Question

Using 2019 IRS forms and the information below, prepare the federal income tax return for William and Joyce Jones. William is 53 and Joyce is

Using 2019 IRS forms and the information below, prepare the federal income tax return for William and Joyce Jones.

William is 53 and Joyce is 51 as of the end of the taxable year. William is a manager for ABC corporation, a firm that manufactures and distributes widgets. Joyce is a self-employed author of children's books. The jones have two children, Will, 21 and Tom, 16 and both are full time students. The children have no income. The Jones are on the cash method of accounting and their return is due April 15. They wish to minimize their tax by deferring income, accelerating deductions and taking advantage of any suggestion you offer.

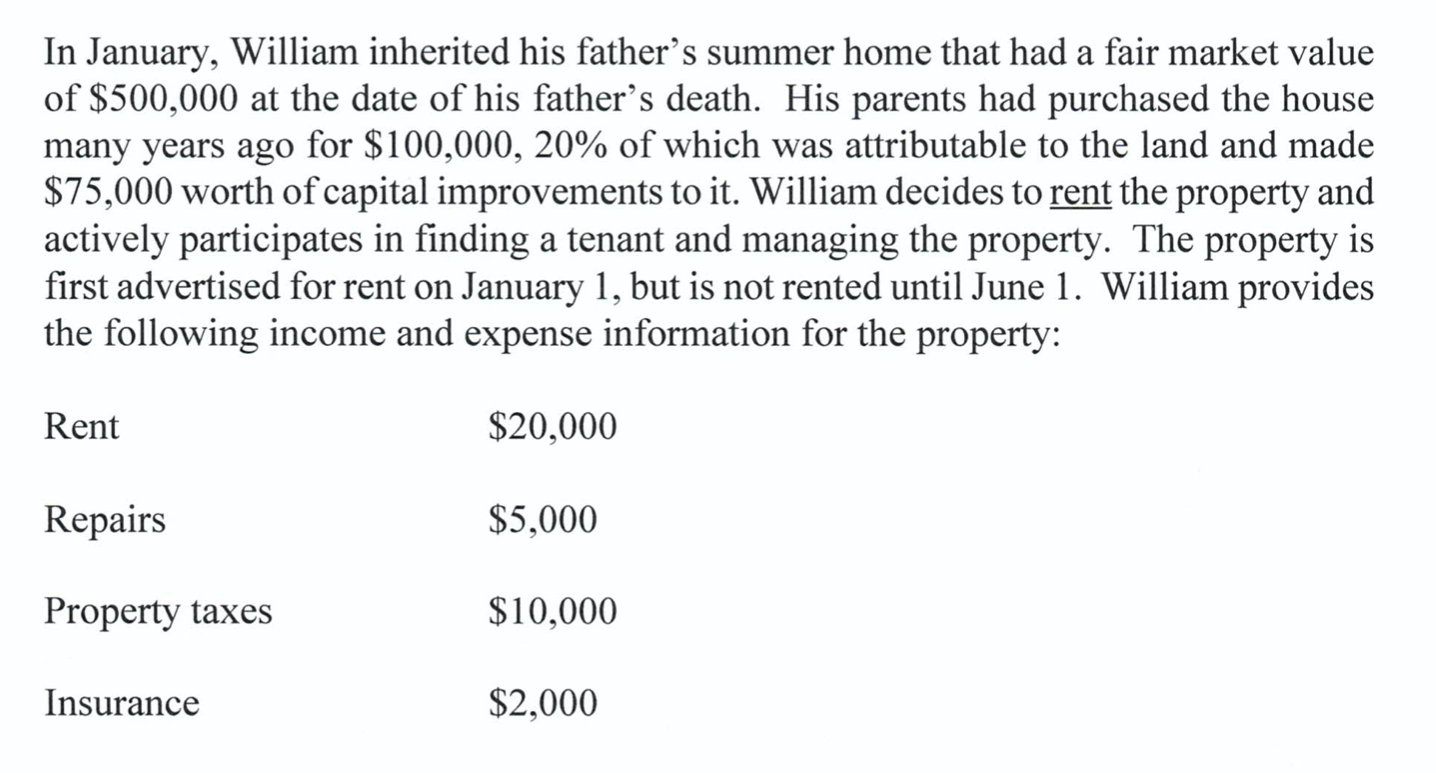

In January, William inherited his father's summer home that had a fair market value of $500,000 at the date of his father's death. His parents had purchased the house many years ago for $100,000, 20% of which was attributable to the land and made $75,000 worth of capital improvements to it. William decides to rent the property and actively participates in finding a tenant and managing the property. The property is first advertised for rent on January 1, but is not rented until June 1. William provides the following income and expense information for the property: Rent $20,000 Repairs $5,000 Property taxes $10,000 Insurance $2,000 In January, William inherited his father's summer home that had a fair market value of $500,000 at the date of his father's death. His parents had purchased the house many years ago for $100,000, 20% of which was attributable to the land and made $75,000 worth of capital improvements to it. William decides to rent the property and actively participates in finding a tenant and managing the property. The property is first advertised for rent on January 1, but is not rented until June 1. William provides the following income and expense information for the property: Rent $20,000 Repairs $5,000 Property taxes $10,000 Insurance $2,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started