Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using binomial interest rate trees, fill out the table below. The first five columns are inputs. CR and Face are, respectively, the coupon rate

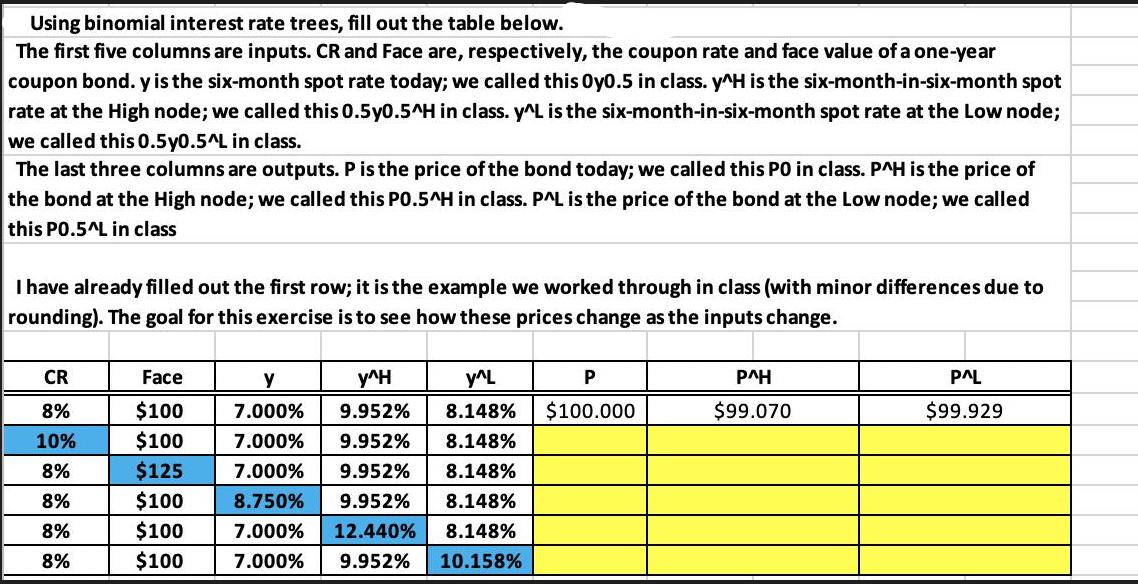

Using binomial interest rate trees, fill out the table below. The first five columns are inputs. CR and Face are, respectively, the coupon rate and face value of a one-year coupon bond. y is the six-month spot rate today; we called this Oy0.5 in class. y^H is the six-month-in-six-month spot rate at the High node; we called this 0.5y0.5^H in class. y^L is the six-month-in-six-month spot rate at the Low node; we called this 0.5y0.5^L in class. The last three columns are outputs. P is the price of the bond today; we called this PO in class. P^H is the price of the bond at the High node; we called this P0.5^H in class. P^L is the price of the bond at the Low node; we called this P0.5^L in class I have already filled out the first row; it is the example we worked through in class (with minor differences due to rounding). The goal for this exercise is to see how these prices change as the inputs change. CR Face y 8% $100 7.000% 10% $100 7.000% 8% $125 7.000% y^H y^L 9.952% 8.148% 9.952% 8.148% 9.952% 8.148% P P^H PL $100.000 $99.070 $99.929 8% $100 8.750% 9.952% 8.148% 8% $100 7.000% 12.440% 8.148% 8% $100 7.000% 9.952% 10.158%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started