Using C++ please

rate (nx12) x(1 - 1) x(1+"ace) nuel SalaryCode: Section 401(k) A 401(k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts. Elective salary deferrals are excluded from the employee's taxable income (except for designated Roth deferrals). Employers can contribute to employees' accounts. Distributions, including earnings, are includible in taxable income at retirement (except for qualified distributions of designated Roth accounts). Source: 401k Plans Internal Revenue Service (irs.gov) The following fields are needed to compute for the Total Account Value of the 401k when an employee retires. Annual Salary ($): Annual Salary Increase (%): Annual Rate of Return (%): Current Age: Age of Retirement: Current 401k Balance ($): Contribution to 401k (%): Employer Match (%): Employer Max Contribution (%): The formula to compute for the Total Account Value (TAV) is a modified version of the Growing Annuity Formula. (1 + i)" - (1 + 9)") FV = Pmt x (i-g FV=Future Value Pmt=Period payment i=Discount rate g=Growth rate n=Number of periods Total Account Value (TAV) rate (nx12) (YC + EC) 1+ rate = CBX + 12 (rate 12 12 TAV: Total Account Value CB: Current 401k Balance rate: Annual Rate of Return (Must be in decimal format. Example, 8% = 0.08) n: Age of Retirement - rent Age YC: Monthly 401(k) Contribution EC: Employer's Monthly 401(k) Adding Annual Salary x Contribution to 401k YC = 12 EC = YC X Employer Match Annual salary ($) + Gross annual pay prior to deductions (tax, social security, insurance, etc.). Annual Salary Increase (%) + How much the salary is estimated to increase per annum. Annual Rate of Return (%) Estimate how the 401k investments will grow per annum. Current Age (years) + How old you are now. Age of Retirement (years) + When you expect to retire. Current 401k Balance ($) + The current balance on the 401k plan, otherwise, enter zero in this field. Contribution to 401k (%) How much of your annual salary will be contributed to the 401k plan? Employer Match (%) The amount the employer will match your contributions. Example, if your monthly contribution is $400 and the employer agrees to pay $200 then enter 50% in this field. Employer Max Contribution (%) + Every employer has a maximum amount they can contribute. Example, the employer will not pay more than 50% of what you contribute up to 8% of your annual salary. + If your annual salary is $50,000.00 then 10% of that will be $5,000.00 annual contribution. Your monthly contribution is $416.67, and your employer will match that by contributing 50% which is $208.34. If you and your employer agreed to a 50% up to 8% plan, they have a certain maximum they can contribute. 8% of your annual salary is $4,000.00 and when divided into 12 months it is $333.33. Get 50% of $333.33 and your employer's maximum contribution is $166.67. + Therefore, instead of contributing $208.34 monthly, they will instead pay $166.67 monthly. 2. Task Write the C++ program that will prompt the user to input the following fields. Annual Salary ($): Annual Salary Increase %): Annual Rate of Return (%): Current Age: Age of Retirement: Current 401k Balance ($): Contribution to 401k (%): Employer Match (%): Employer Max Contribution (%): Create a Struct to hold the fields as attributes. You can include memberon- member functions when they are needed to assign values to the attributes. You will only use member functions of an object to accept input and display the summary. Refer to the main program below. int main {

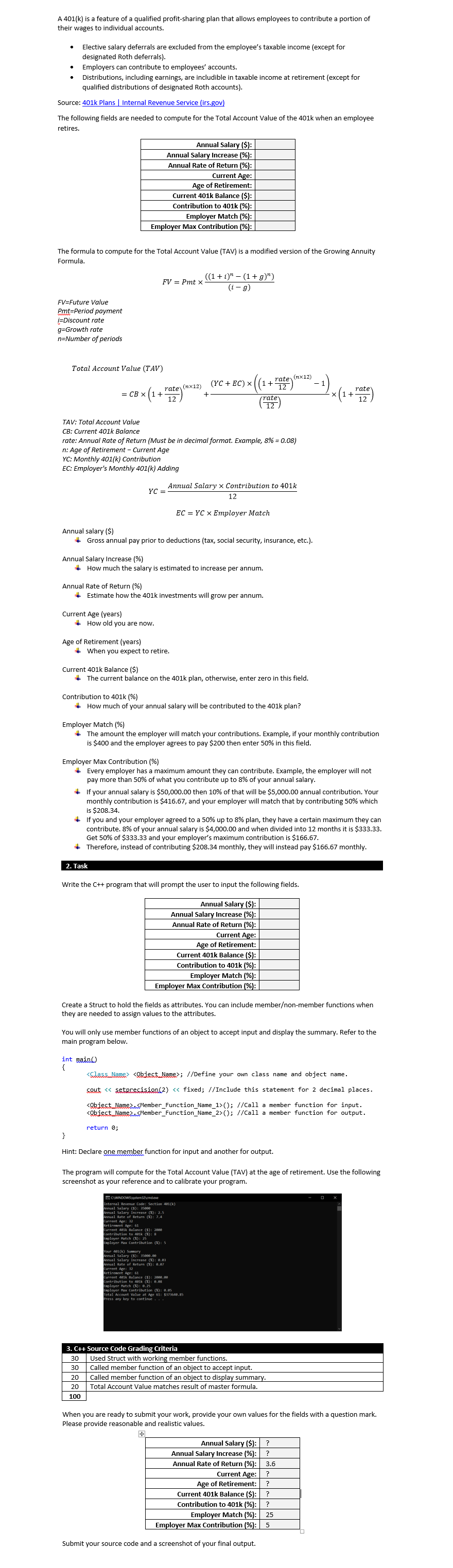

; //Define your own class name and object name. cout (); //Call a member function for input. (); //Call a member function for output. return 0; } Hint: Declare one member function for input and another for output. The program will compute for the Total Account Value (TAV) at the age of retirement. Use the following screenshot as your reference and to calibrate your program. CYWINDOWS system32\credere Anal Salary Increase ($): 2.5 Annual Rate of Return (%): 7.4 Current Age: 32 Retirement Age: 61 current 401k Balance (5): 2000 Contribution to 401k (5): & Employer Match (M): 25 Employer Max Contribution (%): 5 Your 401(k) Sumary Ranual salary ($): 25000.00 Annual salary increase (x): 0.03 Annual Rate of Return (*): 0.07 Current Age: 32 Retirement Age: 61 Current 401k Balance (5): 2800.00 Contribution to 401k (8): 0.08 Employer Match (%): 8.25 ployer Max Contribution (): 4.0 Total nt value at Ape 61: $373668.85 Press any key to continue... Internal ()250 stal Account 3.Ch Source Code Grading Criteria 30 Used Struct with working member functions. 30 Called member function of an object to accept input. 20 Called member function of an object to display summary. 20 Total Account Value matches result of master formula. 100 When you are ready to submit your work, provide your own values for the fields with a question mark. Please provide reasonable and realistic values. Annual Salary ($): ? Annual Salary Increase (%): ? Annual Rate of Return (%): 3.6 Current Age: ? Age of Retirement: ? Current 401k Balance ($): ? Contribution to 401k (%): ? Employer Match (%): 25 Employer Max Contribution (%): 5 Submit your source code and a screenshot of your final output. rate (nx12) x(1 - 1) x(1+"ace) nuel SalaryCode: Section 401(k) A 401(k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts. Elective salary deferrals are excluded from the employee's taxable income (except for designated Roth deferrals). Employers can contribute to employees' accounts. Distributions, including earnings, are includible in taxable income at retirement (except for qualified distributions of designated Roth accounts). Source: 401k Plans Internal Revenue Service (irs.gov) The following fields are needed to compute for the Total Account Value of the 401k when an employee retires. Annual Salary ($): Annual Salary Increase (%): Annual Rate of Return (%): Current Age: Age of Retirement: Current 401k Balance ($): Contribution to 401k (%): Employer Match (%): Employer Max Contribution (%): The formula to compute for the Total Account Value (TAV) is a modified version of the Growing Annuity Formula. (1 + i)" - (1 + 9)") FV = Pmt x (i-g FV=Future Value Pmt=Period payment i=Discount rate g=Growth rate n=Number of periods Total Account Value (TAV) rate (nx12) (YC + EC) 1+ rate = CBX + 12 (rate 12 12 TAV: Total Account Value CB: Current 401k Balance rate: Annual Rate of Return (Must be in decimal format. Example, 8% = 0.08) n: Age of Retirement - rent Age YC: Monthly 401(k) Contribution EC: Employer's Monthly 401(k) Adding Annual Salary x Contribution to 401k YC = 12 EC = YC X Employer Match Annual salary ($) + Gross annual pay prior to deductions (tax, social security, insurance, etc.). Annual Salary Increase (%) + How much the salary is estimated to increase per annum. Annual Rate of Return (%) Estimate how the 401k investments will grow per annum. Current Age (years) + How old you are now. Age of Retirement (years) + When you expect to retire. Current 401k Balance ($) + The current balance on the 401k plan, otherwise, enter zero in this field. Contribution to 401k (%) How much of your annual salary will be contributed to the 401k plan? Employer Match (%) The amount the employer will match your contributions. Example, if your monthly contribution is $400 and the employer agrees to pay $200 then enter 50% in this field. Employer Max Contribution (%) + Every employer has a maximum amount they can contribute. Example, the employer will not pay more than 50% of what you contribute up to 8% of your annual salary. + If your annual salary is $50,000.00 then 10% of that will be $5,000.00 annual contribution. Your monthly contribution is $416.67, and your employer will match that by contributing 50% which is $208.34. If you and your employer agreed to a 50% up to 8% plan, they have a certain maximum they can contribute. 8% of your annual salary is $4,000.00 and when divided into 12 months it is $333.33. Get 50% of $333.33 and your employer's maximum contribution is $166.67. + Therefore, instead of contributing $208.34 monthly, they will instead pay $166.67 monthly. 2. Task Write the C++ program that will prompt the user to input the following fields. Annual Salary ($): Annual Salary Increase %): Annual Rate of Return (%): Current Age: Age of Retirement: Current 401k Balance ($): Contribution to 401k (%): Employer Match (%): Employer Max Contribution (%): Create a Struct to hold the fields as attributes. You can include memberon- member functions when they are needed to assign values to the attributes. You will only use member functions of an object to accept input and display the summary. Refer to the main program below. int main { ; //Define your own class name and object name. cout (); //Call a member function for input. (); //Call a member function for output. return 0; } Hint: Declare one member function for input and another for output. The program will compute for the Total Account Value (TAV) at the age of retirement. Use the following screenshot as your reference and to calibrate your program. CYWINDOWS system32\credere Anal Salary Increase ($): 2.5 Annual Rate of Return (%): 7.4 Current Age: 32 Retirement Age: 61 current 401k Balance (5): 2000 Contribution to 401k (5): & Employer Match (M): 25 Employer Max Contribution (%): 5 Your 401(k) Sumary Ranual salary ($): 25000.00 Annual salary increase (x): 0.03 Annual Rate of Return (*): 0.07 Current Age: 32 Retirement Age: 61 Current 401k Balance (5): 2800.00 Contribution to 401k (8): 0.08 Employer Match (%): 8.25 ployer Max Contribution (): 4.0 Total nt value at Ape 61: $373668.85 Press any key to continue... Internal ()250 stal Account 3.Ch Source Code Grading Criteria 30 Used Struct with working member functions. 30 Called member function of an object to accept input. 20 Called member function of an object to display summary. 20 Total Account Value matches result of master formula. 100 When you are ready to submit your work, provide your own values for the fields with a question mark. Please provide reasonable and realistic values. Annual Salary ($): ? Annual Salary Increase (%): ? Annual Rate of Return (%): 3.6 Current Age: ? Age of Retirement: ? Current 401k Balance ($): ? Contribution to 401k (%): ? Employer Match (%): 25 Employer Max Contribution (%): 5 Submit your source code and a screenshot of your final output