Using data in Exhibit 1, calculate Coxs break-even point in sales dollars (per hen). Taking into account his cumulative revenue for a hen, during which

- Using data in Exhibit 1, calculate Cox’s break-even point in sales dollars (per hen). Taking into account his cumulative revenue for a hen, during which week (approximately) will the break-even point occur? (Hint, consider the pre-production costs as fixed for this calculation.)

- Calculate Cox’s investment in the 130,000 hens. Given the average age of the hens at the Summers’ barns and the Thomas’ barns and the break-even analysis, how should Cox use this information in his decision on what to do about losing the CCF Brands contract?

- Given the situation that Cox faces, build on your contribution margin analysis to compare two options:

- (a) keeping the hens through week 78 or (b) euthanizing early. For each calculation, use the average age of the hens at the two different farms. (Hint: Revise a copy of the marginal analysis tables, one for each farm, beginning the analysis at the weeks indicated in the examples below that correspond to hen age.)

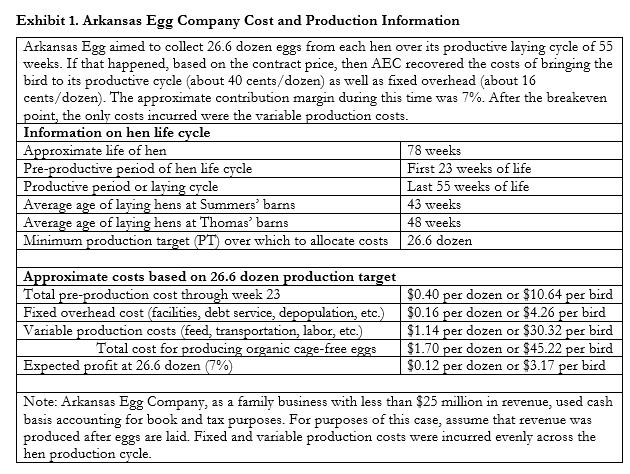

Exhibit 1. Arkansas Egg Company Cost and Production Information Arkansas Egg aimed to collect 26.6 dozen eggs from each hen over its productive laying cycle of 55 weeks. If that happened, based on the contract price, then AEC recovered the costs of bringing the bird to its productive cycle (about 40 cents/dozen) as well as fixed overhead (about 16 cents/dozen). The approximate contribution margin during this time was 7%. After the breakeven point, the only costs incurred were the variable production costs. Information on hen life cycle Approximate life of hen Pre-productive period of hen life cycle Productive period or laying cycle Average age of laying hens at Summers' barns Average age of laying hens at Thomas' barns Minimum production target (PT) over which to allocate costs Approximate costs based on 26.6 dozen production target Total pre-production cost through week 23 Fixed overhead cost (facilities, debt service, depopulation, etc.) Variable production costs (feed, transportation, labor, etc.) Total cost for producing organic cage-free eggs Expected profit at 26.6 dozen (7%) 78 weeks First 23 weeks of life Last 55 weeks of life 43 weeks 48 weeks 26.6 dozen $0.40 per dozen or $10.64 per bird $0.16 per dozen or $4.26 per bird $1.14 per dozen or $30.32 per bird $1.70 per dozen or $45.22 per bird $0.12 per dozen or $3.17 per bird Note: Arkansas Egg Company, as a family business with less than $25 million in revenue, used cash basis accounting for book and tax purposes. For purposes of this case, assume that revenue was produced after eggs are laid. Fixed and variable production costs were incurred evenly across the hen production cycle.

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Coxs breakeven point in sales dollars per hen we need to consider the cumulative revenue per hen and the total costs per hen Lets assume ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started