Question

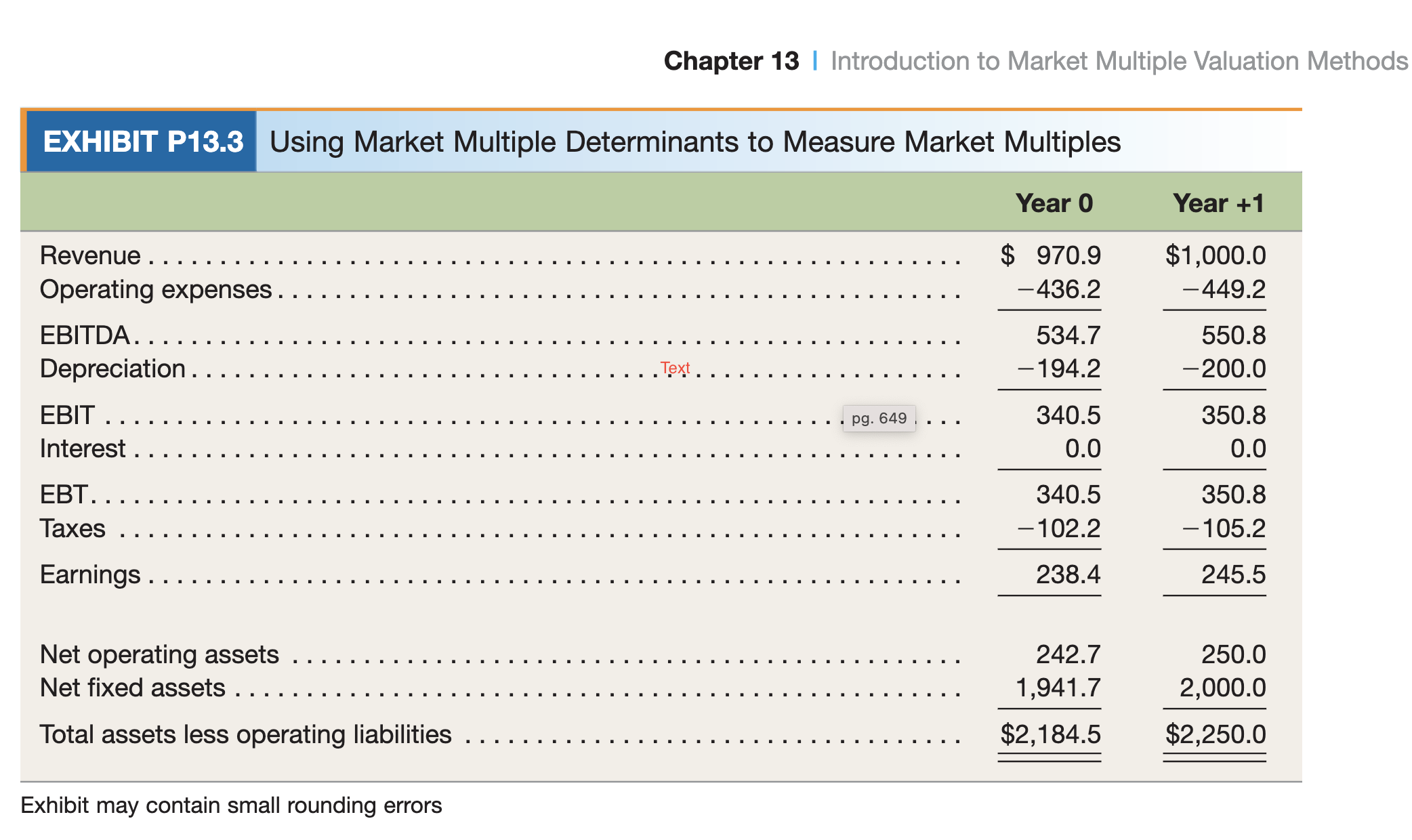

Using Market Multiple Determinants to Measure Multiples: Use the abbreviated income statements and balance sheets for the all-equity financed company in Exhibit P13.3 to measure

Using Market Multiple Determinants to Measure Multiples: Use the abbreviated income statements and balance sheets for the all-equity financed company in Exhibit P13.3 to measure its market multiples (free cash flow, unlevered earnings, EBIT, EBITDA, revenue, and total invested capital) using two approaches(i) the value of the firm divided by the market multiple value driver in Year 1 for the free cash flow, unlevered earnings, EBIT, EBITDA and revenue, and Year 0 for total invested capital and (ii) the formulas derived in the Pepsi simulation. The company has the same forecast drivers in its financial model as Pepsi, although the magnitudes of the forecast drivers are different. The companys operating expenses, depreciation, and net operating working capital are a constant percent of revenues; its capital expenditures are equal to depreciation plus a constant percentage of the growth in revenues; and its revenues and free cash flows grow at a constant rate into perpetuity. The companys firm value is $2,000 and its cost of capital is 12%. ( Hint: First, measure the companys free cash flows; next, measure the companys growth rate and each of the other forecast drivers; then measure the companys market multiples using the two approaches.)

Chapter 13 I Introduction to Market Multiple Valuation Methods

Chapter 13 I Introduction to Market Multiple Valuation Methods Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started