Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q39 Using ratio analysis, common sized percentages, trend analysis and any other relevant metrics, evaluate Target as to its liquidity. Be certain to make

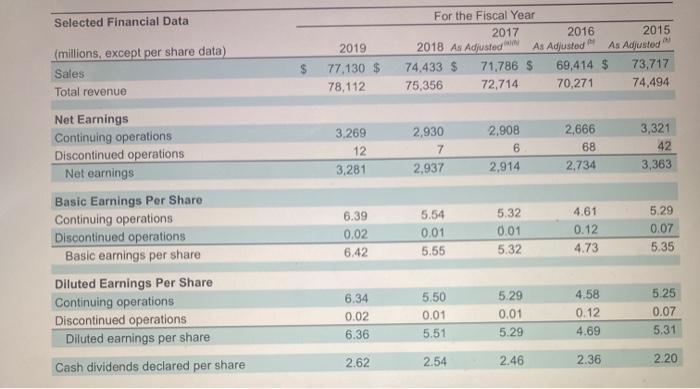

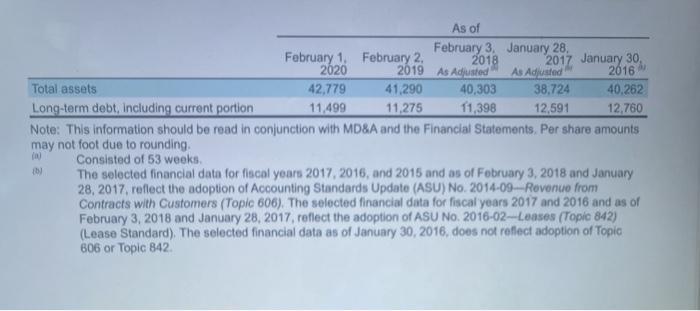

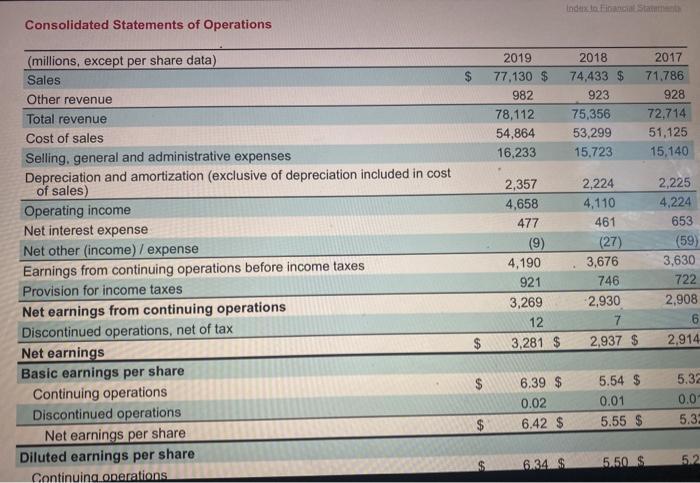

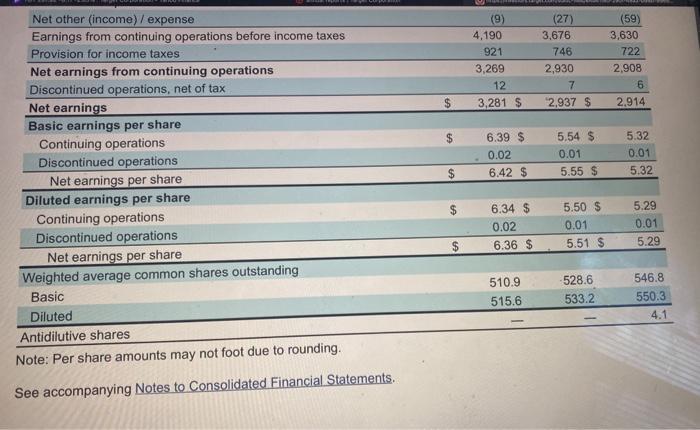

Q39 Using ratio analysis, common sized percentages, trend analysis and any other relevant metrics, evaluate Target as to its liquidity. Be certain to make a statement as to whether it is improving or not. Which metrics did you use to make your determination. Show your calculations Selected Financial Data (millions, except per share data) Sales Total revenue Net Earnings Continuing operations Discontinued operations Net earnings Basic Earnings Per Share Continuing operations Discontinued operations Basic earnings per share Diluted Earnings Per Share Continuing operations Discontinued operations Diluted earnings per share Cash dividends declared per share 2019 77,130 $ 78,112 3,269 12 3,281 6.39 0.02 6.42 6.34 0.02 6.36 2.62 For the Fiscal Year 2017 2015 2016 P 2018 As Adjusted As Adjusted" As Adjusted 74,433 $ 69,414 S 73,717 75,356 70,271 74,494 2,930 7 2,937 5.54 0.01 5.55 5.50 0.01 5.51 2.54 71,786 $ 72,714 2,908 6 2,914 5.32 0.01 5.32 5.29 0.01 5.29 2.46 2,666 68 2,734 4.61 0.12 4.73 4.58 0.12 4.69 2.36 3,321 42 3,363 5.29 0.07 5.35 5.25 0.07 5.31 2.20 February 1, 2020 February 2, 2019 41,290 11,275 As of February 3, January 28, 2018 As Adjusted" 40,303 11,398 2017 January 30, 2016 Total assets 42,779 38,724 40,262 Long-term debt, including current portion 11,499 12,591 12,760 Note: This information should be read in conjunction with MD&A and the Financial Statements. Per share amounts may not foot due to rounding. (0) Consisted of 53 weeks. (b) As Adjusted The selected financial data for fiscal years 2017, 2016, and 2015 and as of February 3, 2018 and January 28, 2017, reflect the adoption of Accounting Standards Update (ASU) No. 2014-09-Revenue from Contracts with Customers (Topic 606). The selected financial data for fiscal years 2017 and 2016 and as of February 3, 2018 and January 28, 2017, reflect the adoption of ASU No. 2016-02-Leases (Topic 842) (Lease Standard). The selected financial data as of January 30, 2016, does not reflect adoption of Topic 606 or Topic 842. Consolidated Statements of Operations (millions, except per share data) Sales Other revenue Total revenue Cost of sales Selling, general and administrative expenses Depreciation and amortization (exclusive of depreciation included in cost of sales) Operating income Net interest expense Net other (income) / expense Earnings from continuing operations before income taxes Provision for income taxes Net earnings from continuing operations Discontinued operations, net of tax Net earnings Basic earnings per share Continuing operations Discontinued operations Net earnings per share Diluted earnings per share Continuing operations $ $ $ 2019 77,130 $ 982 78,112 54,864 16,233 2,357 4,658 477 (9) 4,190 921 3,269 12 3,281 $ 6.39 $ 0.02 6.42 $ 6.34 $ Index to Financial Statements 2018 74,433 $ 923 75,356 53,299 15,723 2,224 4,110 461 (27) 3,676 746 2,930 7 2,937 $ 5.54 $ 0.01 5.55 $ 5.50 $ 2017 71,786 928 72,714 51,125 15,140 2,225 4,224 653 (59) 3,630 722 2,908 6 2,914 5.32 0.01 5.32 Net other (income) / expense Earnings from continuing operations before income taxes Provision for income taxes Net earnings from continuing operations Discontinued operations, net of tax Net earnings Basic earnings per share Continuing operations Discontinued operations Net earnings per share Diluted earnings per share Continuing operations Discontinued operations Net earnings per share Weighted average common shares outstanding Basic Diluted Antidilutive shares Note: Per share amounts may not foot due to rounding. See accompanying Notes to Consolidated Financial Statements. $ $ $ (9) 4,190 921 3,269 12 3,281 S 6.39 $ 0.02 6.42 $ 6.34 $ 0.02 6.36 $ 510.9 515.6 (27) 3,676 746 2,930 7 2,937 $ 5.54 $ 0.01 5.55 $ 5.50 $ 0.01 5.51 528.6 533.2 (59) 3,630 722 2,908 6 2,914 5.32 0.01 5.32 5.29 0.01 5.29 546.8 550.3 4.1

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started