of AOP (Refer FBR Tax Card) will be applied, or 1.5% of turnover whichever is higher. For GST/VAT consider 12% against the profit margin (As previous GST/VAT is adjustable). Depreciation is permissible (As per FBR rule). In order to get the information about the of location feasibility a local survey is conducted and on the basis of survey outcome liberty market had the demand of Shirt, Coat, Tie and paints are 25% more than model town link road, but the average increase in demand of both area is expected to be increased at same rate @ 7.5% per year (sale increase). In similar manner the rent at Link road is 300,000Rs per month whereas of Liberty is 400,000 Rs per month. As per local law one need to pay 3+1 months' rent at the time of taking the property where as half of rent goes to agency and annual increase of rent is 10% per annum. The furniture and others cost (Set up cost) is 2,000,000 Rs for both side and running finance of 500,000Rs for link road and 800,000 Rs for Liberty. Additional Suzuki Bolan is required for commercial activity which cost 1.5 million. The expected demand table of Model Town link road (Per Year) are as follows. (Multiply the number with XXX, to get final quantity) Shirt 50 Multiply by XXX Tie 20 Multiply by XXX Pants 80 Multiply by XXX Coats 20 Multiply by XXX On the basis of data provided find 1- Income statement of the company, first 5 years 2- Balance sheet (Assts and liability sheets), first 5 years, 3- Break-even Point of both alternatives. Which site is best alternative? Assumptions: The shop become operational condition from the day first (No setup time is considered). Assume any vale if required (provide proper justification) Mr. ABC wanted to start a new business in men's Formal wears. He had contacted the manufacture in Italy. The manufacture can supply the Shirt, Coats, Pants & tie at Net cost of $20, $25, $15, $10 respectively at Lahore port including all duties. (1 USD = XXX PKR). The same can be sold with the profit margin of 19%. For his shop, he had two alternatives (a) Main liberty market and (b) Model Town Link road. In order to run the shop Mr. ABC required services of two sales persons & helper having yearly salary as 500,000 Rs and 250,000 Rs respectively. Annual Salary increment is set @ 10%. Plus, commission is equally divided amongst sales person and helper @1% of sales. Yearly average utility and miscellaneous bill is 1,000,000 Rs (Expected increase per year 8%) for both locations. Furthermore, you had decided to take 1,900,000 per annum for your home and personal expense having in mind to get increased in earning @ 17 percent per annum. In order to run your business, He had made agreement with local bank of loan of 10 Million at (KIBOR +4.75) % interest rate with annual payment option at the time of loan issue for the period of 5 years. KIBOR is considered to be of 6 months offer rate (Use SBP KIBOR rate sheet dated 10-Feb-2021). For simplification consider annual payment to bank only as expense. The taxation rule of AOP (Refer FBR Tax Card) will be applied, or 1.5% of turnover whichever is higher. For GST/VAT consider 12% against the profit margin (As previous GST/VAT is adjustable). Depreciation is permissible (As per FBR rule). In order to get the information about the of location feasibility a local survey is conducted and on the basis of survey outcome liberty market had the demand of Shirt, Coat, Tie and paints are 25% more than model town link road, but the average increase in demand of both area is expected to be increased at same rate @ 7.5% per year (sale increase). In similar manner the rent at Link road is 300,000Rs per month whereas of Liberty is 400,000 Rs per month. As per local law one need to pay 3+1 months' rent at the time of taking the property where as half of rent goes to agency and annual increase of rent is 10% per annum. The furniture and others cost (Set up cost) is 2,000,000 Rs for both side and running finance of 500,000Rs for link road and 800,000 Rs for Liberty. Additional Suzuki Bolan is required for commercial activity which cost 1.5 million. The expected demand table of Model Town link road (Per Year) are as follows. (Multiply the number with XXX, to get final quantity) Shirt 50 Multiply by XXX Tie 20 Multiply by XXX Pants 80 Multiply by XXX Coats 20 Multiply by XXX On the basis of data provided find 1- Income statement of the company, first 5 years 2- Balance sheet (Assts and liability sheets), first 5 years, 3- Break-even Point of both alternatives. Which site is best alternative? Assumptions: The shop become operational condition from the day first (No setup time is considered). Assume any vale if required (provide proper justification)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started