Question: Using a 2-year zero-coupon bond and a perpetuity, design an immunization strategy for the following liability: Your firm has sold GIC's (guaranteed investment contracts)

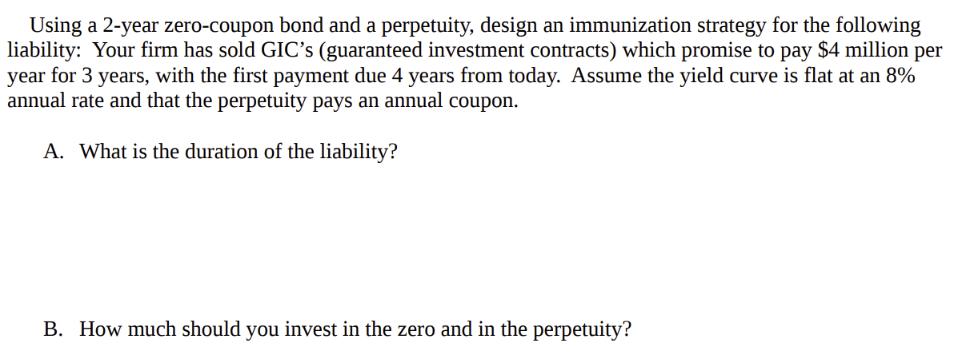

Using a 2-year zero-coupon bond and a perpetuity, design an immunization strategy for the following liability: Your firm has sold GIC's (guaranteed investment contracts) which promise to pay $4 million per year for 3 years, with the first payment due 4 years from today. Assume the yield curve is flat at an 8% annual rate and that the perpetuity pays an annual coupon. A. What is the duration of the liability? B. How much should you invest in the zero and in the perpetuity?

Step by Step Solution

3.54 Rating (168 Votes )

There are 3 Steps involved in it

To design an immunization strategy we need to match the duration of the assets to the duration of the liability Lets calculate the duration of the lia... View full answer

Get step-by-step solutions from verified subject matter experts