Answered step by step

Verified Expert Solution

Question

1 Approved Answer

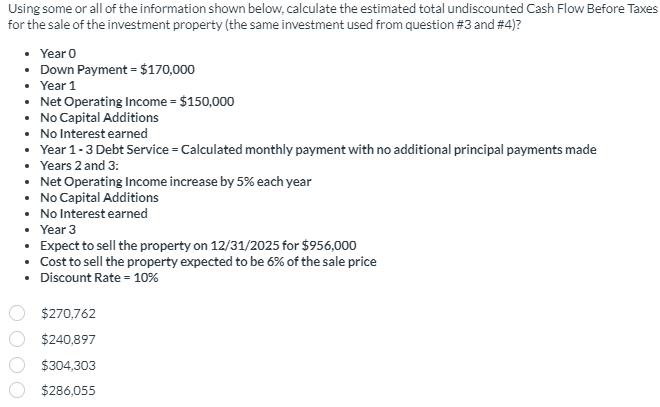

Using some or all of the information shown below, calculate the estimated total undiscounted Cash Flow Before Taxes for the sale of the investment property

Using some or all of the information shown below, calculate the estimated total undiscounted Cash Flow Before Taxes

for the sale of the investment property the same investment used from question # and #

Year

Down Payment $

Year

Net Operating Income $

No Capital Additions

No Interest earned

Year Debt Service Calculated monthly payment with no additional principal payments made

Years and :

Net Operating Income increase by each year

No Capital Additions

No Interest earned

Year

Expect to sell the property on for $

Cost to sell the property expected to be of the sale price

Discount Rate

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started