Using data in Exhibit 1, Cost and Production Information, calculate Coxs break-even point in sales dollars (per hen). Taking into account his cumulative revenue for

Using data in Exhibit 1, Cost and Production Information, calculate Coxs break-even point in sales dollars (per hen). Taking into account his cumulative revenue for a hen, during which week (approximately) will the break-even point occur? (Hint, consider the pre-production costs as fixed for this calculation). Also, Calculate Coxs investment in the 130,000 hens. Given the average age of the hens at the Summers barns and the Thomas barns and the break-even analysis, how should Cox use this information in his decision on what to do about losing the CCF Brands contract?

Please provide the solution and show formulas in Microsoft Excel.

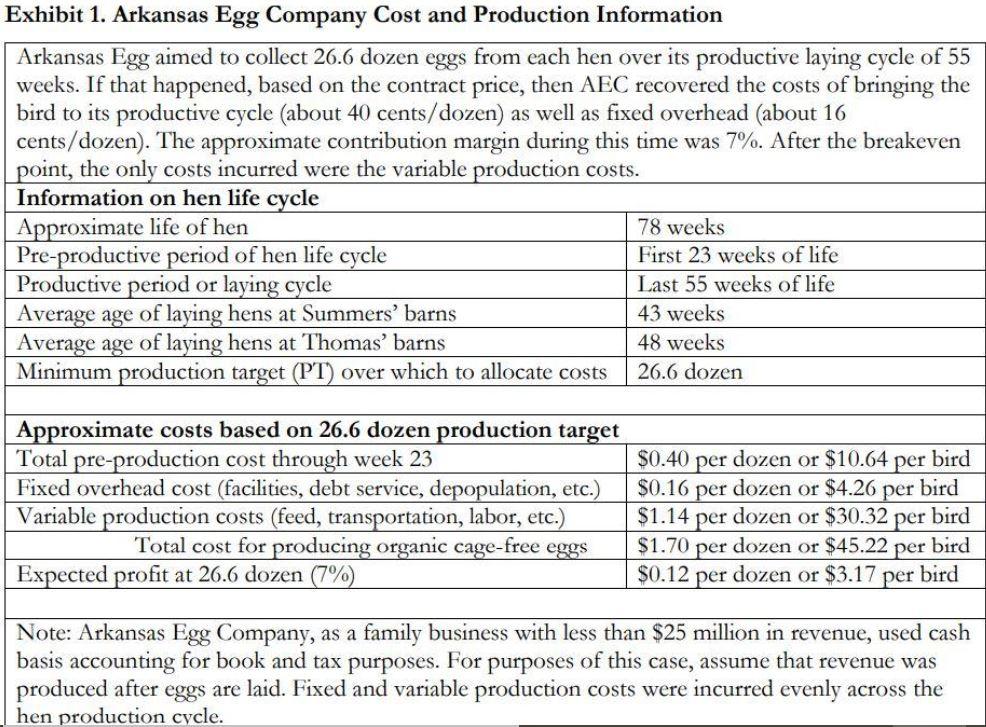

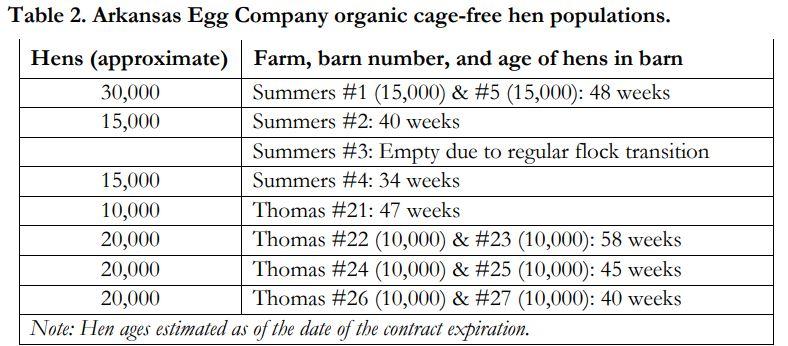

Exhibit 1. Arkansas Egg Company Cost and Production Information Arkansas Egg aimed to collect 26.6 dozen eggs from each hen over its productive laying cycle of 55 weeks. If that happened, based on the contract price, then AEC recovered the costs of bringing the bird to its productive cycle (about 40 cents/dozen) as well as fixed overhead (about 16 cents/dozen). The approximate contribution margin during this time was 7%. After the breakeven point, the only costs incurred were the variable production costs. Information on hen life cycle Approximate life of hen 78 weeks Pre-productive period of hen life cycle First 23 weeks of life Productive period or laying cycle Last 55 weeks of life Average age of laying hens at Summers' barns 43 weeks Average age of laying hens at Thomas' barns 48 weeks Minimum production target (PT) over which to allocate costs 26.6 dozen Approximate costs based on 26.6 dozen production target Total pre-production cost through week 23 Fixed overhead cost (facilities, debt service, depopulation, etc.) Variable production costs (feed, transportation, labor, etc.) Total cost for producing organic cage-free eggs Expected profit at 26.6 dozen (7%) $0.40 per dozen or $10.64 per bird $0.16 per dozen or $4.26 per bird $1.14 per dozen or $30.32 per bird $1.70 per dozen or $45.22 per bird $0.12 per dozen or $3.17 per bird Note: Arkansas Egg Company, as a family business with less than $25 million in revenue, used cash basis accounting for book and tax purposes. For purposes of this case, assume that revenue was produced after eggs are laid. Fixed and variable production costs were incurred evenly across the hen production cycle. Table 2. Arkansas Egg Company organic cage-free hen populations. Hens (approximate) Farm, barn number, and age of hens in barn 30,000 Summers #1 (15,000 & #5 (15,000): 48 weeks 15,000 Summers #2: 40 weeks Summers #3: Empty due to regular flock transition 15,000 Summers #4: 34 weeks 10,000 Thomas #21: 47 weeks 20,000 Thomas #22 (10,000) (10,000): 58 weeks 20,000 Thomas #24 (10,000) (10,000): 45 weeks 20,000 Thomas #26 (10,000) (10,000): 40 weeks Note: Hen ages estimated as of the date of the contract expirationStep by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started