Using all of the documents provided in Week 7, you are to choose one (1) of the three financing deals being offered to Cougar Doors and articulate the financing deal Cougar Doors should pursue. Be detailed and substantially justify your position. Also, please be detailed why you did not choose the other two deals.

- Asset Based Lender

- Traditional Business Bank

- Private Equity Firm

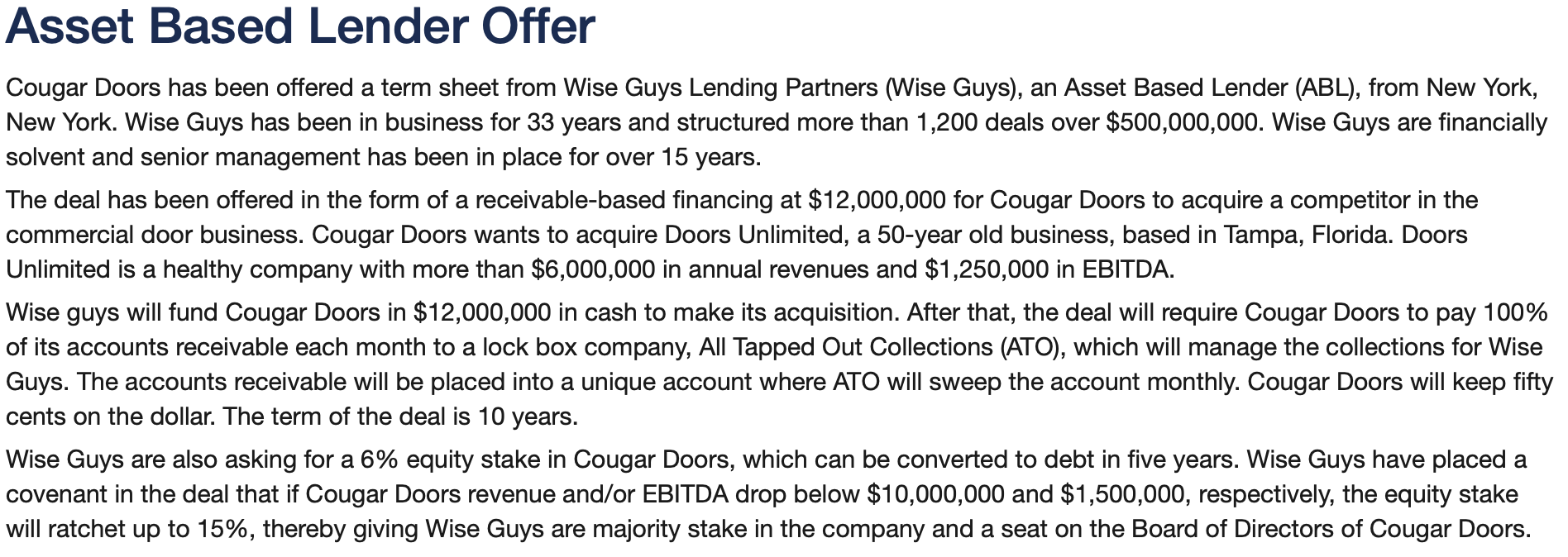

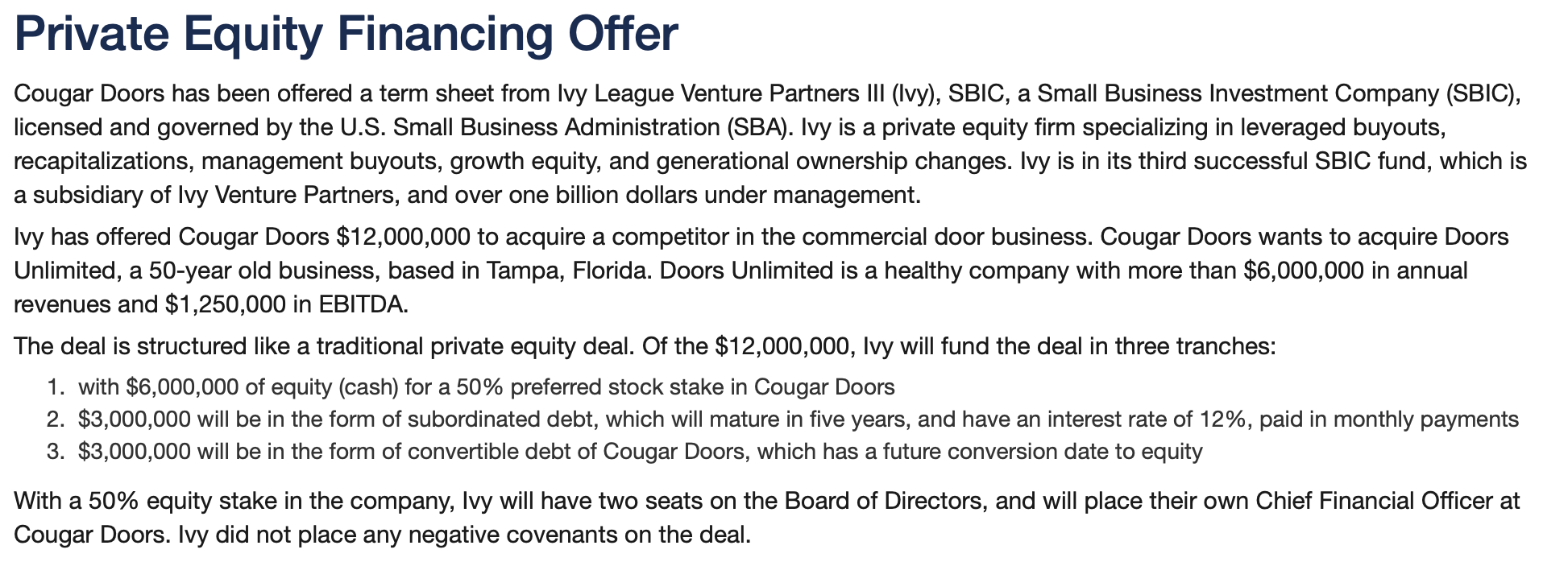

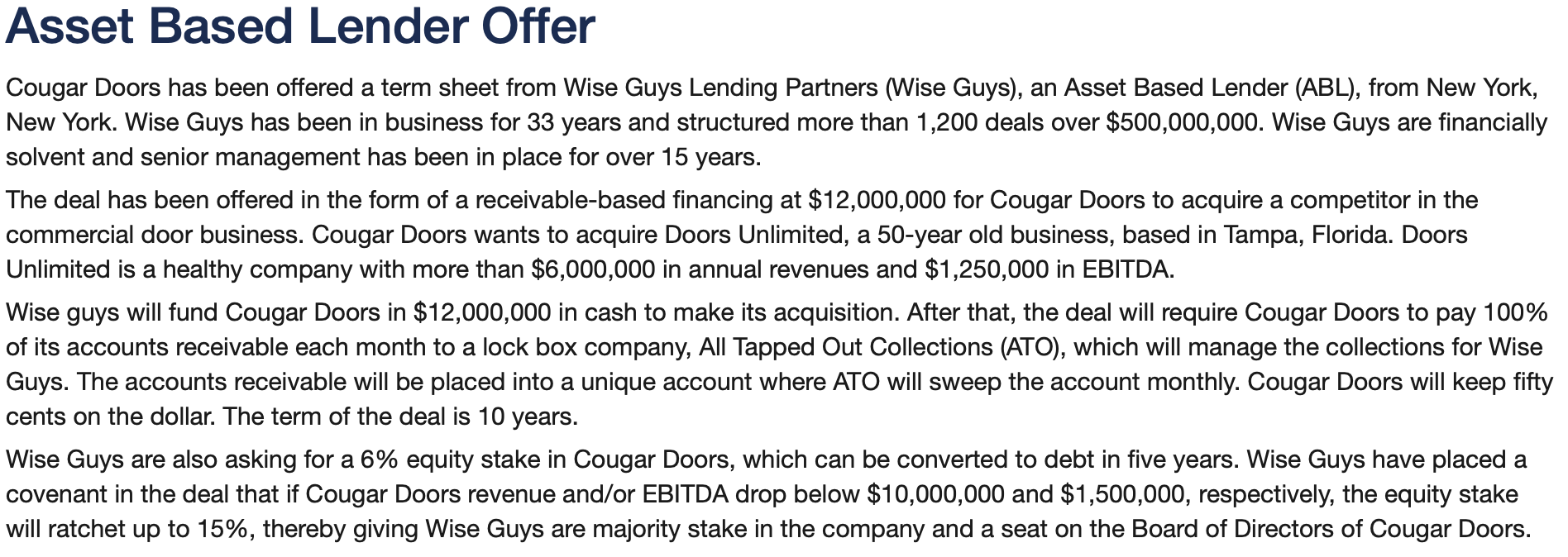

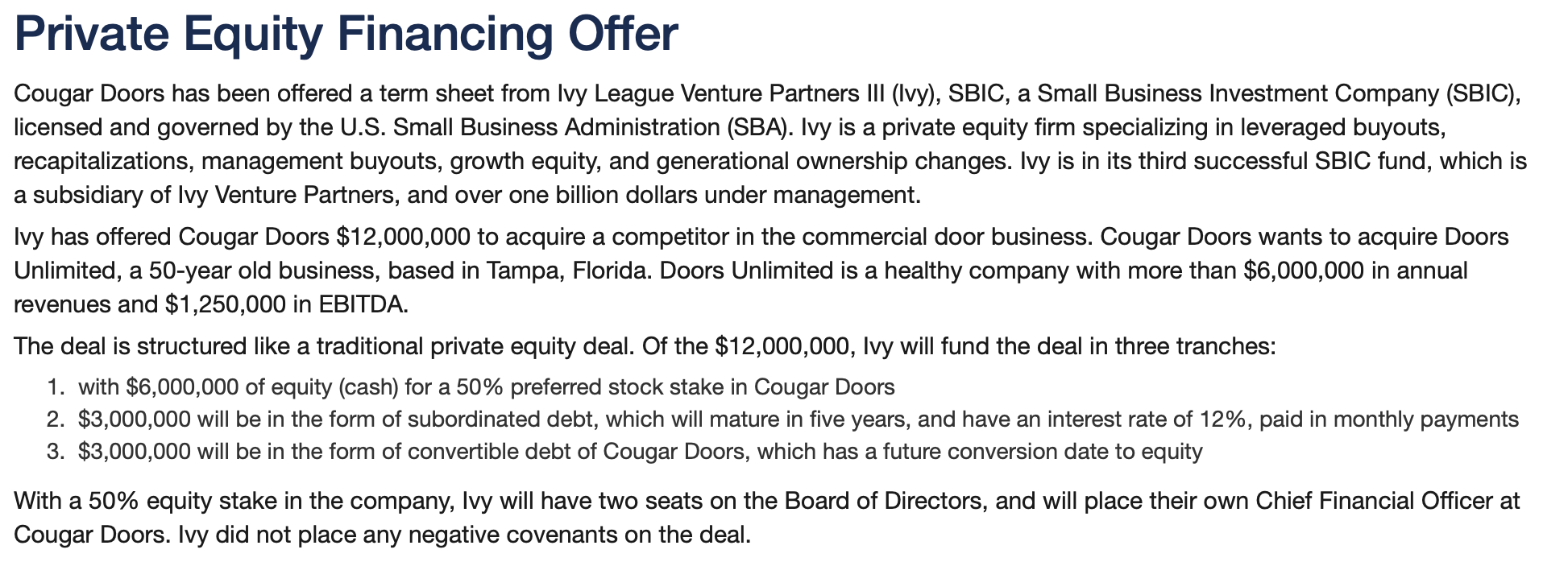

Asset Based Lender Offer Cougar Doors has been offered a term sheet from Wise Guys Lending Partners (Wise Guys), an Asset Based Lender (ABL), from New York, New York. Wise Guys has been in business for 33 years and structured more than 1,200 deals over $500,000,000. Wise Guys are financially solvent and senior management has been in place for over 15 years. The deal has been offered in the form of a receivable-based financing at $12,000,000 for Cougar Doors to acquire a competitor in the commercial door business. Cougar Doors wants to acquire Doors Unlimited, a 50-year old business, based in Tampa, Florida. Doors Unlimited is a healthy company with more than $6,000,000 in annual revenues and $1,250,000 in EBITDA. Wise guys will fund Cougar Doors in $12,000,000 in cash to make its acquisition. After that, the deal will require Cougar Doors to pay 100% of its accounts receivable each month to a lock box company, All Tapped Out Collections (ATO), which will manage the collections for Wise Guys. The accounts receivable will be placed into a unique account where ATO will sweep the account monthly. Cougar Doors will keep fifty cents on the dollar. The term of the deal is 10 years. Wise Guys are also asking for a 6% equity stake in Cougar Doors, which can be converted to debt in five years. Wise Guys have placed a covenant in the deal that if Cougar Doors revenue and/or EBITDA drop below $10,000,000 and $1,500,000, respectively, the equity stake will ratchet up to 15%, thereby giving Wise Guys are majority stake in the company and a seat on the Board of Directors of Cougar Doors. Traditional Business Bank Offer Cougar Doors has been offered a term sheet from Main Street Bank (MSB), community bank, with which Cougar Doors has had an existing relationship for approximately 30 years. MSB is a small, rural community bank in good financial health. MSB has a long-term relationship with Cougar Doors and recognizes they are a major employer in town and wants to support a local business. MSB has offered Cougar Doors $12,000,000 to acquire a competitor in the commercial door business. Cougar Doors wants to acquire Doors Unlimited, a 50-year old business, based in Tampa, Florida. Doors Unlimited is a healthy company with more than $6,000,000 in annual revenues and $1,250,000 in EBITDA. The deal is structured as a loan at 10% over 30 years. MSB's deal of 10% is at the going rate for this type of transaction and no other bank has made an offer, despite Cougar pitching this deal. MSB has placed a few loan covenants on this transaction. 1. MSB is preventing mergers or acquisitions without permission. 2. MSB is restricting or forbidding distributions and/or dividends paid to shareholders. 3. MSB is preventing investment in capital equipment, real estate or other businesses without separate permission. 4. MSB reserves the right to approve any future business deals outside the State of Missouri. If any of these covenants are tripped, MSB has the right to restructure the deal with more covenants or force the company to repay the loan in full. Private Equity Financing Offer Cougar Doors has been offered a term sheet from Ivy League Venture Partners III (Ivy), SBIC, a Small Business Investment Company (SBIC), licensed and governed by the U.S. Small Business Administration (SBA). Ivy is a private equity firm specializing in leveraged buyouts, recapitalizations, management buyouts, growth equity, and generational ownership changes. Ivy is in its third successful SBIC fund, which is a subsidiary of Ivy Venture Partners, and over one billion dollars under management. Ivy has offered Cougar Doors $12,000,000 to acquire a competitor in the commercial door business. Cougar Doors wants to acquire Doors Unlimited, a 50-year old business, based in Tampa, Florida. Doors Unlimited is a healthy company with more than $6,000,000 in annual revenues and $1,250,000 in EBITDA. The deal is structured like a traditional private equity deal. Of the $12,000,000, Ivy will fund the deal in three tranches: 1. with $6,000,000 of equity (cash) for a 50% preferred stock stake in Cougar Doors 2. $3,000,000 will be in the form of subordinated debt, which will mature in five years, and have an interest rate of 12%, paid in monthly payments 3. $3,000,000 will be in the form of convertible debt of Cougar Doors, which has a future conversion date to equity With a 50% equity stake in the company, Ivy will have two seats on the Board of Directors, and will place their own Chief Financial Officer at Cougar Doors. Ivy did not place any negative covenants on the deal. Asset Based Lender Offer Cougar Doors has been offered a term sheet from Wise Guys Lending Partners (Wise Guys), an Asset Based Lender (ABL), from New York, New York. Wise Guys has been in business for 33 years and structured more than 1,200 deals over $500,000,000. Wise Guys are financially solvent and senior management has been in place for over 15 years. The deal has been offered in the form of a receivable-based financing at $12,000,000 for Cougar Doors to acquire a competitor in the commercial door business. Cougar Doors wants to acquire Doors Unlimited, a 50-year old business, based in Tampa, Florida. Doors Unlimited is a healthy company with more than $6,000,000 in annual revenues and $1,250,000 in EBITDA. Wise guys will fund Cougar Doors in $12,000,000 in cash to make its acquisition. After that, the deal will require Cougar Doors to pay 100% of its accounts receivable each month to a lock box company, All Tapped Out Collections (ATO), which will manage the collections for Wise Guys. The accounts receivable will be placed into a unique account where ATO will sweep the account monthly. Cougar Doors will keep fifty cents on the dollar. The term of the deal is 10 years. Wise Guys are also asking for a 6% equity stake in Cougar Doors, which can be converted to debt in five years. Wise Guys have placed a covenant in the deal that if Cougar Doors revenue and/or EBITDA drop below $10,000,000 and $1,500,000, respectively, the equity stake will ratchet up to 15%, thereby giving Wise Guys are majority stake in the company and a seat on the Board of Directors of Cougar Doors. Traditional Business Bank Offer Cougar Doors has been offered a term sheet from Main Street Bank (MSB), community bank, with which Cougar Doors has had an existing relationship for approximately 30 years. MSB is a small, rural community bank in good financial health. MSB has a long-term relationship with Cougar Doors and recognizes they are a major employer in town and wants to support a local business. MSB has offered Cougar Doors $12,000,000 to acquire a competitor in the commercial door business. Cougar Doors wants to acquire Doors Unlimited, a 50-year old business, based in Tampa, Florida. Doors Unlimited is a healthy company with more than $6,000,000 in annual revenues and $1,250,000 in EBITDA. The deal is structured as a loan at 10% over 30 years. MSB's deal of 10% is at the going rate for this type of transaction and no other bank has made an offer, despite Cougar pitching this deal. MSB has placed a few loan covenants on this transaction. 1. MSB is preventing mergers or acquisitions without permission. 2. MSB is restricting or forbidding distributions and/or dividends paid to shareholders. 3. MSB is preventing investment in capital equipment, real estate or other businesses without separate permission. 4. MSB reserves the right to approve any future business deals outside the State of Missouri. If any of these covenants are tripped, MSB has the right to restructure the deal with more covenants or force the company to repay the loan in full. Private Equity Financing Offer Cougar Doors has been offered a term sheet from Ivy League Venture Partners III (Ivy), SBIC, a Small Business Investment Company (SBIC), licensed and governed by the U.S. Small Business Administration (SBA). Ivy is a private equity firm specializing in leveraged buyouts, recapitalizations, management buyouts, growth equity, and generational ownership changes. Ivy is in its third successful SBIC fund, which is a subsidiary of Ivy Venture Partners, and over one billion dollars under management. Ivy has offered Cougar Doors $12,000,000 to acquire a competitor in the commercial door business. Cougar Doors wants to acquire Doors Unlimited, a 50-year old business, based in Tampa, Florida. Doors Unlimited is a healthy company with more than $6,000,000 in annual revenues and $1,250,000 in EBITDA. The deal is structured like a traditional private equity deal. Of the $12,000,000, Ivy will fund the deal in three tranches: 1. with $6,000,000 of equity (cash) for a 50% preferred stock stake in Cougar Doors 2. $3,000,000 will be in the form of subordinated debt, which will mature in five years, and have an interest rate of 12%, paid in monthly payments 3. $3,000,000 will be in the form of convertible debt of Cougar Doors, which has a future conversion date to equity With a 50% equity stake in the company, Ivy will have two seats on the Board of Directors, and will place their own Chief Financial Officer at Cougar Doors. Ivy did not place any negative covenants on the deal