- Using an appropriate formula, compute the sustainable growth rate for the firm

- Based on your computed sustainable growth rate and the projected sales growth of 20% next year, what is your advice/recommendation to the firm?

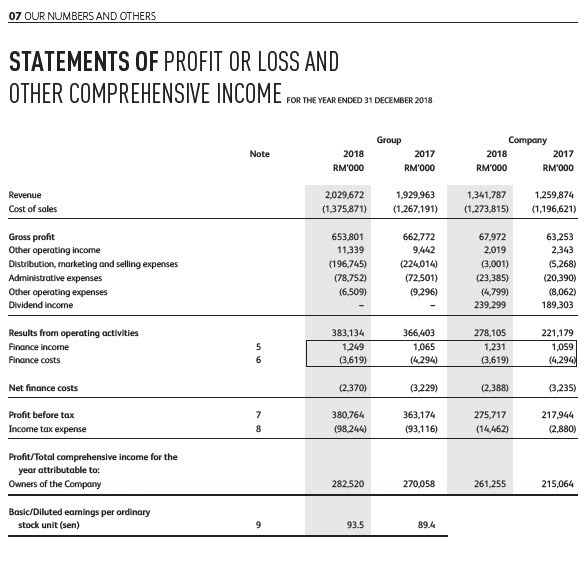

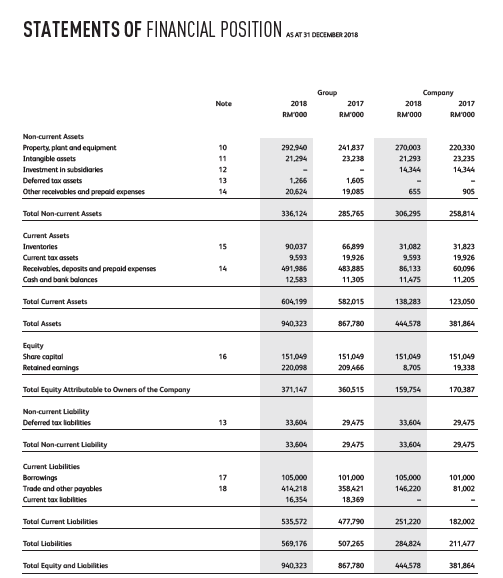

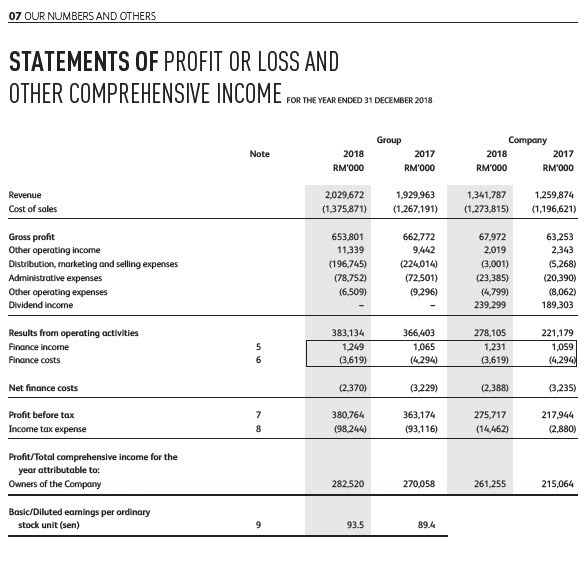

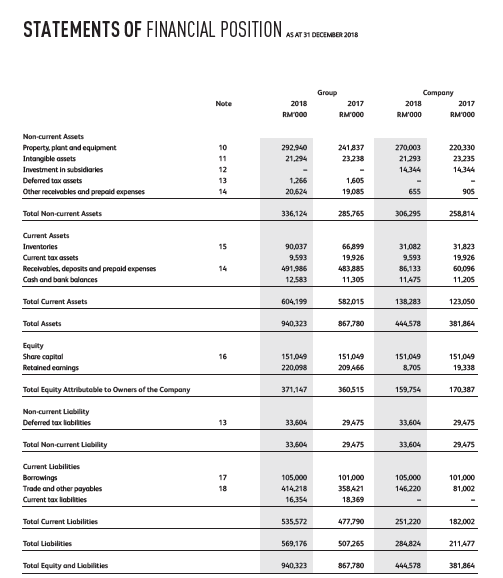

07 OUR NUMBERS AND OTHERS STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2018 Note 2018 RM'000 Group 2017 RM'000 Company 2018 2017 RM'000 RM'000 Revenue Cost of sales 2,029,672 (1,375,871) 1.929.963 (1,267,191) 1,341,787 (1.273,815) 1,259,874 (1,196,621) Gross profit Other operating income Distribution, marketing and selling expenses Administrative expenses Other operating expenses Dividend income 653,801 11,339 (196,745) (78,752) (6.509) 662,772 9.442 (224,014) (72.501) (9.296) 67.972 2,019 (3.001) (23,385) (4,799) 239,299 63,253 2,343 (5.268) (20,390) (8,062) 189,303 Results from operating activities Finance income Finance costs 5 6 383,134 1.249 (3.619) 366,403 1,065 (4294) 278,105 1,231 (3.619) 221,179 1,059 (4.294 Net finance costs (2.370) (3.229) (2,388) 33.235) Profit before tax Income tax expense 7 8 380,764 (98.244) 363.174 (93.116) 275,717 (14.462) 217,944 (2,880) Profit/Total comprehensive income for the year attributable to: Owners of the Company 282,520 270,058 261,255 215,064 Basic/Diluted earnings per ordinary stock unit (sen) 9 93.5 89.4 STATEMENTS OF FINANCIAL POSITION SAT H1 DECEMBER 2016 Group Note 2018 RM000 2017 RMOOO Company 2018 2017 RM1000 RM 000 292,940 21.294 241837 23.238 Non-current Assets Property, plant and equipment Intangible assets Investment in subsidiaries Deferred tax assets Other receivables and prepaid expenses 10 11 12 13 14 270.003 21.293 14.344 220330 23.235 14344 1.256 20,624 1,605 19,085 655 905 Total Non-current Assets 336,124 285.765 306.295 258.814 15 Current Assets Inventories Current tax assets Receivables, deposits and prepaid expenses Cash and bank balances 90,037 9,593 491,985 12.583 66,899 19.926 483.885 11.305 31.082 9.593 86.133 11.475 31823 19.926 60.096 11.205 14 Total Current Assets 604.199 582.015 134283 123.050 Total Assets 940,323 867,780 444.578 381 864 Equity Share capital Retained earings 16 151,049 220,098 151049 209.466 151.049 8.705 151.049 19.338 Total Equity Attributable to Owners of the Company 371,147 360,515 159.754 170.387 Non-current Liability Deferred tax liabilities 13 33,604 29.475 33.604 29.475 Total Non-current Liability 33.604 29.475 33,604 29.475 Current Liabilities Borrowings Trade and other payables Current tax liabilities 17 18 105,000 414.218 16,354 101.000 358421 18,369 105.000 146.220 101.000 81.002 Total Current Liabilities 535,572 477.790 251.220 182.002 Total Liabilities 569,176 507265 284, 824 211A77 Total Equity and Liabilities 940,323 867,780 444.578 381.864 07 OUR NUMBERS AND OTHERS STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2018 Note 2018 RM'000 Group 2017 RM'000 Company 2018 2017 RM'000 RM'000 Revenue Cost of sales 2,029,672 (1,375,871) 1.929.963 (1,267,191) 1,341,787 (1.273,815) 1,259,874 (1,196,621) Gross profit Other operating income Distribution, marketing and selling expenses Administrative expenses Other operating expenses Dividend income 653,801 11,339 (196,745) (78,752) (6.509) 662,772 9.442 (224,014) (72.501) (9.296) 67.972 2,019 (3.001) (23,385) (4,799) 239,299 63,253 2,343 (5.268) (20,390) (8,062) 189,303 Results from operating activities Finance income Finance costs 5 6 383,134 1.249 (3.619) 366,403 1,065 (4294) 278,105 1,231 (3.619) 221,179 1,059 (4.294 Net finance costs (2.370) (3.229) (2,388) 33.235) Profit before tax Income tax expense 7 8 380,764 (98.244) 363.174 (93.116) 275,717 (14.462) 217,944 (2,880) Profit/Total comprehensive income for the year attributable to: Owners of the Company 282,520 270,058 261,255 215,064 Basic/Diluted earnings per ordinary stock unit (sen) 9 93.5 89.4 STATEMENTS OF FINANCIAL POSITION SAT H1 DECEMBER 2016 Group Note 2018 RM000 2017 RMOOO Company 2018 2017 RM1000 RM 000 292,940 21.294 241837 23.238 Non-current Assets Property, plant and equipment Intangible assets Investment in subsidiaries Deferred tax assets Other receivables and prepaid expenses 10 11 12 13 14 270.003 21.293 14.344 220330 23.235 14344 1.256 20,624 1,605 19,085 655 905 Total Non-current Assets 336,124 285.765 306.295 258.814 15 Current Assets Inventories Current tax assets Receivables, deposits and prepaid expenses Cash and bank balances 90,037 9,593 491,985 12.583 66,899 19.926 483.885 11.305 31.082 9.593 86.133 11.475 31823 19.926 60.096 11.205 14 Total Current Assets 604.199 582.015 134283 123.050 Total Assets 940,323 867,780 444.578 381 864 Equity Share capital Retained earings 16 151,049 220,098 151049 209.466 151.049 8.705 151.049 19.338 Total Equity Attributable to Owners of the Company 371,147 360,515 159.754 170.387 Non-current Liability Deferred tax liabilities 13 33,604 29.475 33.604 29.475 Total Non-current Liability 33.604 29.475 33,604 29.475 Current Liabilities Borrowings Trade and other payables Current tax liabilities 17 18 105,000 414.218 16,354 101.000 358421 18,369 105.000 146.220 101.000 81.002 Total Current Liabilities 535,572 477.790 251.220 182.002 Total Liabilities 569,176 507265 284, 824 211A77 Total Equity and Liabilities 940,323 867,780 444.578 381.864