Answered step by step

Verified Expert Solution

Question

1 Approved Answer

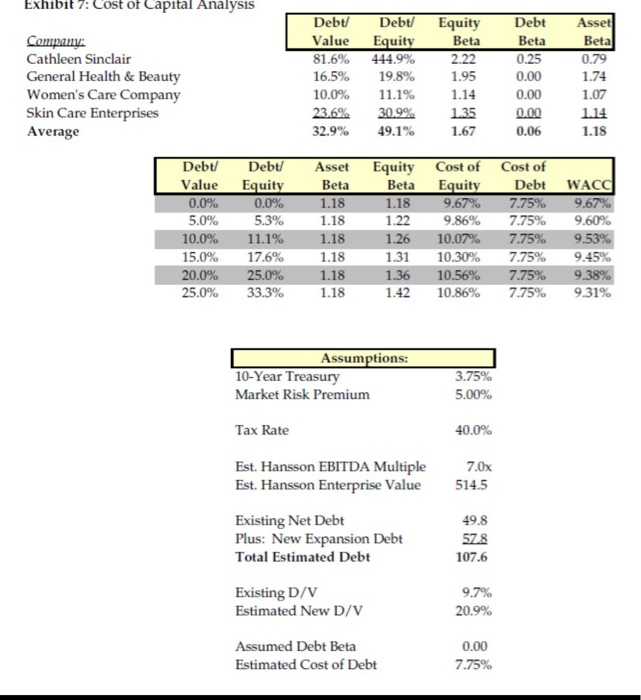

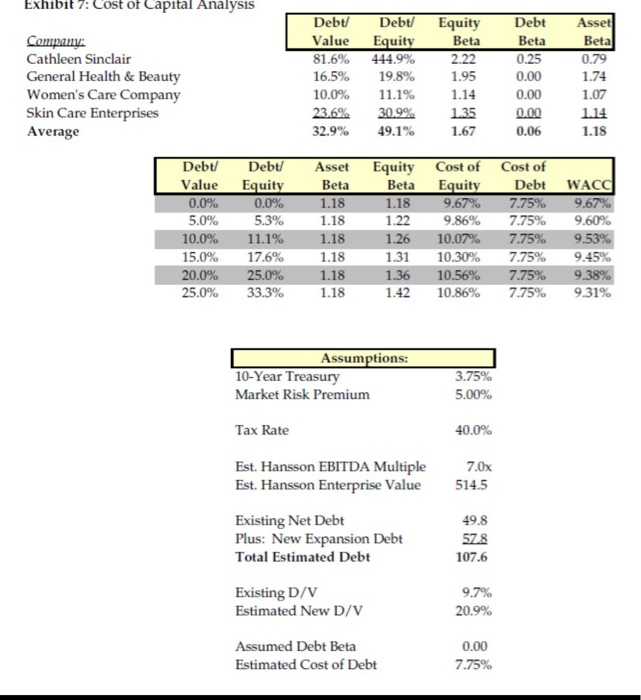

using cfo Sheila Dowlings projected weighted average cost of capital (wacc) schedule, I chose to use a discount rate of 9.45 to evaluate the Hansson

using cfo Sheila Dowlings projected weighted average cost of capital (wacc) schedule, I chose to use a discount rate of 9.45 to evaluate the Hansson Private Label case because of many evaluations I did such as using the CAPM and WACC models, my question is, what flaws, if any, might be inherent in using that WACC as the discount rate

Exhibit 7: Cost of Capital Analysis Debt Debt/ Equity Beta 2.22 Debt Asset Beta Company Cathleen Sinclair Value 81.6% 444.9% Equity Beta 0.25 0.79 General Health & Beauty Women's Care Company Skin Care Enterprises Average 16.5% 19.8% 1.95 0.00 1.74 10.0% 11.1% 0.00 1.07 1.14 30.9% 0.00 L14 23.6% 1.35 32.9% 49.1% 1.67 0.06 1.18 Equity Cost of Cost of Beta Equity 1.18 Debt Debt/ Asset Debt WACC Value 0.0% 5.0% Equity 0.0% 5.3% Beta 7.75% 9.67% 9.67% 1.18 1.18 1.22 9.86% 7.75% 9.60% 10.07% 7.75% 9.53% 10.0% 11.1% 1.18 1.26 1.31 15.0% 10.30% 17.6% 1.18 7.75% 9.45% 20.0% 9.38% 25.0% 1.18 1.36 10.56% 7.75% 25.0% 10.86% 7.75% 9.31% 1.18 1.42 33.3% Assumptions: 10-Year Treasury Market Risk Premium 3.75% 5.00% Tax Rate 40.0% Est. Hansson EBITDA Multiple Est. Hansson Enterprise Value 7.0x 514.5 Existing Net Debt Plus: New Expansion Debt Total Estimated Debt 49.8 57.8 107.6 Existing D/V Estimated New D/V 9.7% 20.9% Assumed Debt Beta 0.00 Estimated Cost of Debt 7.75%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started