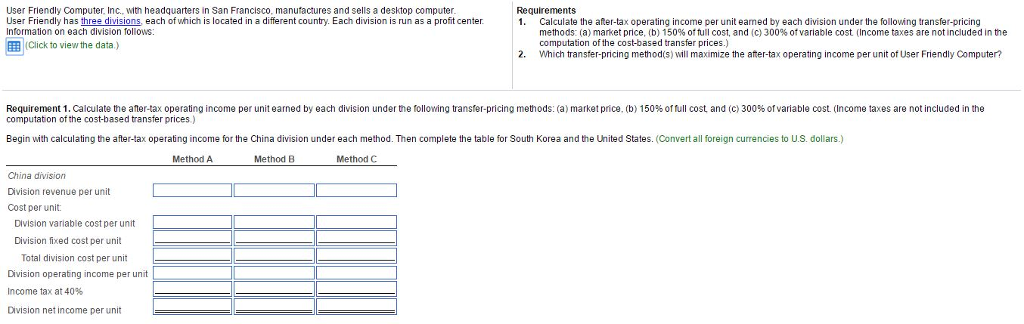

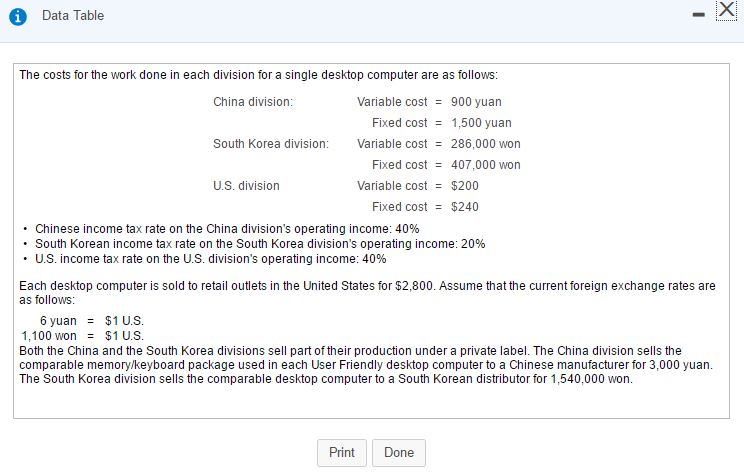

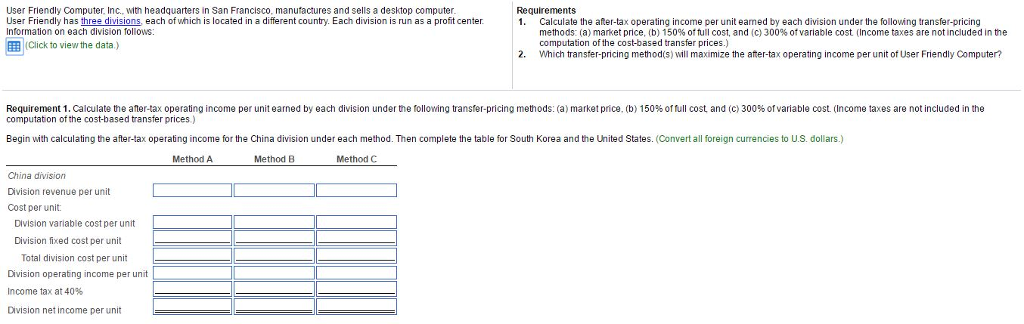

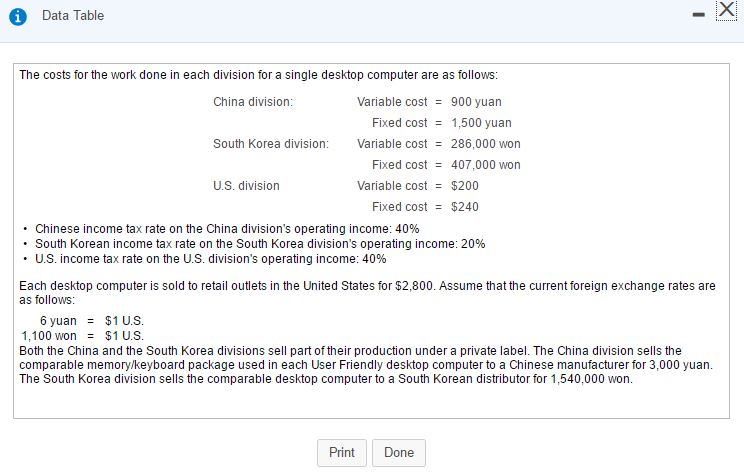

User Friendly Computer Inc. with headquarters in San Francisco. manufactures and sells a desktop computer. Requirements User Friendly has three divisions, each of which is located in a different country. Each division is run as a profitcenter 1. Calculate the after-tax operating income per unit earned by each division under the followng transfer-pricing formation on each divi methods (a) mark price, (b) 150% of full cost, and (c)300% of variable cost. (Income taxes are not included In the on follows computation of the cost-based transfer prices.) (Click to view the data.) 2. Which transfer-pricing method(s)will maximize the ater-tax operating income per unit of User Friendly Computer? Requirement 1. Calculate the after-tax operating income per unitearned by each division under the following pricing methods: (a) market price (b) 50% of full cost and (c) 300% variable cost. (Income taxes are not included in the computation of the cost-based transfer prices) Begin with calculating the after-tax operating income for the China division under each method. Then complete the table for South Korea and the United States. (Convert all foreign currencies to US. dollars) Method A Method B Method C China division Division revenue per unit Cost per unit. Division variable cost per unit Division fixed cost per unit Total division cost per unit Division operating income per unit Income tax at 40 Division net income per unit User Friendly Computer Inc. with headquarters in San Francisco. manufactures and sells a desktop computer. Requirements User Friendly has three divisions, each of which is located in a different country. Each division is run as a profitcenter 1. Calculate the after-tax operating income per unit earned by each division under the followng transfer-pricing formation on each divi methods (a) mark price, (b) 150% of full cost, and (c)300% of variable cost. (Income taxes are not included In the on follows computation of the cost-based transfer prices.) (Click to view the data.) 2. Which transfer-pricing method(s)will maximize the ater-tax operating income per unit of User Friendly Computer? Requirement 1. Calculate the after-tax operating income per unitearned by each division under the following pricing methods: (a) market price (b) 50% of full cost and (c) 300% variable cost. (Income taxes are not included in the computation of the cost-based transfer prices) Begin with calculating the after-tax operating income for the China division under each method. Then complete the table for South Korea and the United States. (Convert all foreign currencies to US. dollars) Method A Method B Method C China division Division revenue per unit Cost per unit. Division variable cost per unit Division fixed cost per unit Total division cost per unit Division operating income per unit Income tax at 40 Division net income per unit