Answered step by step

Verified Expert Solution

Question

1 Approved Answer

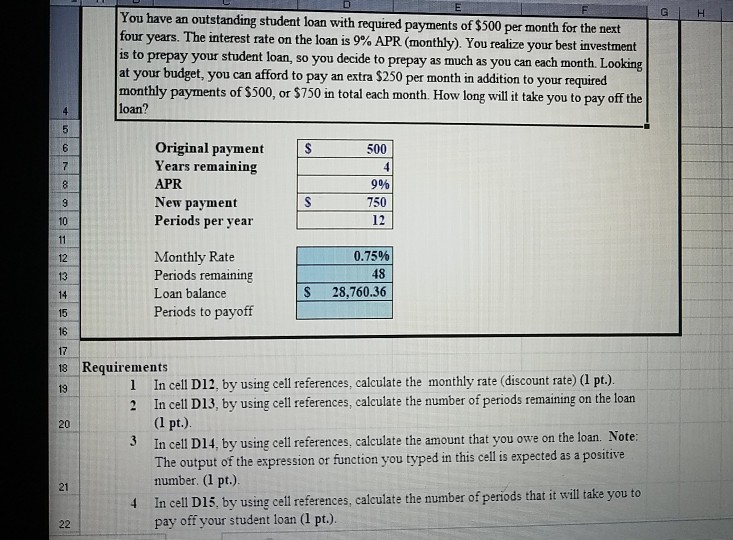

using excel cell references. You have an outstanding student loan with required payments of S500 per month for the next four years. The interest rate

using excel cell references.

You have an outstanding student loan with required payments of S500 per month for the next four years. The interest rate on the loan is 9% is to prepay your student loan, so you decide to prepay as much as you can each month. Looking at your budget, you can afford to pay an extra $250 per month in addition to your required monthly payments of $500, or $750 in total each month. How long will t take you to pay off the APR (monthly). You realize your best investment loan? Original payment Years remaining APR New payment Periods per year S 500 9% 750 12 10 12 13 14 15 16 17 18 Requirements Monthly Rate Periods remaining Loan balance Periods to payoff 0.75 % 48 S 28,760.36 In cell D12, by using cell references, calculate the monthly rate (discount rate) (1 pt.) In cell D13, by using cell references, calculate the number of periods remaining on the loan (1 pt.) In cell D14, by using cell references, calculate the amount that you owe on the loan. Note: The output of the expression or function you typed in this cellis expected as a positive number. (1 pt.) In cell DI5, by using cell references, calculate the number of penods that it will take you to pay off your student loan (1 pt.). 1 2 20 3 21Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started