Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using IFRS correct them 1 23 4 5 69 7 80 9 Instructions: A collection of $4,600 on account from a customer received on

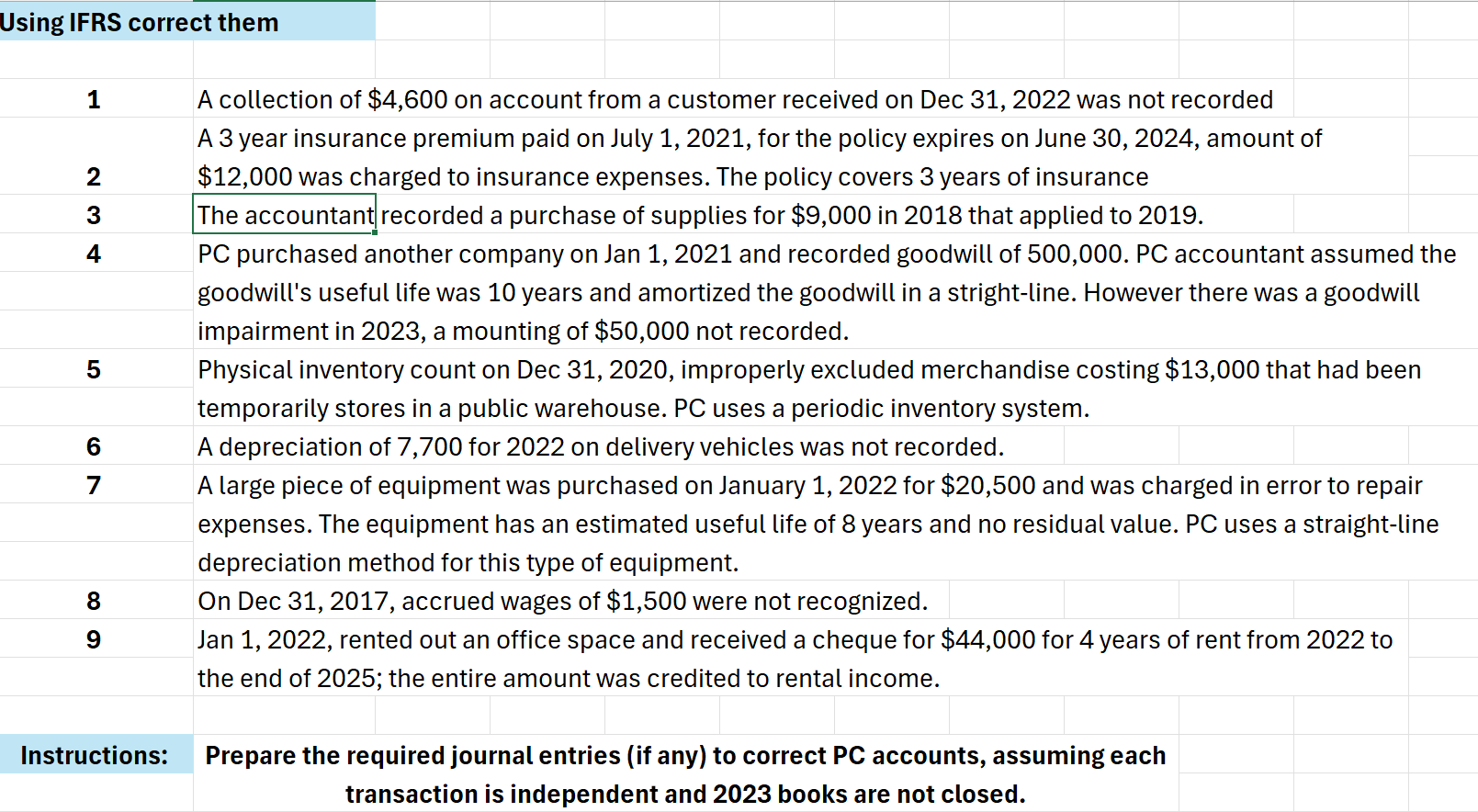

Using IFRS correct them 1 23 4 5 69 7 80 9 Instructions: A collection of $4,600 on account from a customer received on Dec 31, 2022 was not recorded A 3 year insurance premium paid on July 1, 2021, for the policy expires on June 30, 2024, amount of $12,000 was charged to insurance expenses. The policy covers 3 years of insurance The accountant recorded a purchase of supplies for $9,000 in 2018 that applied to 2019. PC purchased another company on Jan 1, 2021 and recorded goodwill of 500,000. PC accountant assumed the goodwill's useful life was 10 years and amortized the goodwill in a stright-line. However there was a goodwill impairment in 2023, a mounting of $50,000 not recorded. Physical inventory count on Dec 31, 2020, improperly excluded merchandise costing $13,000 that had been temporarily stores in a public warehouse. PC uses a periodic inventory system. A depreciation of 7,700 for 2022 on delivery vehicles was not recorded. A large piece of equipment was purchased on January 1, 2022 for $20,500 and was charged in error to repair expenses. The equipment has an estimated useful life of 8 years and no residual value. PC uses a straight-line depreciation method for this type of equipment. On Dec 31, 2017, accrued wages of $1,500 were not recognized. Jan 1, 2022, rented out an office space and received a cheque for $44,000 for 4 years of rent from 2022 to the end of 2025; the entire amount was credited to rental income. Prepare the required journal entries (if any) to correct PC accounts, assuming each transaction is independent and 2023 books are not closed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started