Question

Using High-Low to Calculate the Variable Rate, Calculate Fixed Cost, and Construct a Cost Function Pizza Vesuvio makes specialty pizzas. Data for the past

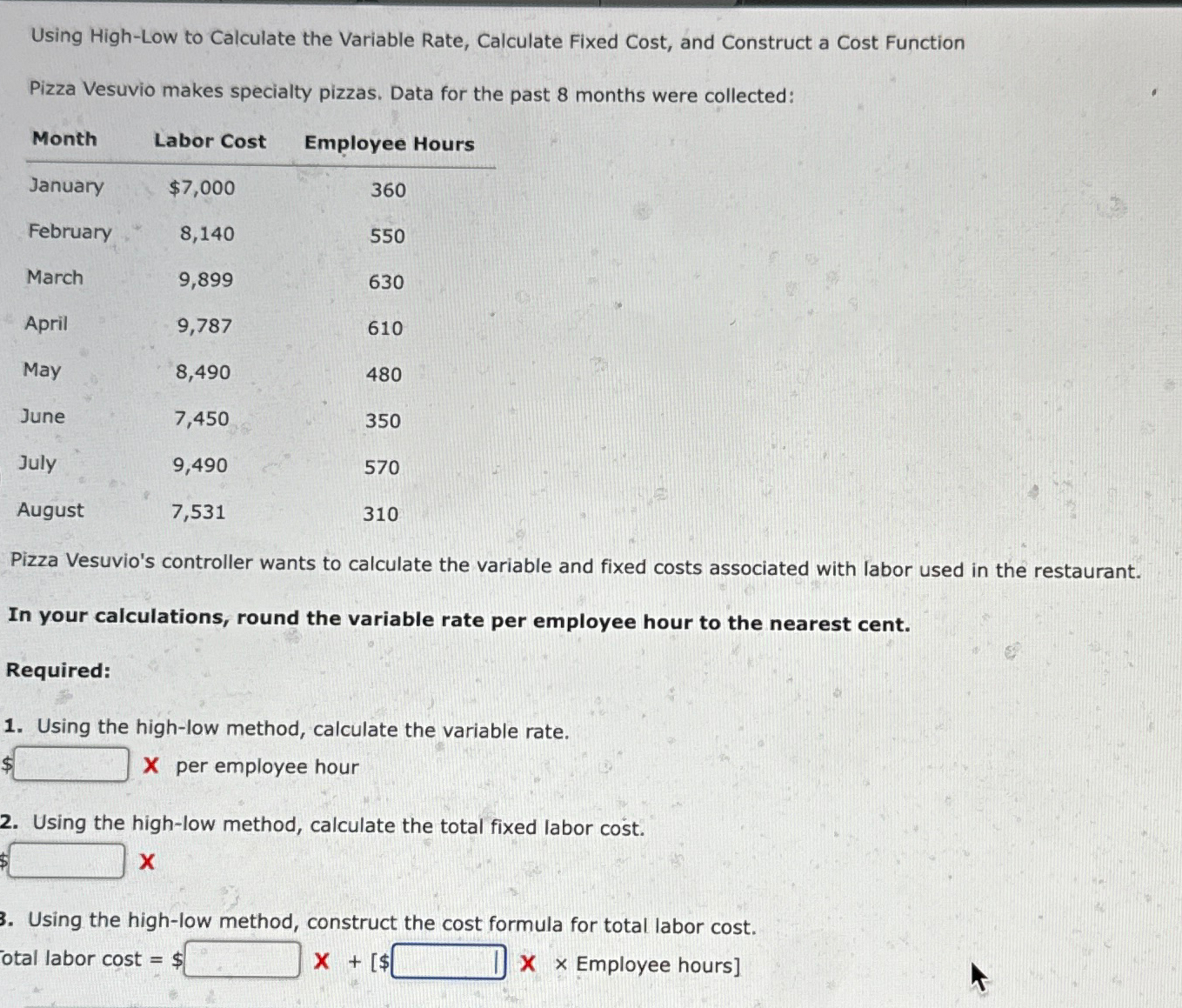

Using High-Low to Calculate the Variable Rate, Calculate Fixed Cost, and Construct a Cost Function Pizza Vesuvio makes specialty pizzas. Data for the past 8 months were collected: Month Labor Cost Employee Hours January $7,000 360 February 8,140 550 March 9,899 630 April 9,787 610 May 8,490 480 June 7,450 350 July 9,490 570 7,531 310 August Pizza Vesuvio's controller wants to calculate the variable and fixed costs associated with labor used in the restaurant. In your calculations, round the variable rate per employee hour to the nearest cent. Required: 1. Using the high-low method, calculate the variable rate. $ X per employee hour 2. Using the high-low method, calculate the total fixed labor cost. X 3. Using the high-low method, construct the cost formula for total labor cost. $ Total labor cost = X +[$ Xx Employee hours]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting The Cornerstone Of Business Decision Making

Authors: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

8th Edition

0357715349, 978-0357715345

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App