Question

Using ROE, P/B ratio and P/E ratios, discuss the market's expectation on future performance of A and B relative to their current performance (current

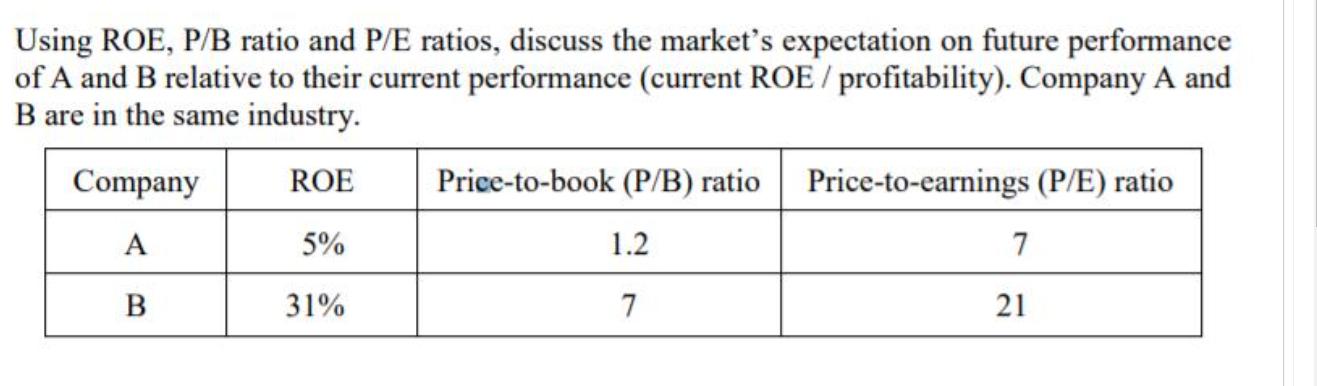

Using ROE, P/B ratio and P/E ratios, discuss the market's expectation on future performance of A and B relative to their current performance (current ROE/ profitability). Company A and B are in the same industry. ROE 5% 31% Company A B Price-to-book (P/B) ratio Price-to-earnings (P/E) ratio 1.2 7 7 21

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Market Expectations on Future Performance A vs B Based on the provided financial ratios ROE PB and PE the market seems to expect a difference in futur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham

Concise 9th Edition

1305635937, 1305635930, 978-1305635937

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App