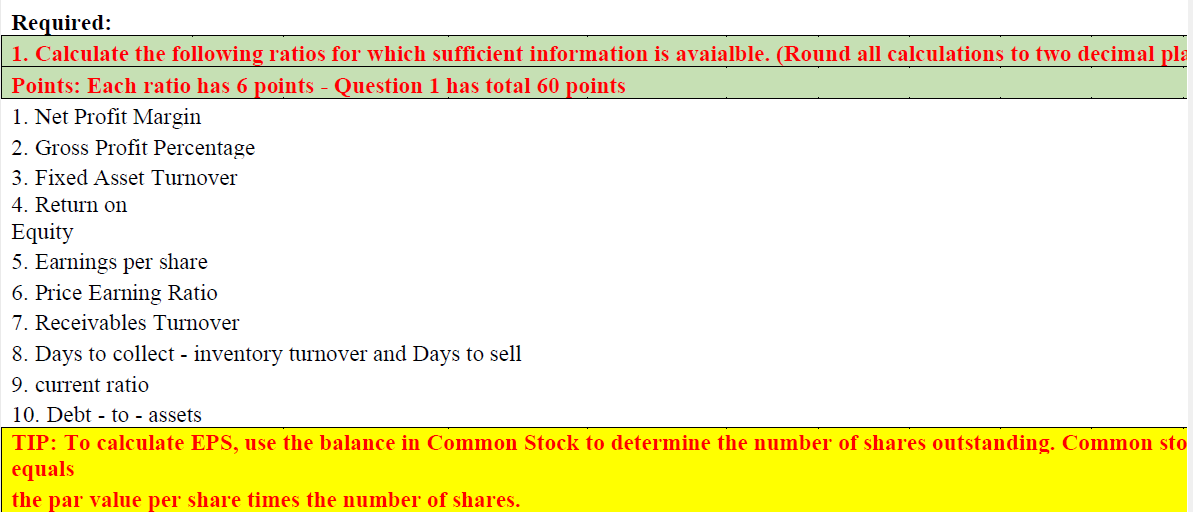

Question

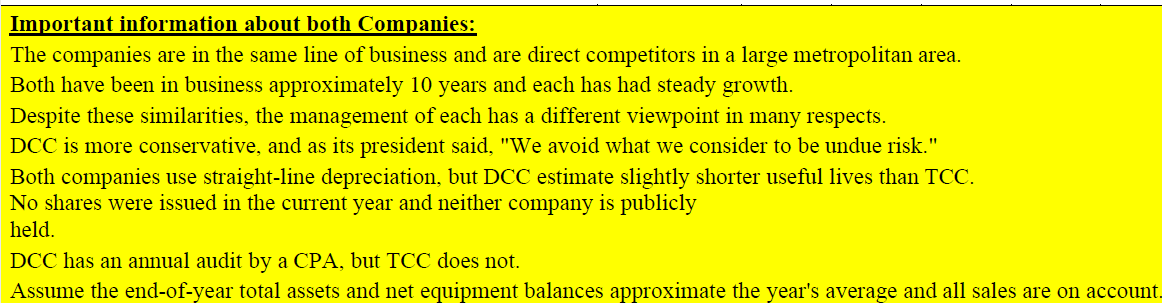

Using Ration to Compare Alternative Investment Opportunities The financial statements for Royale and Cavalier companies are summarized here: TCC DCC Balance Sheet Cash $ 35,000

| Using Ration to Compare Alternative Investment Opportunities The financial statements for Royale and Cavalier companies are summarized here: | TCC | DCC | |||||

| Balance Sheet | |||||||

| Cash | $ | 35,000 | $ | 22,000 | |||

| Accounts Receivable, Net | 40,000 | 30,000 | |||||

| Inventory | 100,000 | 40,000 | |||||

| Equipment, Net | 180,000 | 300,000 | |||||

| Other Assets | 45,000 | 408,000 | |||||

| Total Assets | $ | 400,000 | $ | 800,000 | |||

| Current Liabilities | $ | 100,000 | $ | 50,000 | |||

| Note Payable (long-term) | 60,000 | 370,000 | |||||

| Common Stock (par $20) | 150,000 | 200,000 | |||||

| Additional Paid-In Capital | 30,000 | 110,000 | |||||

| Retained Earnings | 60,000 | 70,000 | |||||

| Total Liabilities and Stockholders Equity | $ | 400,000 | $ | 800,000 | |||

| Income Statement | |||||||

| Sales Revenue | $ | 450,000 | $ | 810,000 | |||

| Cost of Goods Sold | 245,000 | 405,000 | |||||

| Other Expenses | 160,000 | 315,000 | |||||

| Net Income | $ | 45,000 | $ | 90,000 | |||

| Other Data | |||||||

| Per share price at end of year | $ | 18.00 | $ | 27.00 | |||

| Selected Data from Previous Year | |||||||

| Accounts Receivable, Net | $ | 20,000 | $ | 38,000 | |||

| Inventory |

| 92,000 |

|

|

| 45,000 |

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started