Answered step by step

Verified Expert Solution

Question

1 Approved Answer

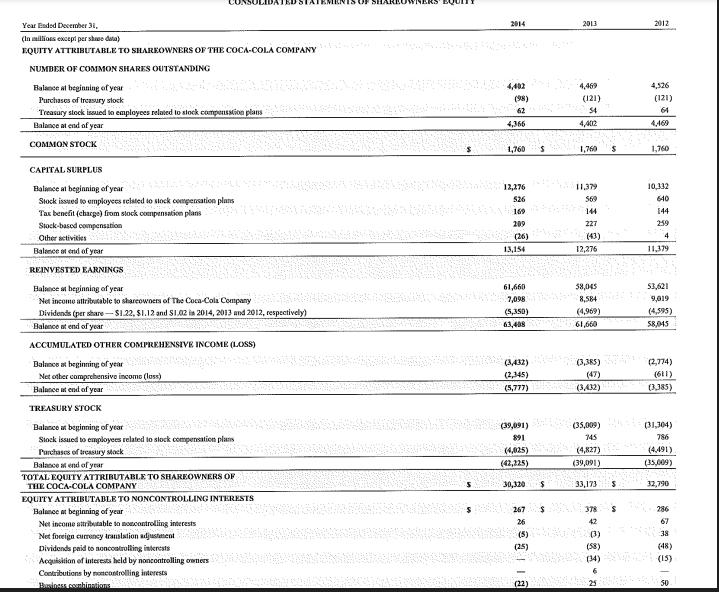

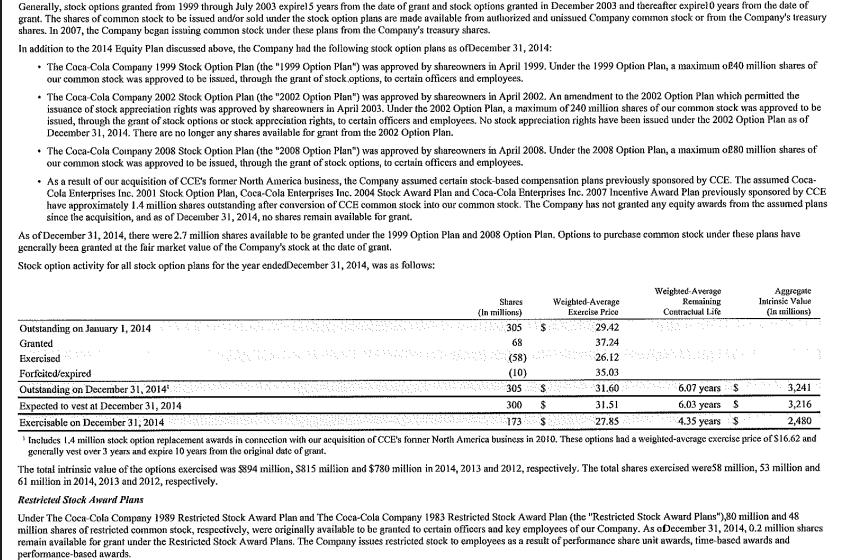

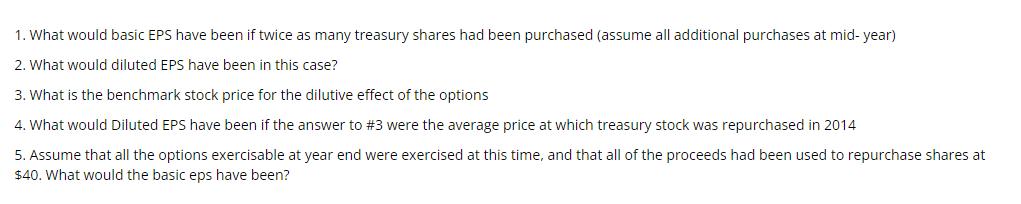

Using Coca colas 2014 financial statements: Assume that all options are in the money, and that these are the only dilutive securities. The tax rate

Using Coca colas 2014 financial statements: Assume that all options are in the money, and that these are the only dilutive securities. The tax rate is 35%. Use NI attributable to shareholders of Coca cola as your NI metric

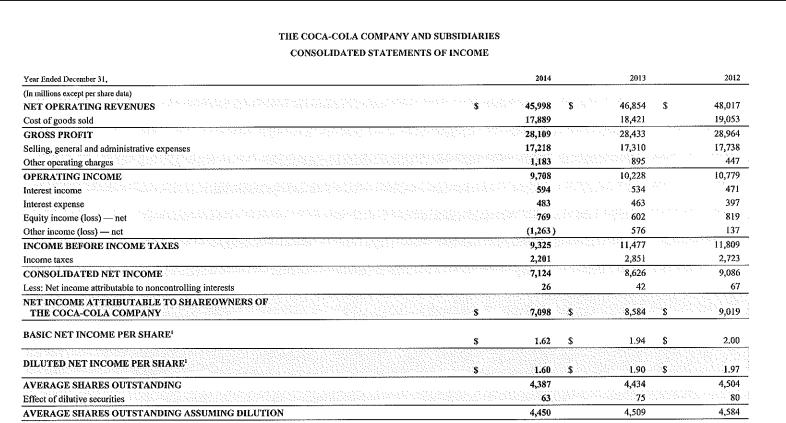

Year Ended December 31, (In millions except per share data) NET OPERATING REVENUES Cost of goods sold GROSS PROFIT Selling, general and administrative expenses Other operating charges OPERATING INCOME Interest income Interest expense Equity income (loss) - net Other income (loss)-nct INCOME BEFORE INCOME TAXES Income taxes CONSOLIDATED NET INCOME Less: Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY BASIC NET INCOME PER SHARE THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME DILUTED NET INCOME PER SHARE AVERAGE SHARES OUTSTANDING Effect of dilutive securities AVERAGE SHARES OUTSTANDING ASSUMING DILUTION $ 2014 45,998 17,889 28,109 17,218 1,183 9,708 594 483 769 (1,263) 9,325 2,201 7,124 26 7,098 1.62 1.60 4,387 4,450 $ $ $ $ 2013 46,854 18,421 28,433 17,310 895 10,228 534 463 602 576 11,477 2,851 8,626 42 8,584 1.94 1.90 4,434 75 4,509 S S $ $ 2012 48,017 19,053 28,964 17,738 447 10,779 471 397 819 137 11,809 2,723 9,086 67 9,019 2,00 1.97 4,504 80 4,584

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Net Income attributable to shareholders 7098 million Weighted average shares outs...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started