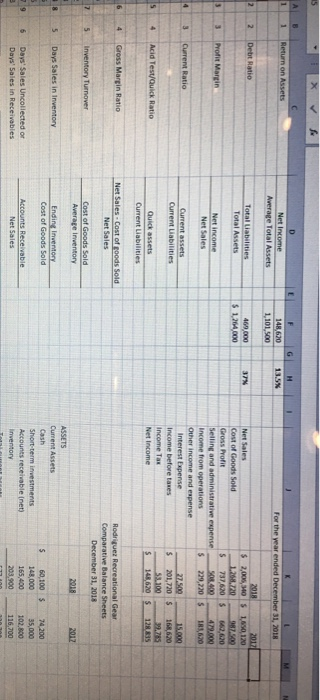

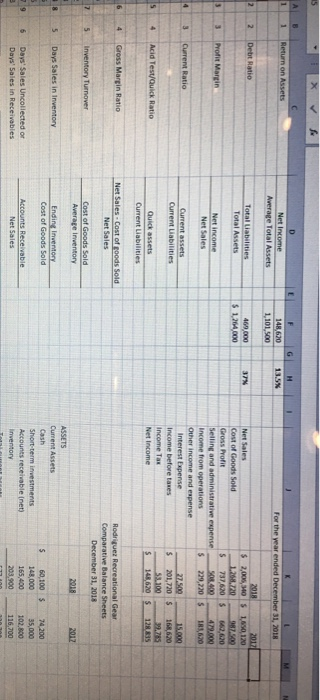

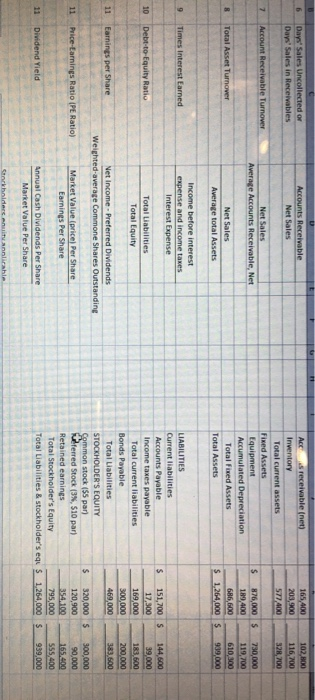

using an excel spreadsheet that contains comparative financial statements Rodriguez Recreational Gear determine the following measures for 2018, rounding to one decimal places except for per-share amounts, which should be rounded to the nearest penny.

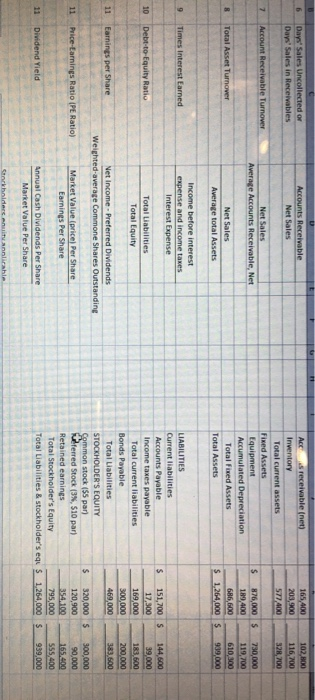

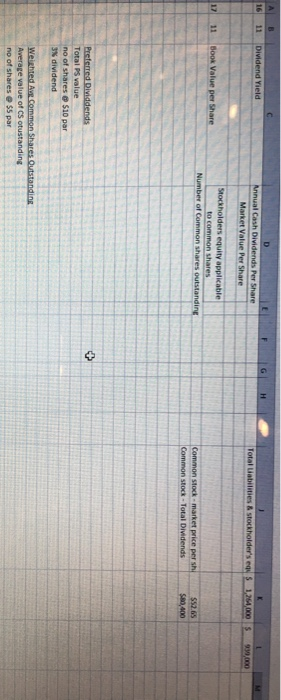

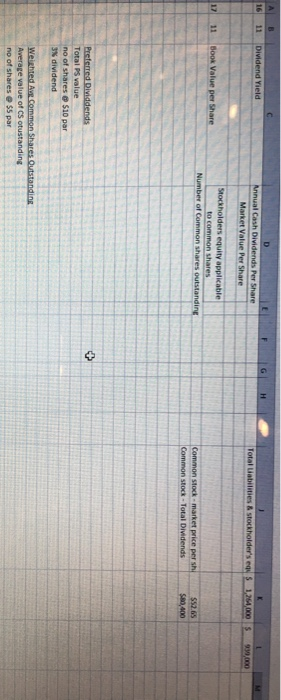

15 X 1 Return on Assets 1480 For the year ended December 31, 2018 Average Total Assets 1,101,500 2 2 Debt Ratio Total Liabilities Total Assets 469,000 1,264.000 $ 2018 2,000 5 1,00 120 S 737,620 3 3 Profit Margin S 2,620 Net income Net Sales Net Sales cost of Goods Sold Gross Profit Selling and administrative expense income from operations Other income and expense Interest Expense Income before tanes $ 229,220 S 183,670 4 3 Current Ratio Current assets Current Liabilities 27.500 201,720 5 168670 4 Acid Test/Quick Ratio Quick assets Current Liabilities $ 145,620 S 128835 Gross Margin Ratio let Sales. Cost of goods Sold Net Sales Rodriguez Recreational Gear Comparative Balance Sheets December 31, 2018 5 inventory Turnove Cost of Goods Sold Average Inventory 2018 2012 5 Days Sales in Inventory Ending Inventory $ ASSETS Current Assets Cash Short-term investments Accounts receivable (net) Inventory 196 Days Sales Uncollected or Days' Sales in Receivables 60,100 148,000 155,400 203.900 74.200 35 000 102,800 116.700 6 Days Sales Uncollected or Days' Sales in Receivables Accounts Receivable Net Sales 165,400 203,900 577 400 102,00 116,00 2700 Account Receivable Turnover Net Sales Average Accounts Receivable, Net Acts receivable (net) Inventory Total current assets Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets 5 876,000 189.400 730,000 119,700 610,300 909,000 8 Total Asset Turnover 686,600 Net Sales Average total Assets S 1,264,000 5 9 Times Interest Earned Income before interest expense and income taxes Interest Expense S 10 Debt-to-Equity Ratio Total Liabilities Total Equity 151,700 17.300 169,000 300,000 469,000 144,500 39.000 183.600 200.000 383.600 11 LIABILITIES Current liabilities Accounts Payable Income taxes payable Total current liabilities Bonds Payable Total Liabilities STOCKHOLDER'S EQUITY Sommon stock (55 par) teferred Stock (3%, 510 par) Retained earnings Total Stockholder's Equity Total Liabilities & stockholder's equs Earnings per Share Net Income . Preferred Dividends Weighted average Commone Shares Outstanding S 300,000 11 Price-Earnings Ratio (PE Ratio) 90,000 Market Value (price) Per Share Earnings Per Share 320,000 120,900 354,100 795,000 1,264,000 S55,400 939,000 11 Dividend Yield S Annual Cash Dividends Per Share Market Value Per Share Stockholders. Annlicable 16 11 Dividend Yield Annual Cash Dividends Per Share Market Value Per Share Total abilities & stockholder's 5 1254 000 979,000 12 11 Book Value per Share Stockholders equity applicable to common shares Number of Common shares outstanding common stock market price persh Common stock - Total Dividends 5 52.65 $80,400 Preferred Dividends Total P value no of shares o si par 3 dividend Weighted Ave Common Shares Outstanding Average value of CS otustanding no of shares e $5 par