Using ONE of the jobs adverts below write a covering letter for a job application. (200 words)

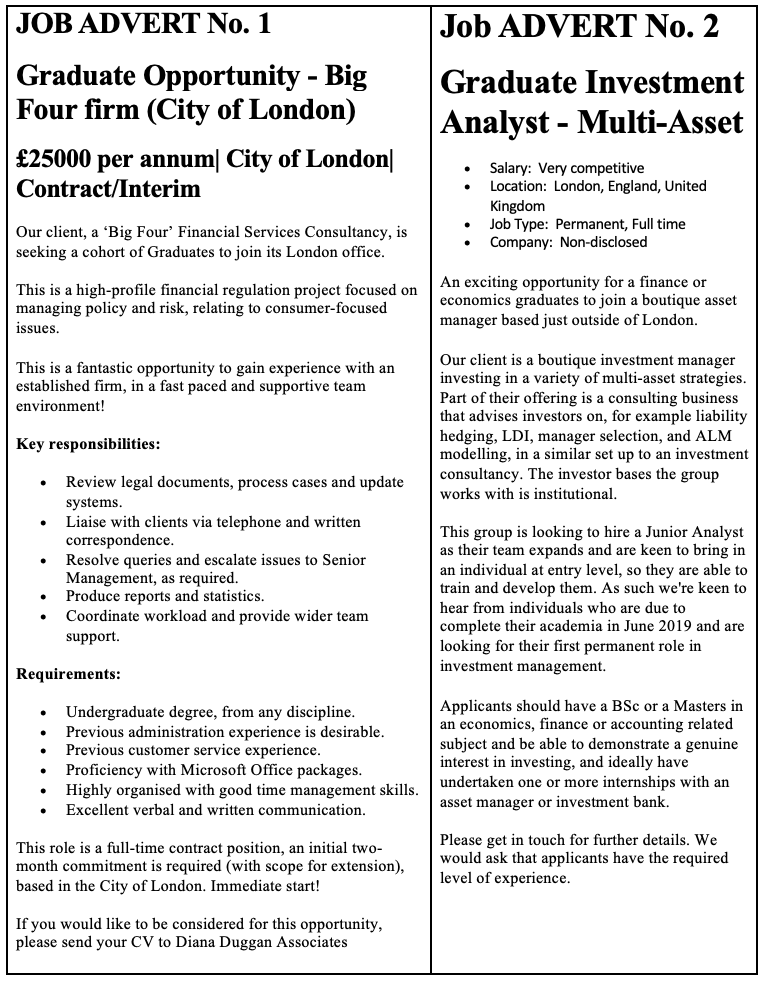

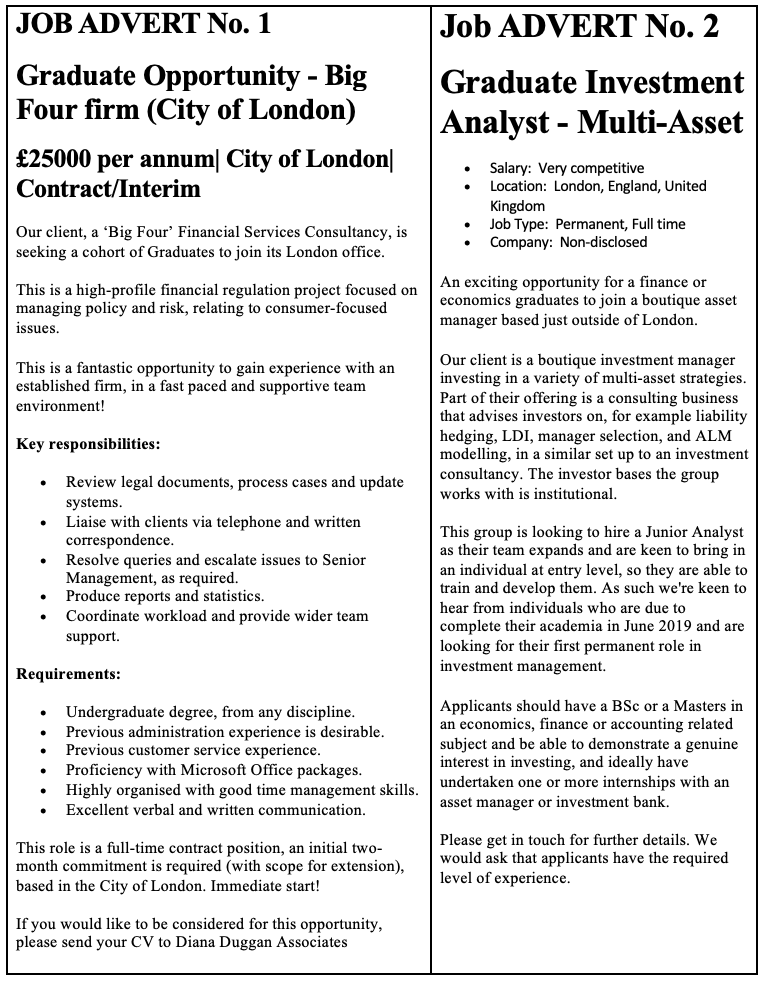

JOB ADVERT No. 1 Job ADVERT No. 2 Graduate Opportunity - Big Four firm (City of London) 25000 per annum City of London Contract/Interim Graduate Investment Analyst - Multi-Asset Salary: Very competitive Location: London, England, United Kingdom Job Type: Permanent, Full time Company: Non-disclosed Our client, a 'Big Four' Financial Services Consultancy, is seeking a cohort of Graduates to join its London office. This is a high-profile financial regulation project focused on managing policy and risk, relating to consumer-focused issues. An exciting opportunity for a finance or economics graduates to join a boutique asset manager based just outside of London. This is a fantastic opportunity to gain experience with an established firm, in a fast paced and supportive team environment! Our client is a boutique investment manager investing in a variety of multi-asset strategies. Part of their offering is a consulting business that advises investors on, for example liability hedging, LDI, manager selection, and ALM modelling, in a similar set up to an investment consultancy. The investor bases the group works with is institutional. Key responsibilities: . . Review legal documents, process cases and update systems. Liaise with clients via telephone and written correspondence. Resolve queries and escalate issues to Senior Management, as required. Produce reports and statistics. Coordinate workload and provide wider team support. This group is looking to hire a Junior Analyst as their team expands and are keen to bring in an individual at entry level, so they are able to train and develop them. As such we're keen to hear from individuals who are due to complete their academia in June 2019 and are looking for their first permanent role in investment management. Requirements: Undergraduate degree, from any discipline. Previous administration experience is desirable. Previous customer service experience. Proficiency with Microsoft Office packages. Highly organised with good time management skills. Excellent verbal and written communication. Applicants should have a BSc or a Masters in an economics, finance or accounting related subject and be able to demonstrate a genuine interest in investing, and ideally have undertaken one or more internships with an asset manager or investment bank. This role is a full-time contract position, an initial two- month commitment is required (with scope for extension), based in the City of London. Immediate start! Please get in touch for further details. We would ask that applicants have the required level of experience. If you would like to be considered for this opportunity, please send your CV to Diana Duggan Associates JOB ADVERT No. 1 Job ADVERT No. 2 Graduate Opportunity - Big Four firm (City of London) 25000 per annum City of London Contract/Interim Graduate Investment Analyst - Multi-Asset Salary: Very competitive Location: London, England, United Kingdom Job Type: Permanent, Full time Company: Non-disclosed Our client, a 'Big Four' Financial Services Consultancy, is seeking a cohort of Graduates to join its London office. This is a high-profile financial regulation project focused on managing policy and risk, relating to consumer-focused issues. An exciting opportunity for a finance or economics graduates to join a boutique asset manager based just outside of London. This is a fantastic opportunity to gain experience with an established firm, in a fast paced and supportive team environment! Our client is a boutique investment manager investing in a variety of multi-asset strategies. Part of their offering is a consulting business that advises investors on, for example liability hedging, LDI, manager selection, and ALM modelling, in a similar set up to an investment consultancy. The investor bases the group works with is institutional. Key responsibilities: . . Review legal documents, process cases and update systems. Liaise with clients via telephone and written correspondence. Resolve queries and escalate issues to Senior Management, as required. Produce reports and statistics. Coordinate workload and provide wider team support. This group is looking to hire a Junior Analyst as their team expands and are keen to bring in an individual at entry level, so they are able to train and develop them. As such we're keen to hear from individuals who are due to complete their academia in June 2019 and are looking for their first permanent role in investment management. Requirements: Undergraduate degree, from any discipline. Previous administration experience is desirable. Previous customer service experience. Proficiency with Microsoft Office packages. Highly organised with good time management skills. Excellent verbal and written communication. Applicants should have a BSc or a Masters in an economics, finance or accounting related subject and be able to demonstrate a genuine interest in investing, and ideally have undertaken one or more internships with an asset manager or investment bank. This role is a full-time contract position, an initial two- month commitment is required (with scope for extension), based in the City of London. Immediate start! Please get in touch for further details. We would ask that applicants have the required level of experience. If you would like to be considered for this opportunity, please send your CV to Diana Duggan Associates