Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using excel formulas pls Financial Forecasting Verbalife Ltd., a network marketing company, sells weight management, nutritional supplement, energy, sports and fitness, and personal care products

Using excel formulas pls

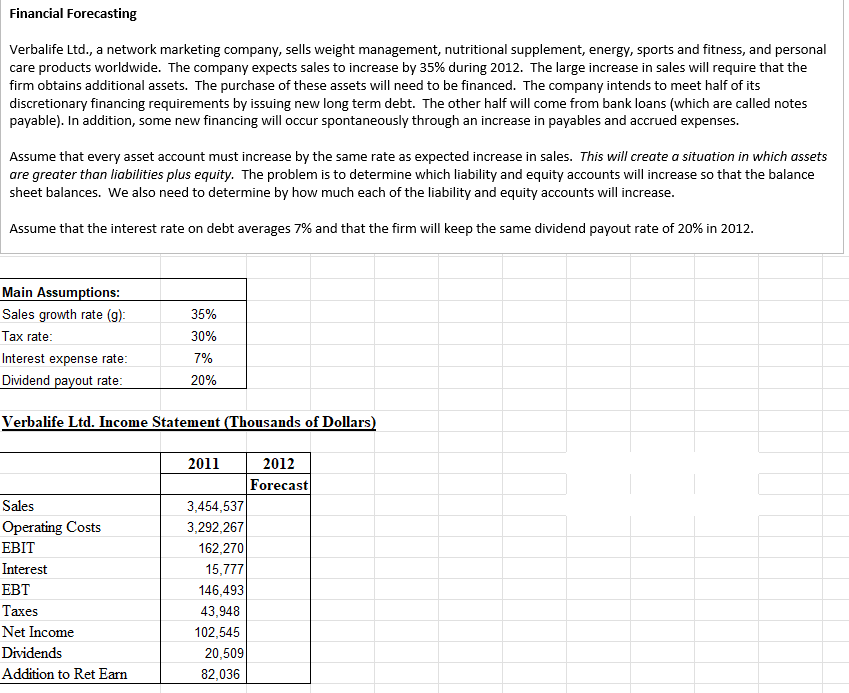

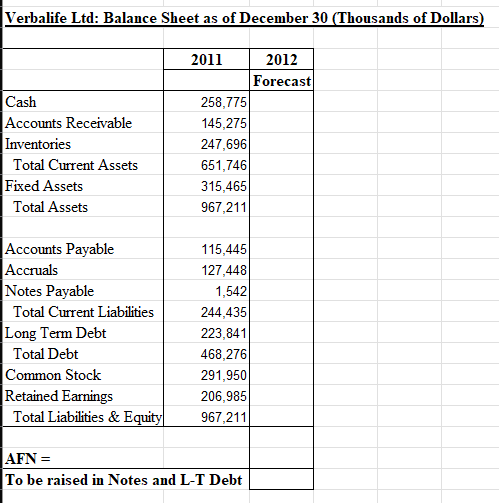

Financial Forecasting Verbalife Ltd., a network marketing company, sells weight management, nutritional supplement, energy, sports and fitness, and personal care products worldwide. The company expects sales to increase by 35% during 2012 . The large increase in sales will require that the firm obtains additional assets. The purchase of these assets will need to be financed. The company intends to meet half of its discretionary financing requirements by issuing new long term debt. The other half will come from bank loans (which are called notes payable). In addition, some new financing will occur spontaneously through an increase in payables and accrued expenses. Assume that every asset account must increase by the same rate as expected increase in sales. This will create a situation in which assets are greater than liabilities plus equity. The problem is to determine which liability and equity accounts will increase so that the balance sheet balances. We also need to determine by how much each of the liability and equity accounts will increase. Assume that the interest rate on debt averages 7\% and that the firm will keep the same dividend payout rate of 20% in 2012 . Verbalife Ltd. Income Statement (Thousands of Dollars) Verbalife Ltd: Balance Sheet as of December 30 (Thousands of Dollars) \begin{tabular}{|l|r|r|} \hline & \multicolumn{1}{|c|}{2011} & 2012 \\ \cline { 2 - 3 } & & Forecast \\ \hline Cash & 258,775 & \\ Accounts Receivable & 145,275 & \\ Inventories & 247,696 & \\ Total Current Assets & 651,746 & \\ Fixed Assets & 315,465 & \\ Total Assets & 967,211 & \\ & & \\ Accounts Payable & 115,445 & \\ Accruals & 127,448 & \\ Notes Payable & 1,542 & \\ Total Current Liabilities & 244,435 & \\ Long Term Debt & 223,841 & \\ Total Debt & 468,276 & \\ Common Stock & 291,950 & \\ Retained Earnings & 206,985 & \\ Total Liabilities \& Equity & 967,211 & \\ \hline & & \\ \hline AFN = & & \\ \hline To be raised in Notes and L-T Debt & \\ \cline { 2 - 3 } & \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started