Question: Using EDGAR (Electronic Data Gathering, Analysis, and Retrieval system), find the annual report (10-K) for Coca-Cola and PepsiCo fo the year ended December 2019. Locate

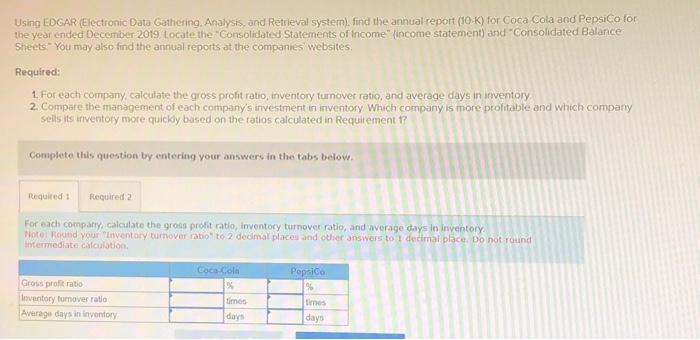

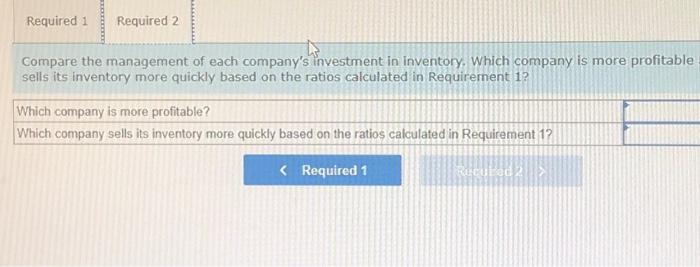

Using EDGAR (Electronic Data Gathering. Analysis, and Retrieval system), find the annual repolt (10-K) for Coca Cola and PepsiCo for: the year ended December 2019 . Locate the "Consolidated Statements of income" (income statement) and "Consolidated Balance Sheets - You may also find the annual reports at the companies websites. Required: 1. For each company, calculate the gross prolit ratio, inventory turnover ratio, and average days in imventory. 2. Compare the management of each company s investment in inventory Which company is more prolitable and which company selis its inventory more quickly based on the ratios calculated in Requirement ? Complete this question by entering your answers in the tabs below. For each compary, calcalate the groes profit ratio, inventory turnover ratio, and average days in inventory. Note Rochid your "Inventory turnover ratio" to 2 decimal places and other answers to 1 decimal place. Do not round intermediate calculaton. Compare the management of each company's investment in inventory. Which company is more profitable selis its inventory more quickly based on the ratios calculated in Requirement 1 ? Which company is more profitable? Which company sells its inventory more quickly based on the ratios calculated in Requirement 1? Using EDGAR (Electronic Data Gathering. Analysis, and Retrieval system), find the annual repolt (10-K) for Coca Cola and PepsiCo for: the year ended December 2019 . Locate the "Consolidated Statements of income" (income statement) and "Consolidated Balance Sheets - You may also find the annual reports at the companies websites. Required: 1. For each company, calculate the gross prolit ratio, inventory turnover ratio, and average days in imventory. 2. Compare the management of each company s investment in inventory Which company is more prolitable and which company selis its inventory more quickly based on the ratios calculated in Requirement ? Complete this question by entering your answers in the tabs below. For each compary, calcalate the groes profit ratio, inventory turnover ratio, and average days in inventory. Note Rochid your "Inventory turnover ratio" to 2 decimal places and other answers to 1 decimal place. Do not round intermediate calculaton. Compare the management of each company's investment in inventory. Which company is more profitable selis its inventory more quickly based on the ratios calculated in Requirement 1 ? Which company is more profitable? Which company sells its inventory more quickly based on the ratios calculated in Requirement 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts