Question: Using a required rate of return equal to 14 percent, compute the modified internal rate of return (MIRR) for a project that costs $80,000 and

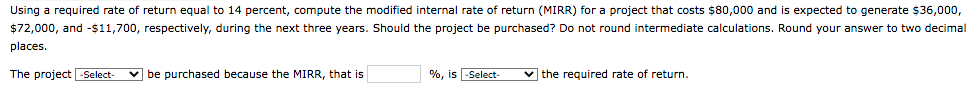

Using a required rate of return equal to 14 percent, compute the modified internal rate of return (MIRR) for a project that costs $80,000 and is expected to generate $36,000, $72,000, and -$11,700, respectively, during the next three years. Should the project be purchased? Do not round intermediate calculations. Round your answer to two decimal places.

The project - SHOULD / SHOULD NOT - be purchased because the MIRR, that is ______ %, is - GREATER THAN / LOWER THAN / EQUAL TO - the required rate of return.

Using a required rate of return equal to 14 percent, compute the modified internal rate of return (MIRR) for a project that costs $80,000 and is expected to generate $36,000, $72,000, and -$11,700, respectively, during the next three years. Should the project be purchased? Do not round intermediate calculations. Round your answer to two decimal places. The project -Select- be purchased because the MIRR, that is %, is -Select- the required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts