Question: Using python Task 4: Finance Equation II Present Value of an Ordinary Annuity: P = (PMT [(1 - (1/(1 + r)n)) /r]) x (1+r) Use

Using python

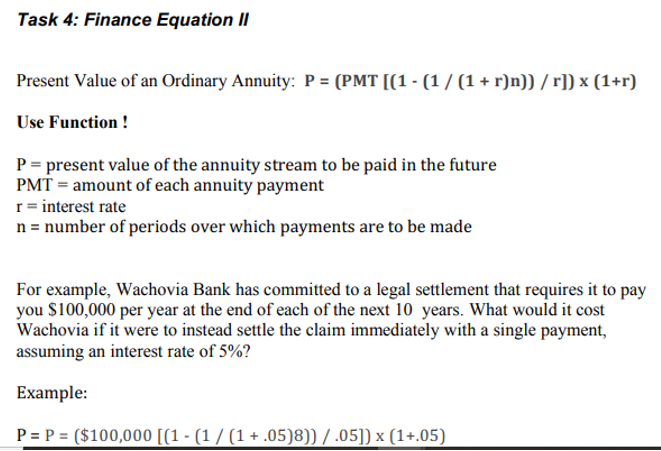

Task 4: Finance Equation II Present Value of an Ordinary Annuity: P = (PMT [(1 - (1/(1 + r)n)) /r]) x (1+r) Use Function ! P = present value of the annuity stream to be paid in the future PMT = amount of each annuity payment r= interest rate n = number of periods over which payments are to be made For example, Wachovia Bank has committed to a legal settlement that requires it to pay you $100,000 per year at the end of each of the next 10 years. What would it cost Wachovia if it were to instead settle the claim immediately with a single payment, assuming an interest rate of 5%? Example: P= P = ($100,000 [(1 - (1/(1 +.05)8)) /.05]) X (1+.05)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts