Using Exhibit 1 data, how many 100,000 barrel 90-day futures contracts did you assume the company bought in Jan, March and June to meet its delivery obligations?

Using Exhibit 1 data, how many 100,000 barrel 90-day futures contracts did you assume the company bought in Jan, March and June to meet its delivery obligations?

Does the accounting give the correct signal to the supervisory board?

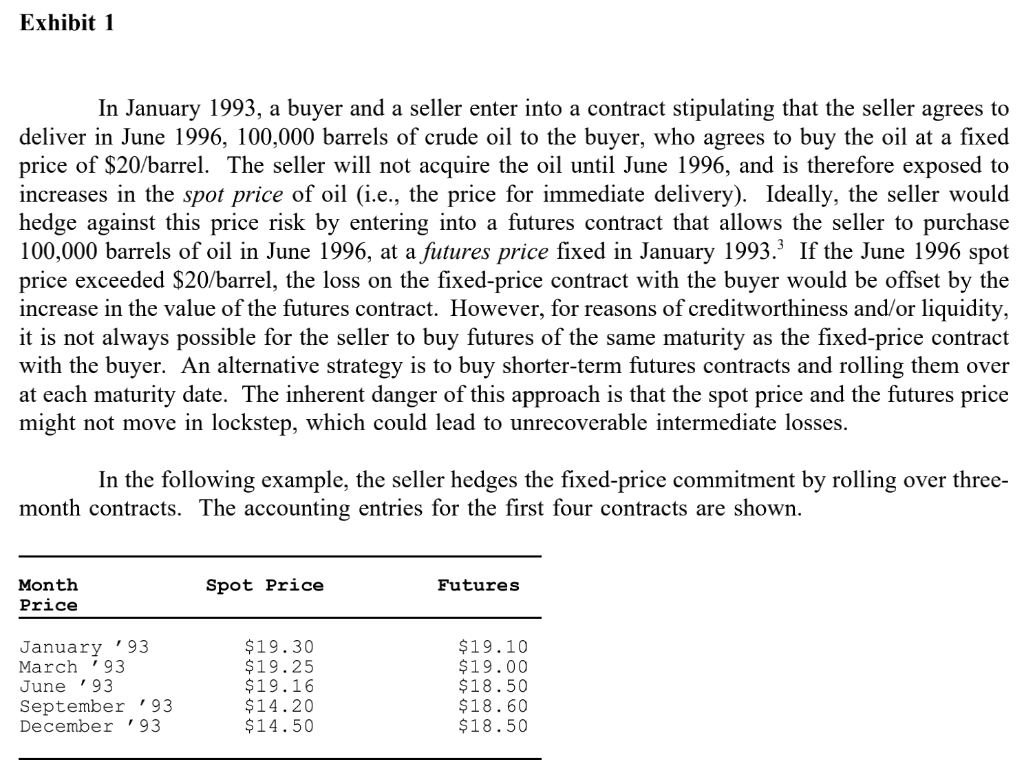

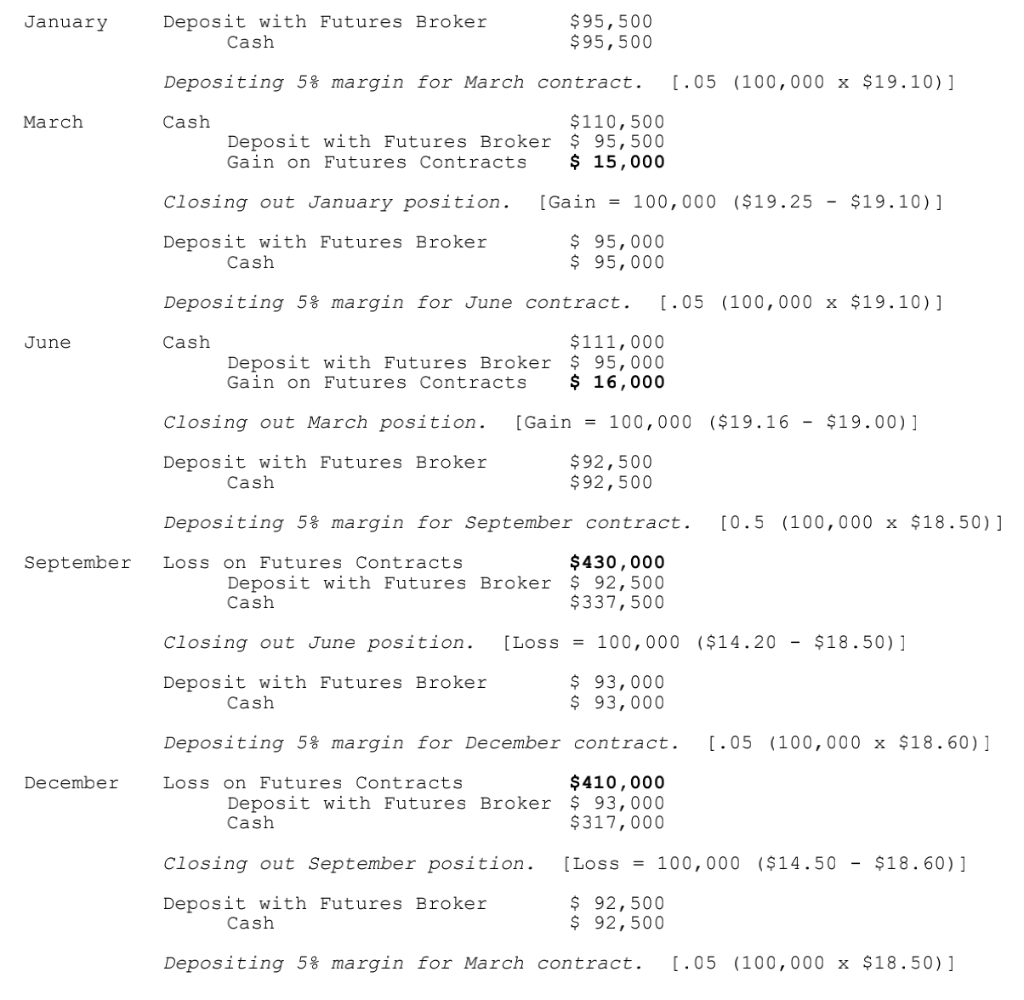

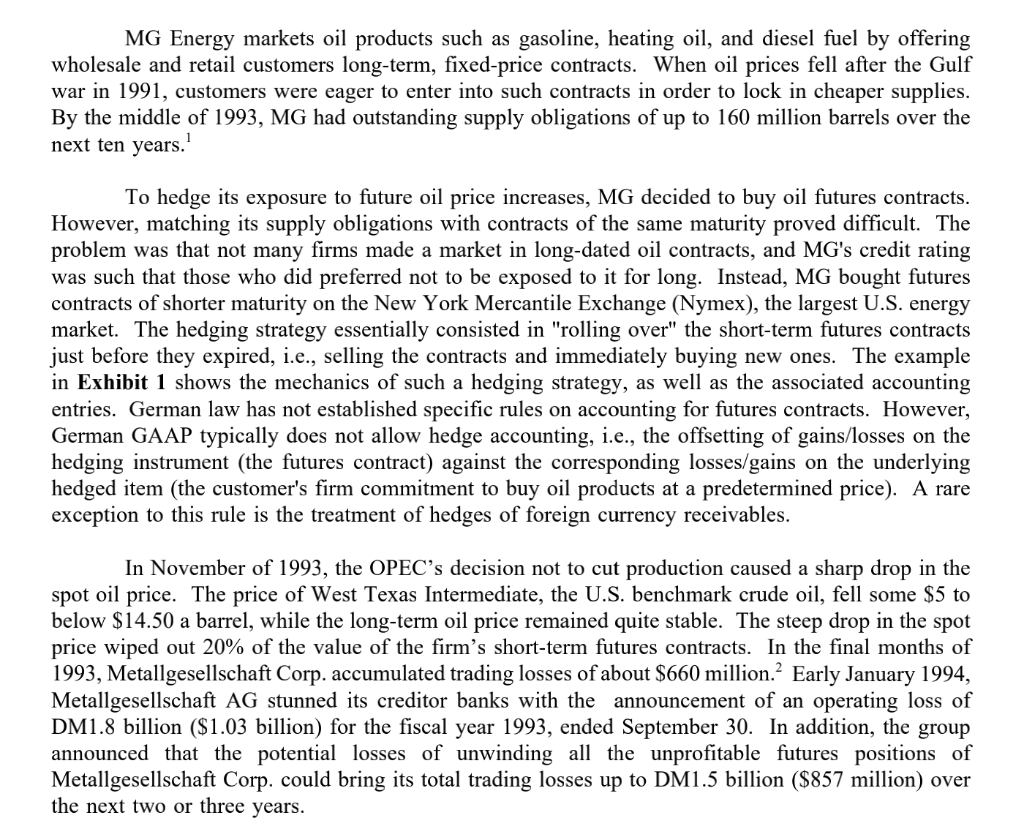

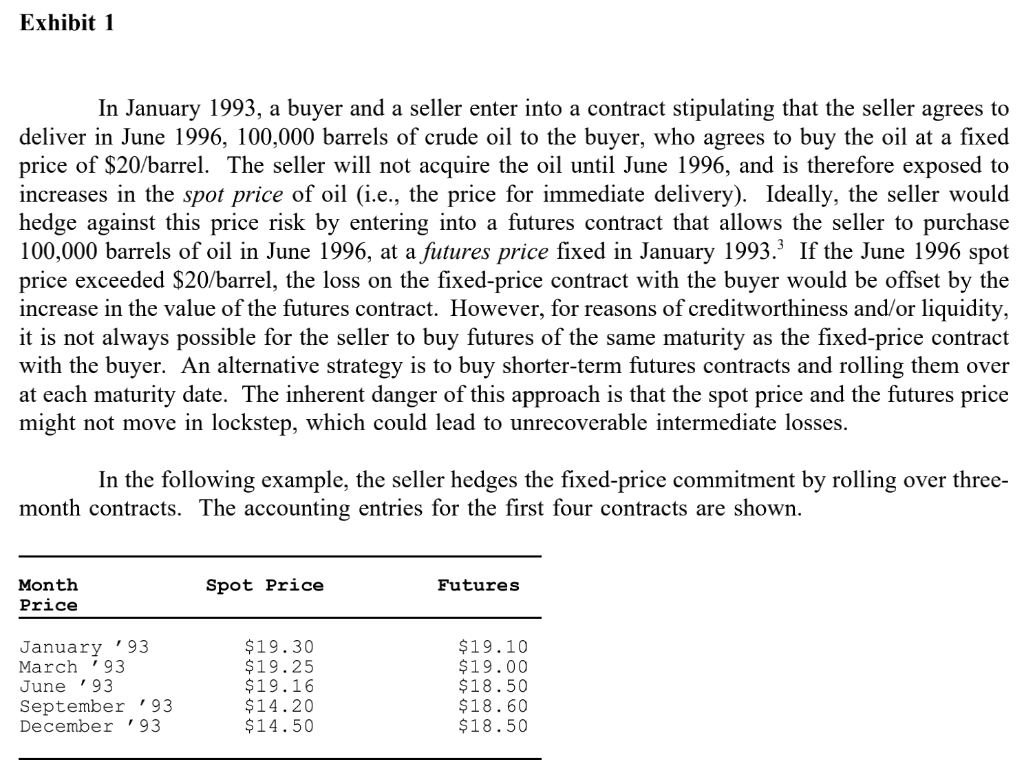

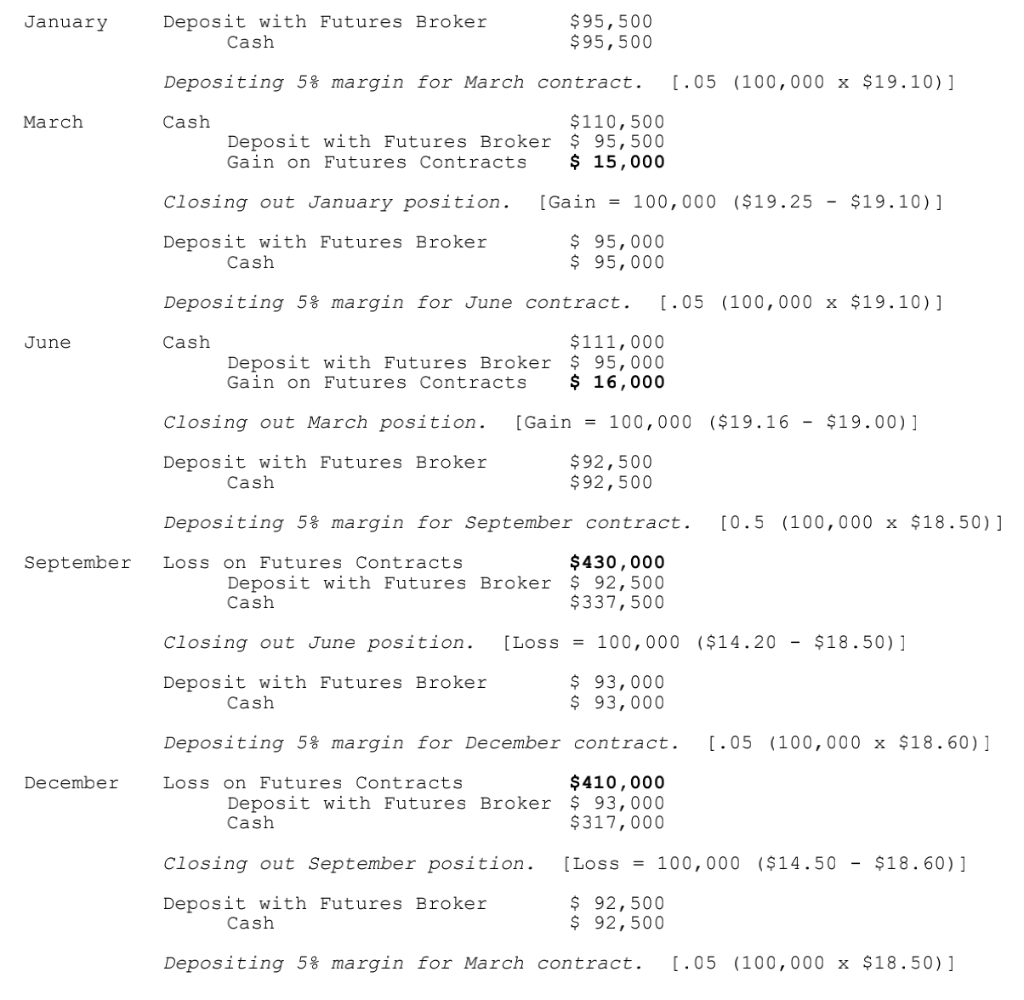

MG Energy markets oil products such as gasoline, heating oil, and diesel fuel by offering wholesale and retail customers long-term, fixed-price contracts. When oil prices fell after the Gulf war in 1991, customers were eager to enter into such contracts in order to lock in cheaper supplies. By the middle of 1993, MG had outstanding supply obligations of up to 160 million barrels over the next ten years. To hedge its exposure to future oil price increases, MG decided to buy oil futures contracts. However, matching its supply obligations with contracts of the same maturity proved difficult. The problem was that not many firms made a market in long-dated oil contracts, and MG's credit rating was such that those who did preferred not to be exposed to it for long. Instead, MG bought futures contracts of shorter maturity on the New York Mercantile Exchange (Nymex), the largest U.S. energy market. The hedging strategy essentially consisted in "rolling over" the short-term futures contracts just before they expired, i.e., selling the contracts and immediately buying new ones. The example in Exhibit 1 shows the mechanics of such a hedging strategy, as well as the associated accounting entries. German law has not established specific rules on accounting for futures contracts. However, German GAAP typically does not allow hedge accounting, i.e., the offsetting of gains/losses on the hedging instrument (the futures contract) against the corresponding losses/gains on the underlying hedged item (the customer's firm commitment to buy oil products at a predetermined price). A rare exception to this rule is the treatment of hedges of foreign currency receivables. In November of 1993, the OPEC's decision not to cut production caused a sharp drop in the spot oil price. The price of West Texas Intermediate, the U.S. benchmark crude oil, fell some $5 to below $14.50 a barrel, while the long-term oil price remained quite stable. The steep drop in the spot price wiped out 20% of the value of the firm's short-term futures contracts. In the final months of 1993, Metallgesellschaft Corp. accumulated trading losses of about $660 million. Early January 1994, Metallgesellschaft AG stunned its creditor banks with the announcement of an operating loss of DM1.8 billion ($1.03 billion) for the fiscal year 1993, ended September 30. In addition, the group announced that the potential losses of unwinding all the unprofitable futures positions of Metallgesellschaft Corp. could bring its total trading losses up to DM1.5 billion ($857 million) over the next two or three years. Exhibit 1 In January 1993, a buyer and a seller enter into a contract stipulating that the seller agrees to deliver in June 1996, 100,000 barrels of crude oil to the buyer, who agrees to buy the oil at a fixed price of $20/barrel. The seller will not acquire the oil until June 1996, and is therefore exposed to increases in the spot price of oil (i.e., the price for immediate delivery). Ideally, the seller would hedge against this price risk by entering into a futures contract that allows the seller to purchase 100,000 barrels of oil in June 1996, at a futures price fixed in January 1993. If the June 1996 spot price exceeded $20/barrel, the loss on the fixed-price contract with the buyer would be offset by the increase in the value of the futures contract. However, for reasons of creditworthiness and/or liquidity, it is not always possible for the seller to buy futures of the same maturity as the fixed-price contract with the buyer. An alternative strategy is to buy shorter-term futures contracts and rolling them over at each maturity date. The inherent danger of this approach is that the spot price and the futures price might not move in lockstep, which could lead to unrecoverable intermediate losses. In the following example, the seller hedges the fixed-price commitment by rolling over three- month contracts. The accounting entries for the first four contracts are shown. Month Price Spot Price Futures January '93 March '93 June '93 September '93 December '93 $19.30 $19.25 $19.16 $14.20 $14.50 $19.10 $19.00 $18.50 $18.60 $18.50 January Deposit with Futures Broker Cash $ 95,500 $ 95,500 Depositing 5% margin for March contract. [.05 (100,000 x $19.10)] March Cash $110,500 Deposit with Futures Broker $ 95,500 Gain on Futures Contracts $ 15,000 closing out January position. (Gain = 100,000 ($19.25 - $19.10)] Deposit with Futures Broker Cash $ 95,000 $ 95,000 Depositing 5% margin for June contract. 1.05 (100,000 x $19.10)] June Cash $111,000 Deposit with Futures Broker $ 95,000 Gain on Futures Contracts $ 16,000 closing out March position. [Gain = 100,000 ($19.16 - $19.00)] Broker Deposit with Futures Cash $92,500 $92,500 Depositing 5% margin for September contract. [0.5 (100,000 x $18.50) ] September Loss on Futures Contracts $430,000 Deposit with Futures Broker $ 92,500 Cash $337,500 [LOSS = 100,000 ($14.20 - $18.50)] Closing out June position. Deposit with Futures Broker Cash $ 93,000 $ 93,000 Depositing 5% margin for December contract. [.05 (100,000 x $18.60)] December LOSS on Futures Contracts Deposit with Futures Broker Cash $410,000 $ 93,000 $317,000 Closing out September position. [LOSS = 100,000 ($14.50 - $18.60)] Deposit with Futures Broker Cash $ 92,500 $ 92,500 Depositing 5% margin for March contract. [.05 (100,000 x $18.50)]

Using Exhibit 1 data, how many 100,000 barrel 90-day futures contracts did you assume the company bought in Jan, March and June to meet its delivery obligations?

Using Exhibit 1 data, how many 100,000 barrel 90-day futures contracts did you assume the company bought in Jan, March and June to meet its delivery obligations?