Answered step by step

Verified Expert Solution

Question

1 Approved Answer

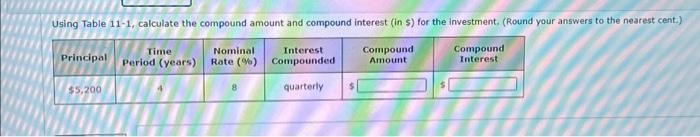

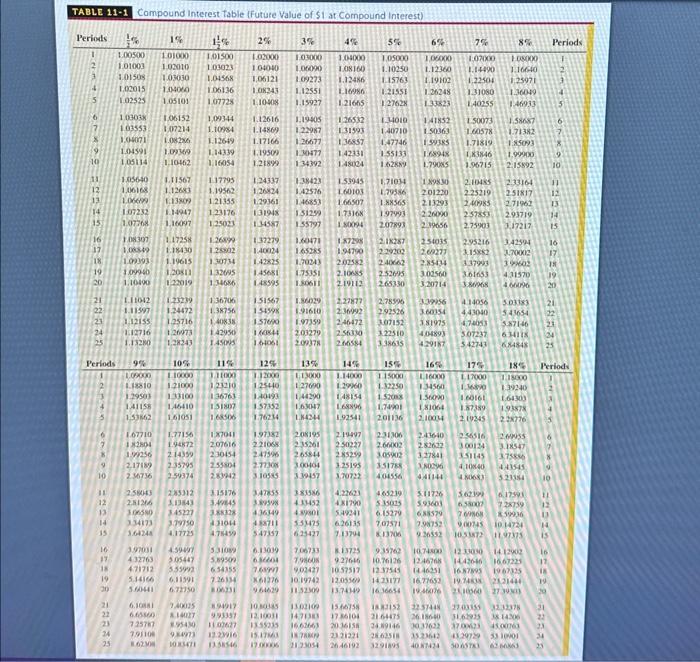

Using Table 11-1, calculate the compound amount and compound interest (in $) for the investment. (Round your answers to the nearest cent.) Principal $5,200

Using Table 11-1, calculate the compound amount and compound interest (in $) for the investment. (Round your answers to the nearest cent.) Principal $5,200 Time Nominal Interest Period (years) Rate (%) Compounded quarterly Compound Amount Compound Interest TABLE 11-1 Compound Interest Table (Future Value of $1 at Compound Interest) Periods 103038 103553 104071 1.04591 10 1,05134 105640 12 106168 13 L06699 14 107232 1% 1% 1.00500 101000 1.01500 1.01003 102010 103023 101508 103030 1.04568 1.02015 1.04060 106136 102525 1.05101 107728 1.06152 1,09344 107214 1.10984 1.08286 1.12649 1.09369 1.14339 1.10462 1,16054 1.11567 117795 1.12683 1.19562 1.21355 123176 3% 1.13809 134947 153 107768 1.16097 125023 16 108307 117258 17 108849 18 19 20 1.10400 122019 126899 E18430 1.25802 109393 1.19615 130734 1.09940 12080 132695 134686 148595 21 22 23 24 25 11042 123239 136706 131597 1.24472 1.38756 1.12155 125716 140838 E12716 126973 142950 1.13280 1.28243 145095 2% 4% 5% 6% 7% 1.02000 103000 1.04000 1,05000 1.06000 107000 105000 104040 1.06090 108160 1.10250 1.12360 1.14490 1.16640 1.06121 1.09273 1.12486 115763 1.19102 1,22504 125071 1.08343 1.12551 L16986 1.21551 1.26248 1.31080 136049 1.10408 1.15927 1.21665 127628 133823 140255 146933 1.12616 1.19405 126532 14010 141852 L50073 1.58687 1.14869 122987 1.31593 140710 150363 160578 1.71382 1.17166 126677 136857 147746 159385 1.71819 1.85093 1.19509 130477 142331 3.55133 168948 1,83846 1.99900 1.21899 134392 148024 1.62889 1.79085 196715 2.15892 1.24337 138423 1.53945 1.71034 189830 2.10485 233164 " 1.26824 1.42576 160103 1.79386 201220 2.25219 2.51817 12 129361 1.46853 166507 1.88565 213293 240985 2.71962 13 131948 151259 1.73168 197993 226090 257853 2.93719 14 134587 135797 180094 207893 2.39656 2.75903 317217 15 132279 1.60471 137298 2.18287 2.95216 342594 16 140024 165285 194790 229202 209277 3.15882 3.70002 17 142825 1.70243 202582 240662 2.85434 337993 39602 18 145681 1.75351 2.105 2.52695 3.02560 3.61653 431570 19 1.30611 2.19112 265330 3.20714 380968 4.66096 20 151567 1.36029 2.27877 2.78596 339956 414056 5.03183 21 154598 191610 236992 292526 360354 4,43040 543654 131690 1.97359 246472 307152 3.81975 474053 5.87146 360844 203279 256330 322510 404893 5.07237 634118 24 164061 209378 266584 3.38615 429187 542743 684848 25 8% Periods 6 9 10 254035 Periods 12% 132000 125440 167710 9 10 9% 10% 11% 13% 14% 15% 16% 17% 18% 109000 110000 331000 613000 1.14000 115000 L16000 117000 118000 1.18810 121000 123210 127690 1.32250 134560 136890 139240 129503 133100 136763 140193 144290 148154 15208 1.56090 160161 164303 141158 146410 131807 157352 163047 168896 174901 E81064 187389 193878 153862 161051 168506 176234 134244 192541 201136 210034 219245 228776 1.77156 1X7041 197382 2.08195 219497 231306 182804 194872 207616 221068 235261 250227 2.66002 199256 214359 230454 247596 265844 2.85259 3.05902 2.17189 235795 255804 2.7730 300404 3.25195 351788 2.36736 259374 283942 310585 404556 Periods 1.29960 243640 256516 269955 282622 300124 3.18547 3.27841 351145 37588 3.39457 170722 3 80296 4,1040 443545 44044 480683 3.23384 10 JU 258043 235312 12 2.81266 313843 13 306580 345223 14 15 334173 1.64248 16 37 18 471712 3.55992 6.54355 3151761 347855 3.83586 422623 465239 501726 562399 612591 349845 3.89598 4.33452 431790 535025 593601 658007 728759 3.88328 436349 489801 549241 6.15279 688579 769868 19936 339750 31044 488711 553475 626135 7.07571 7.98752 9,00745 10.14724 4.37725 4.75459 547357 625427 7.13794 813706 9.26552 1053872 197375 is 397031 459497 531089 6.13039 706733 813725 4.32763 505447 5.89509 6304 19860 927646 76999) 902427 10.57517 19 534166 631591 7.26134 x61276 10.19742 20 560441 21 6.1088 140025 894917 22 23 24 25 2123054 6.72750 BOADE 9.64629 1132309 3030385 13.02109 6.65560 814027 993357 1210011 34700 1736104 21.64475 26.18640 31.62925 725787 895430 1102627 1355235 3662663 20.36158 2489146 3037622 37.00625 791108 934973 12.23916) 15.1763 1878809 2321221 2862518 35.23642 43.29729 6230 103471 13.38546 17.00006 26-46192 3291895 4087424 50 65783 935762 1074800 12.33030 1412902 16 10.76126 1246768 1442646 16.67225 17 12.37545 (446251 16.87595 1967325 18 12.05569 1423177 16.77653 19.74838 213144 19 1374349 1636654 1946076 210560 27 30 20 1566758 188152 22.57448 2703355 3232378 38 14306 31 22 45.00763 23 53 10001 34 626863 23

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the compound amount and compound interest for the investment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started