Using Problem 11- 61 (re: Bottle-Up Inc.) from the course textbook, prepare 2021 return without software usage.

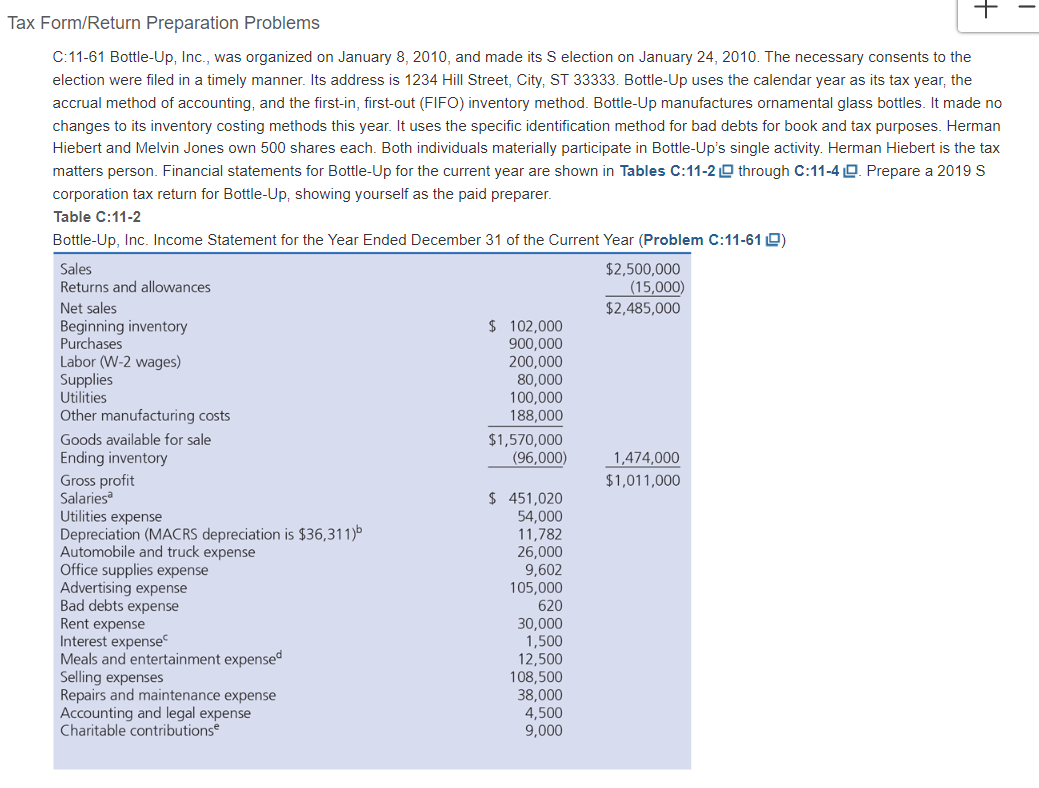

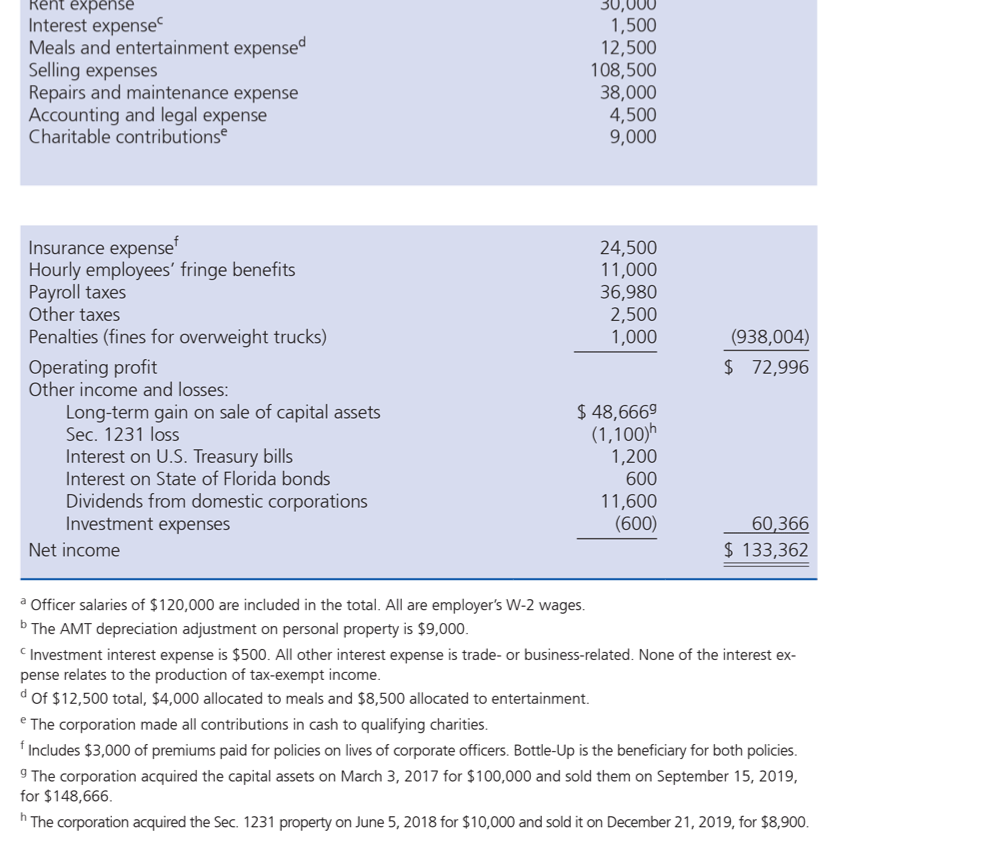

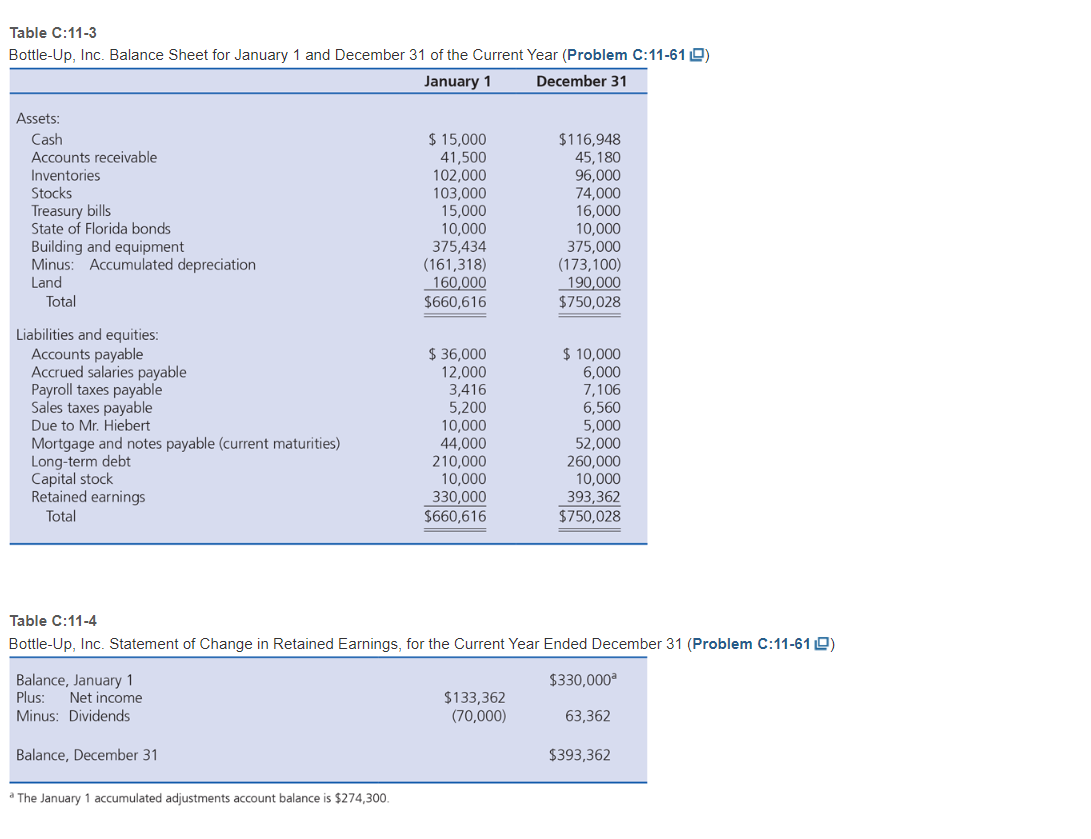

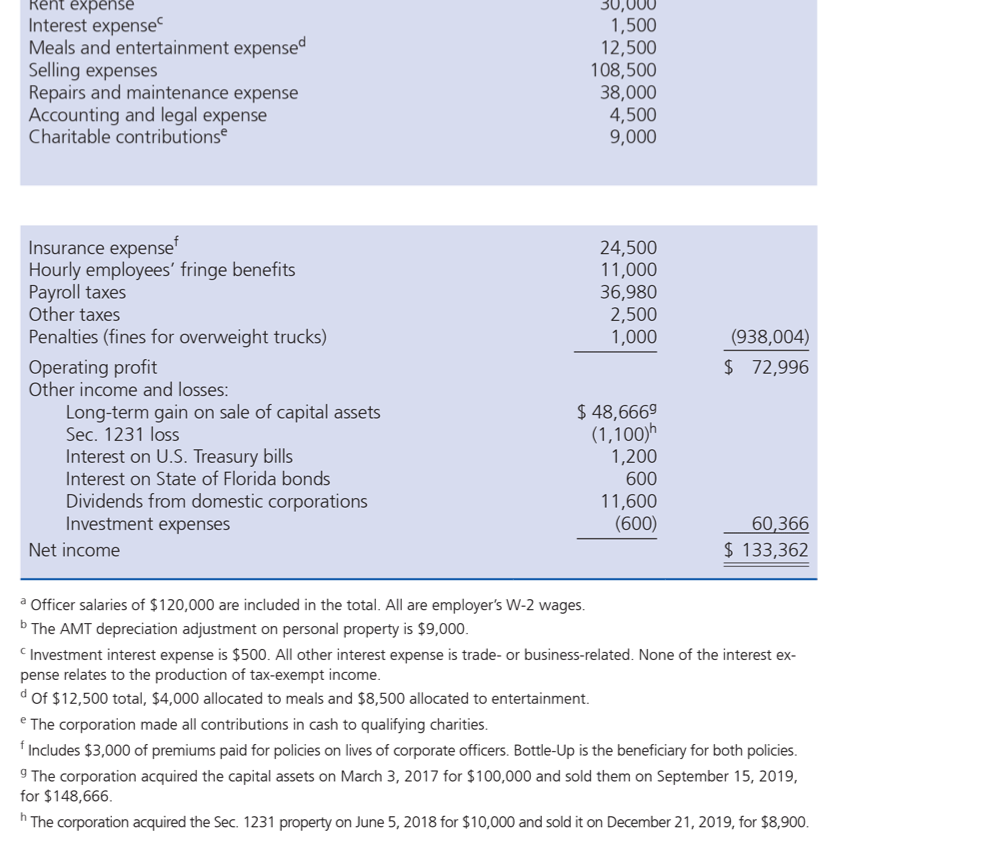

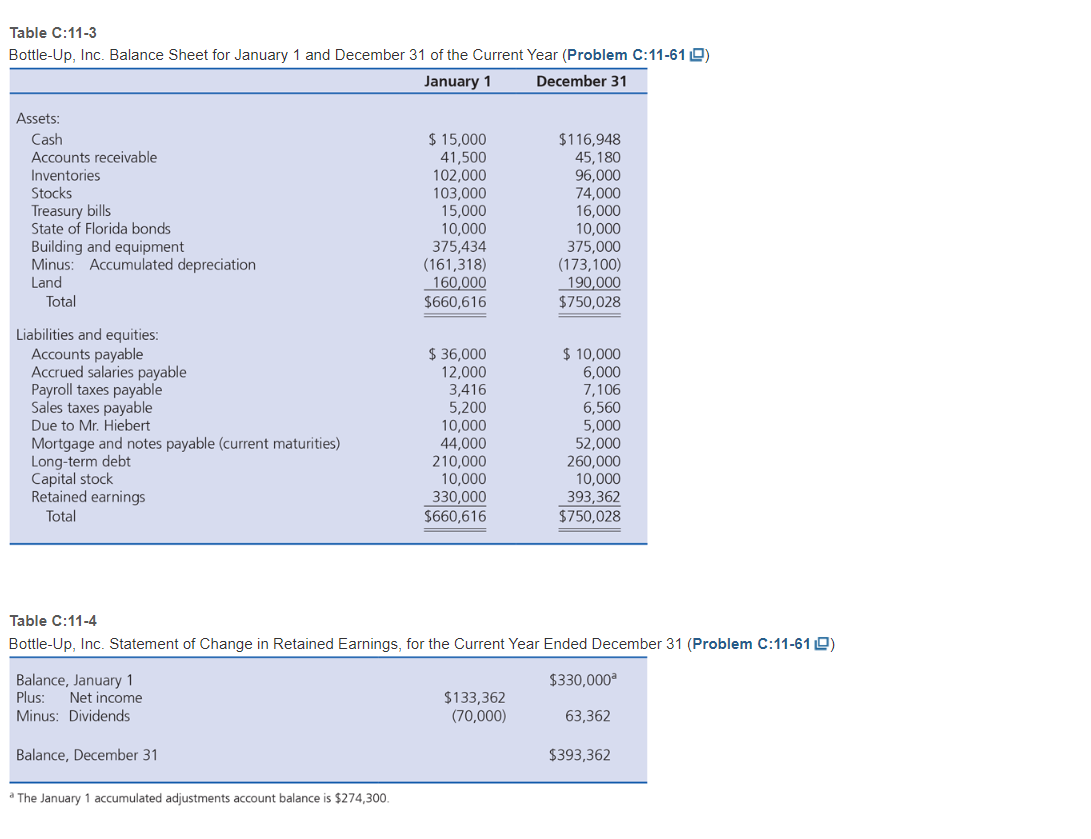

Tax Form/Return Preparation Problems C:11-61 Bottle-Up, Inc., was organized on January 8, 2010, and made its S election on January 24, 2010. The necessary consents to the election were filed in a timely manner. Its address is 1234 Hill Street, City, ST 33333. Bottle-Up uses the calendar year as its tax year, the accrual method of accounting, and the first-in, first-out (FIFO) inventory method. Bottle-Up manufactures ornamental glass bottles. It made no changes to its inventory costing methods this year. It uses the specific identification method for bad debts for book and tax purposes. Herman Hiebert and Melvin Jones own 500 shares each. Both individuals materially participate in Bottle-Up's single activity. Herman Hiebert is the tax matters person. Financial statements for Bottle-Up for the current year are shown in Tables C:11-2 through C:11-4. Prepare a 2019 S corporation tax return for Bottle-Up, showing yourself as the paid preparer. Table C:11-2 Bottle-Up, Inc. Income Statement for the Year Ended December 31 of the Current Year (Problem C:11-61 ) Sales Returns and allowances Net sales Beginning inventory Purchases Labor (W-2 wages) Supplies Utilities Other manufacturing costs Goods available for sale Ending inventory Gross profit Salariesa Utilities expense Depreciation (MACRS depreciation is $36,311)b Automobile and truck expense Office supplies expense Advertising expense Bad debts expense Rent expense Interest expense Meals and entertainment expensed Selling expenses Repairs and maintenance expense Accounting and legal expense Charitable contributions $ 102,000 900,000 200,000 80,000 100,000 188,000 $1,570,000 (96,000) $ 451,020 54,000 11,782 26,000 9,602 105,000 620 30,000 1,500 12,500 108,500 38,000 4,500 9,000 $2,500,000 (15,000) $2,485,000 + 1,474,000 $1,011,000 I Rent expense Interest expense Meals and entertainment expensed Selling expenses Repairs and maintenance expense Accounting and legal expense Charitable contributions Insurance expensef Hourly employees' fringe benefits Payroll taxes Other taxes Penalties (fines for overweight trucks) Operating profit Other income and losses: Long-term gain on sale of capital assets Sec. 1231 loss Interest on U.S. Treasury bills Interest on State of Florida bonds Dividends from domestic corporations Investment expenses Net income 30,000 1,500 12,500 108,500 38,000 4,500 9,000 a Officer salaries of $120,000 are included in the total. All are employer's W-2 wages. b The AMT depreciation adjustment on personal property is $9,000. 24,500 11,000 36,980 2,500 1,000 $ 48,6669 (1,100)h 1,200 600 11,600 (600) (938,004) $ 72,996 60,366 $ 133,362 Investment interest expense is $500. All other interest expense is trade- or business-related. None of the interest ex- pense relates to the production of tax-exempt income. d Of $12,500 total, $4,000 allocated to meals and $8,500 allocated to entertainment. The corporation made all contributions in cash to qualifying charities. Includes $3,000 of premiums paid for policies on lives of corporate officers. Bottle-Up is the beneficiary for both policies. 9 The corporation acquired the capital assets on March 3, 2017 for $100,000 and sold them on September 15, 2019, for $148,666. hThe corporation acquired the Sec. 1231 property on June 5, 2018 for $10,000 and sold it on December 21, 2019, for $8,900. Table C:11-3 Bottle-Up, Inc. Balance Sheet for January 1 and December 31 of the Current Year (Problem C:11-61 ) January 1 December 31 Assets: Cash Accounts receivable Inventories Stocks Treasury bills State of Florida bonds Building and equipment Minus: Accumulated depreciation Land Total Liabilities and equities: Accounts payable Accrued salaries payable Payroll taxes payable Sales taxes payable Due to Mr. Hiebert Mortgage and notes payable (current maturities) Long-term debt Capital stock Retained earnings Total Balance, January 1 Plus: Net income Minus: Dividends Balance, December 31 $ 15,000 41,500 102,000 103,000 15,000 10,000 375,434 (161,318) 160,000 $660,616 a The January 1 accumulated adjustments account balance is $274,300. $ 36,000 12,000 3,416 5,200 10,000 44,000 210,000 10,000 330,000 $660,616 Table C:11-4 Bottle-Up, Inc. Statement of Change in Retained Earnings, for the Current Year Ended December 31 (Problem C:11-61 ) $116,948 45,180 96,000 74,000 16,000 10,000 $133,362 (70,000) 375,000 (173,100) 190,000 $750,028 $ 10,000 6,000 7,106 6,560 5,000 52,000 260,000 10,000 393,362 $750,028 $330,000 63,362 $393,362 Tax Form/Return Preparation Problems C:11-61 Bottle-Up, Inc., was organized on January 8, 2010, and made its S election on January 24, 2010. The necessary consents to the election were filed in a timely manner. Its address is 1234 Hill Street, City, ST 33333. Bottle-Up uses the calendar year as its tax year, the accrual method of accounting, and the first-in, first-out (FIFO) inventory method. Bottle-Up manufactures ornamental glass bottles. It made no changes to its inventory costing methods this year. It uses the specific identification method for bad debts for book and tax purposes. Herman Hiebert and Melvin Jones own 500 shares each. Both individuals materially participate in Bottle-Up's single activity. Herman Hiebert is the tax matters person. Financial statements for Bottle-Up for the current year are shown in Tables C:11-2 through C:11-4. Prepare a 2019 S corporation tax return for Bottle-Up, showing yourself as the paid preparer. Table C:11-2 Bottle-Up, Inc. Income Statement for the Year Ended December 31 of the Current Year (Problem C:11-61 ) Sales Returns and allowances Net sales Beginning inventory Purchases Labor (W-2 wages) Supplies Utilities Other manufacturing costs Goods available for sale Ending inventory Gross profit Salariesa Utilities expense Depreciation (MACRS depreciation is $36,311)b Automobile and truck expense Office supplies expense Advertising expense Bad debts expense Rent expense Interest expense Meals and entertainment expensed Selling expenses Repairs and maintenance expense Accounting and legal expense Charitable contributions $ 102,000 900,000 200,000 80,000 100,000 188,000 $1,570,000 (96,000) $ 451,020 54,000 11,782 26,000 9,602 105,000 620 30,000 1,500 12,500 108,500 38,000 4,500 9,000 $2,500,000 (15,000) $2,485,000 + 1,474,000 $1,011,000 I Rent expense Interest expense Meals and entertainment expensed Selling expenses Repairs and maintenance expense Accounting and legal expense Charitable contributions Insurance expensef Hourly employees' fringe benefits Payroll taxes Other taxes Penalties (fines for overweight trucks) Operating profit Other income and losses: Long-term gain on sale of capital assets Sec. 1231 loss Interest on U.S. Treasury bills Interest on State of Florida bonds Dividends from domestic corporations Investment expenses Net income 30,000 1,500 12,500 108,500 38,000 4,500 9,000 a Officer salaries of $120,000 are included in the total. All are employer's W-2 wages. b The AMT depreciation adjustment on personal property is $9,000. 24,500 11,000 36,980 2,500 1,000 $ 48,6669 (1,100)h 1,200 600 11,600 (600) (938,004) $ 72,996 60,366 $ 133,362 Investment interest expense is $500. All other interest expense is trade- or business-related. None of the interest ex- pense relates to the production of tax-exempt income. d Of $12,500 total, $4,000 allocated to meals and $8,500 allocated to entertainment. The corporation made all contributions in cash to qualifying charities. Includes $3,000 of premiums paid for policies on lives of corporate officers. Bottle-Up is the beneficiary for both policies. 9 The corporation acquired the capital assets on March 3, 2017 for $100,000 and sold them on September 15, 2019, for $148,666. hThe corporation acquired the Sec. 1231 property on June 5, 2018 for $10,000 and sold it on December 21, 2019, for $8,900. Table C:11-3 Bottle-Up, Inc. Balance Sheet for January 1 and December 31 of the Current Year (Problem C:11-61 ) January 1 December 31 Assets: Cash Accounts receivable Inventories Stocks Treasury bills State of Florida bonds Building and equipment Minus: Accumulated depreciation Land Total Liabilities and equities: Accounts payable Accrued salaries payable Payroll taxes payable Sales taxes payable Due to Mr. Hiebert Mortgage and notes payable (current maturities) Long-term debt Capital stock Retained earnings Total Balance, January 1 Plus: Net income Minus: Dividends Balance, December 31 $ 15,000 41,500 102,000 103,000 15,000 10,000 375,434 (161,318) 160,000 $660,616 a The January 1 accumulated adjustments account balance is $274,300. $ 36,000 12,000 3,416 5,200 10,000 44,000 210,000 10,000 330,000 $660,616 Table C:11-4 Bottle-Up, Inc. Statement of Change in Retained Earnings, for the Current Year Ended December 31 (Problem C:11-61 ) $116,948 45,180 96,000 74,000 16,000 10,000 $133,362 (70,000) 375,000 (173,100) 190,000 $750,028 $ 10,000 6,000 7,106 6,560 5,000 52,000 260,000 10,000 393,362 $750,028 $330,000 63,362 $393,362