Answered step by step

Verified Expert Solution

Question

1 Approved Answer

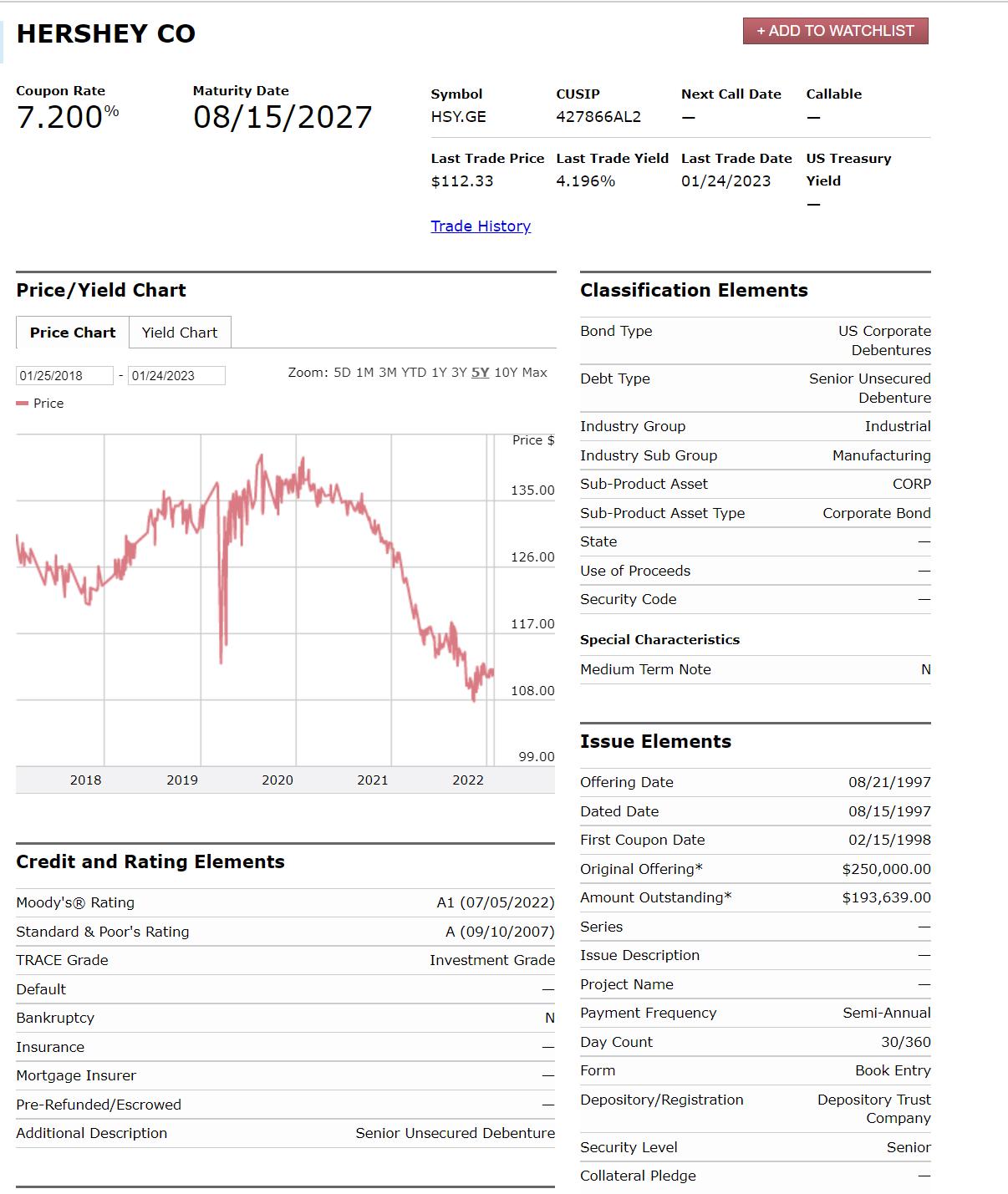

Using Hershey's bond information below can you please help me with these questions? How much are the annual coupon interest payments for these bonds? How

Using Hershey's bond information below can you please help me with these questions?

How much are the annual coupon interest payments for these bonds?

- How much is the YTM listed in the quotes of the bonds (in the Last Sale column - Yield) (no calculations are required for this question).

- When do these bonds mature?

- Calculate the Macaulay duration and Modified duration of these bonds. You should use on-line Duration calculator. https://dqydj.com/bond-duration-calculator/. Present the results of your calculations in your posting. How the changes of interest rates will affect the bonds' prices?

- Go to the Internet and find the forecast of interest rates (short-term and long-term). Create the forecast of the bonds' prices using Modified duration you calculated and forecast of the interest rates. Explain your results.

- Please answer the flowing questions:

- If you are going to buy a bond, which bond would you choose? Why?

- Are there any connections between economic trends analysis, bond market performance, and investment decisions? Please explain your answer.

- Take a look at the balance sheet and income statement of the companies. What data or ratios support your decision to buy this bond or not?

HERSHEY CO Coupon Rate 7.200% Price/Yield Chart Price Chart Yield Chart 01/25/2018 -Price 2018 Maturity Date 08/15/2027 01/24/2023 2019 Bankruptcy Insurance Mortgage Insurer Pre-Refunded/Escrowed Credit and Rating Elements Moody's Rating Standard & Poor's Rating TRACE Grade Default Additional Description 2020 Symbol HSY.GE 2021 Zoom: 5D 1M 3M YTD 1Y 3Y 5Y 10Y Max Trade History. 2022 Last Trade Price Last Trade Yield Last Trade Date $112.33 4.196% 01/24/2023 Price $ 135.00 126.00 117.00 108.00 99.00 A1 (07/05/2022) A (09/10/2007) Investment Grade N CUSIP 427866AL2 Senior Unsecured Debenture Bond Type Debt Type Next Call Date Classification Elements Industry Group Industry Sub Group Sub-Product Asset Sub-Product Asset Type State Use of Proceeds Security Code Special Characteristics Medium Term Note Issue Elements Offering Date Dated Date First Coupon Date Original Offering* Amount Outstanding* Series Issue Description Project Name Payment Frequency Day Count Form + ADD TO WATCHLIST Depository/Registration Security Level Collateral Pledge Callable US Treasury Yield US Corporate Debentures Senior Unsecured Debenture Industrial Manufacturing CORP Corporate Bond N 08/21/1997 08/15/1997 02/15/1998 $250,000.00 $193,639.00 Semi-Annual 30/360 Book Entry Depository Trust Company Senior

Step by Step Solution

There are 3 Steps involved in it

Step: 1

YTM is given in the yield column and is 4991 for VZRM and 4588 for VZRR Yield to maturity or YTM is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started