Question

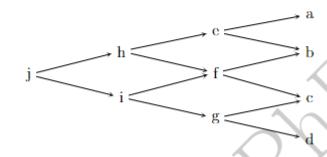

Using a three-period binomial tree, such as the one depicted below, calculate the price of an 18-month, at-the-money, European put option written on stock that

Using a three-period binomial tree, such as the one depicted below, calculate the price of an 18-month, at-the-money, European put option written on stock that is trading for $50 today. The option is trading at an implied volatility of 60%. The risk-free rate is equal to 3% per year, continuously compounded, and the stock pays no income.

(B) Using the risk-neutral valuation methodology, flesh-out the components of the option's manufacturing mix at nodes e, f, g, and j, i.e., the quantity of stock and the face value of the risk-free debt included in the option's replicating portfolio, and calculate the amount of leverage embedded in the option at each node.

(C) Based on your calculations other things kept equal, what is the relationship between the option's leverage ratio and its degree of moneyness?

(D) Based on your calculations other things equal, what is the relationship between the option's leverage and its time to maturity?

j V M MM bo W a b

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To address your questions we need to build a threeperiod binomial tree for the stock price then use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started