Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using a discount rate of 4.5% compounded annually, a pension fund estimates that the present value of its assets and liabilities are $14 million

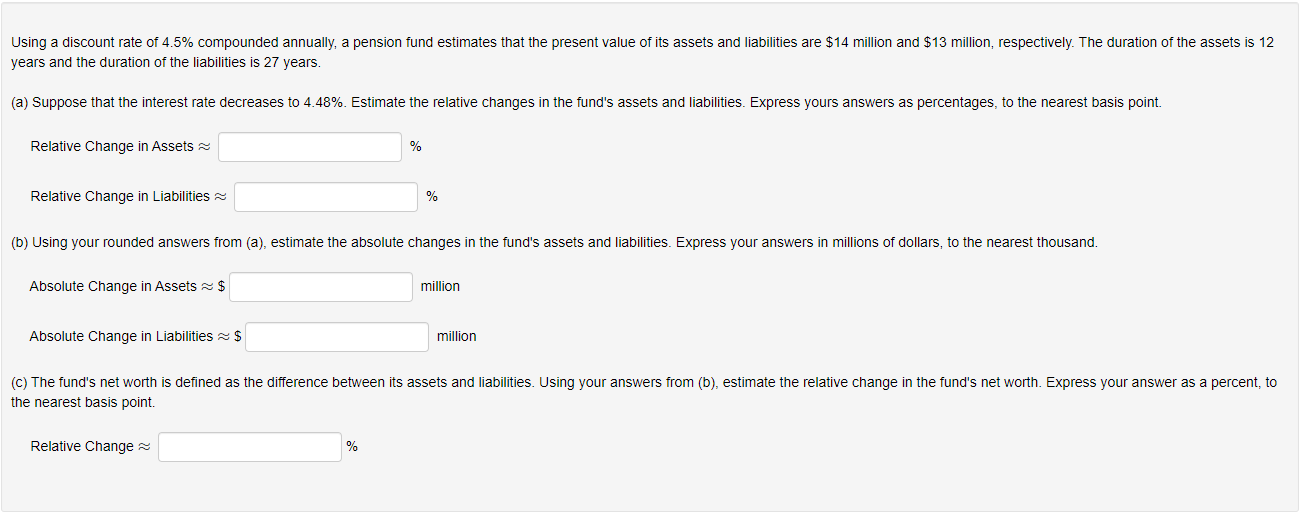

Using a discount rate of 4.5% compounded annually, a pension fund estimates that the present value of its assets and liabilities are $14 million and $13 million, respectively. The duration of the assets is 12 years and the duration of the liabilities is 27 years. (a) Suppose that the interest rate decreases to 4.48%. Estimate the relative changes in the fund's assets and liabilities. Express yours answers as percentages, to the nearest basis point. Relative Change in Assets Relative Change in Liabilities % % (b) Using your rounded answers from (a), estimate the absolute changes in the fund's assets and liabilities. Express your answers in millions of dollars, to the nearest thousand. Absolute Change in Assets = $ Absolute Change in Liabilities ~ $ million million (c) The fund's net worth is defined as the difference between its assets and liabilities. Using your answers from (b), estimate the relative change in the fund's net worth. Express your answer as a percent, to the nearest basis point. Relative Change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Solution a Relative Changes Since duration measures the sensitivity of the present value to i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started