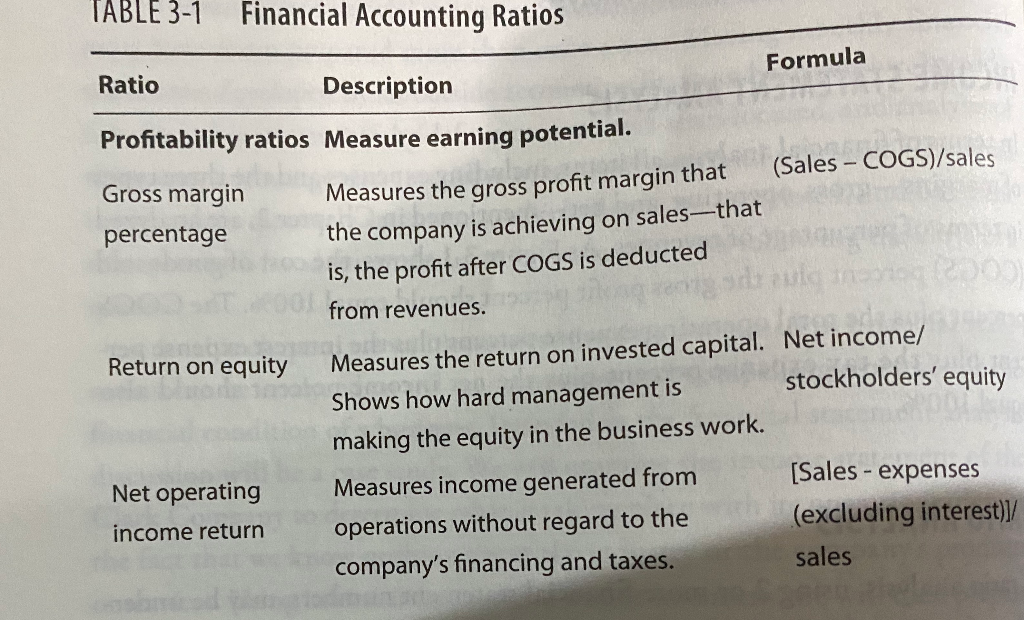

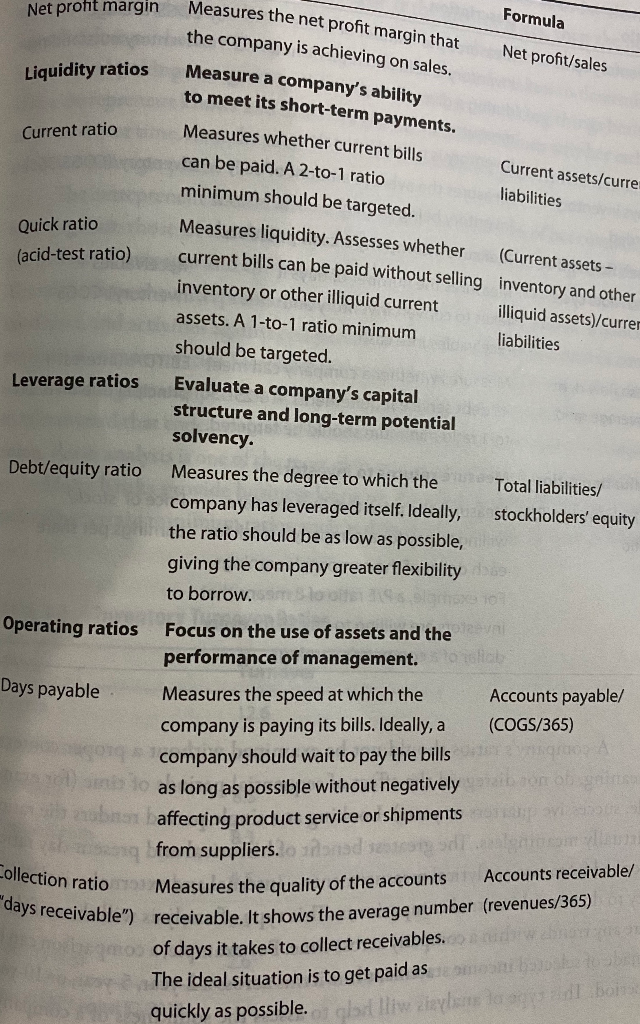

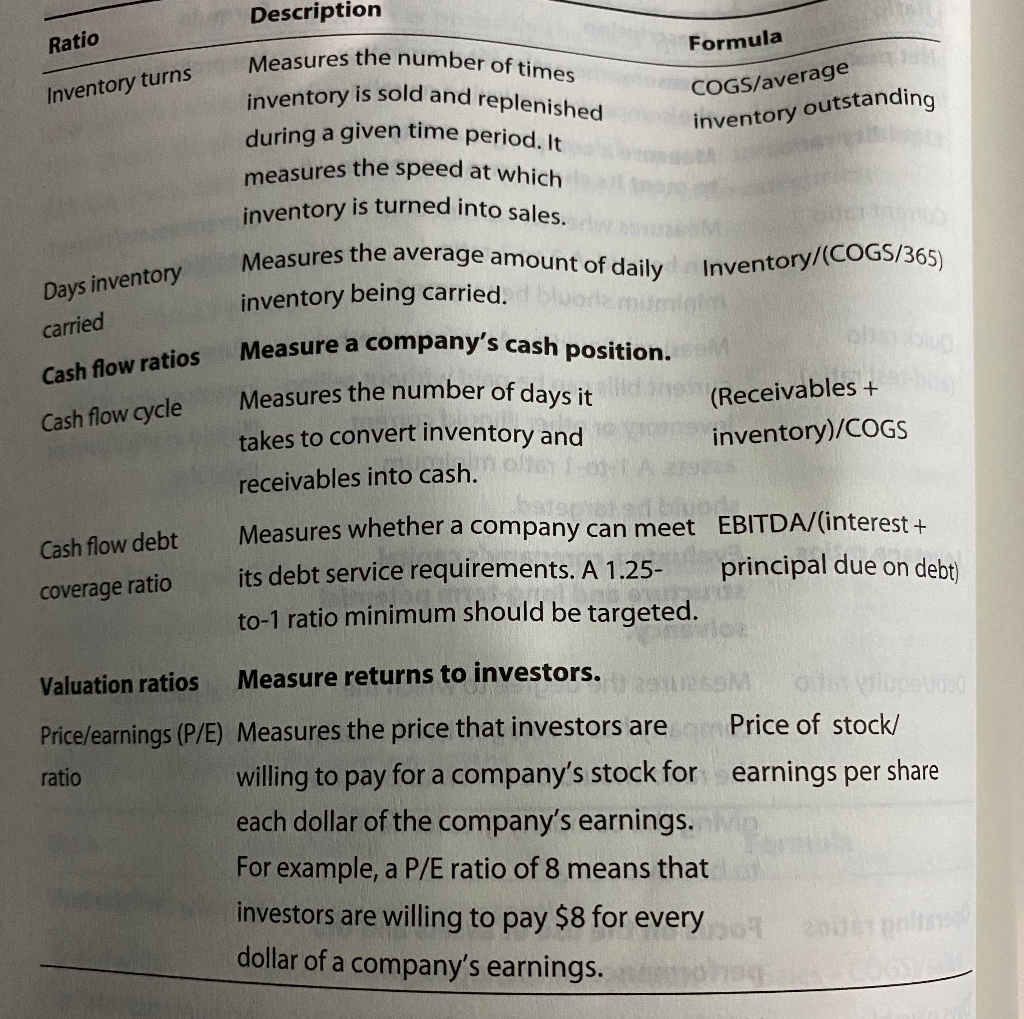

Using Table 3-1 on pages 42-43 for the Ratio Formulas, compute Gross Margin, the Return on Equity and the Current Ratio.

Lucky Larrys is an entrepreneur company that has the following info: Net Income ---- $251,883 Current Assets ---- $1,357,992 Current Liabilities ---- $502, 536 Stockholders Equity ---- $1,726,883 Sales ---- $3,055,560 Cost of Goods Sold ---- $2,005,830

Question #1 - What is the Gross Margin?

Question #2 What is the Return on Equity?

Question #3 What is the Current Ratio?

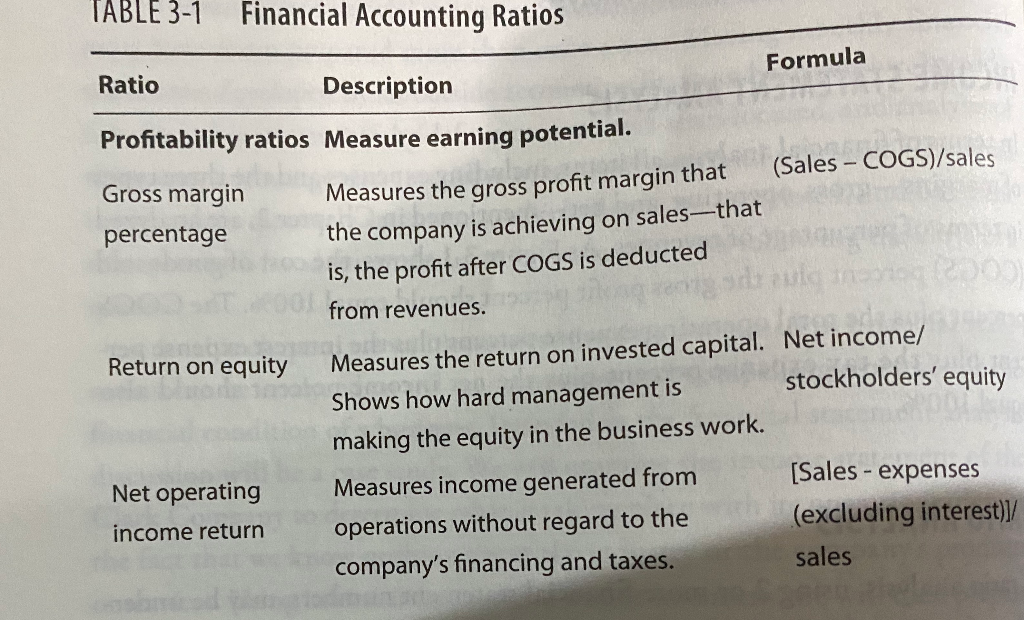

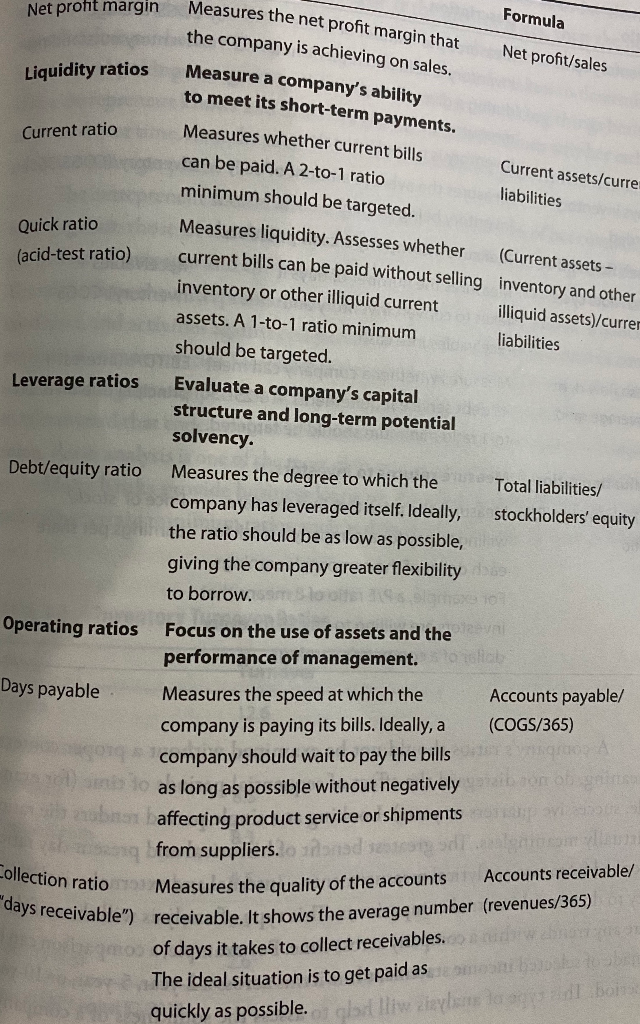

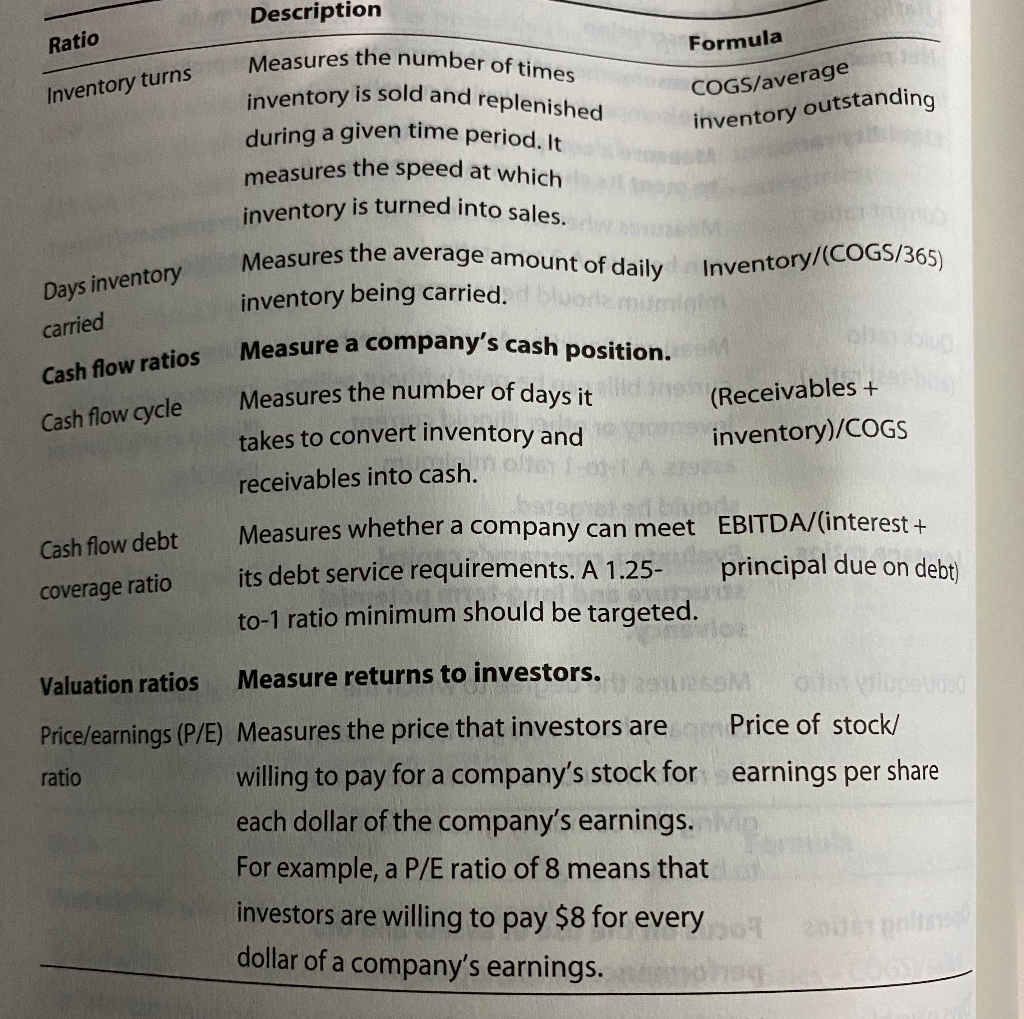

TABLE 3-1 Financial Accounting Ratios Ratio Formula Description Profitability ratios Measure earning potential. Gross margin (Sales - COGS)/sales Measures the gross profit margin that percentage the company is achieving on sales-that is, the profit after COGS is deducted from revenues. Return on equity Measures the return on invested capital. Net income/ Shows how hard management is stockholders' equity making the equity in the business work. Net operating Measures income generated from [Sales - expenses income return operations without regard to the (excluding interest) company's financing and taxes. sales Formula Net profit/sales days receivable") receivable. It shows the average number (revenues/365) Net profit margin Liquidity ratios Current ratio Quick ratio (acid-test ratio) Leverage ratios Debt/equity ratio company has leveraged itself. Ideally, the ratio should be as low as possible, giving the company greater flexibility to borrow. Operating ratios Focus on the use of assets and the performance of management. Measures the speed at which the Accounts payable/ company is paying its bills. Ideally, a (COGS/365) company should wait to pay the bills as long as possible without negatively affecting product service or shipments from suppliers. Measures the quality of the accounts Accounts receivable/ Measures the net profit margin that the company is achieving on sales. Measure a company's ability to meet its short-term payments. Measures whether current bills Current assets/curre can be paid. A 2-to-1 ratio liabilities minimum should be targeted. Measures liquidity. Assesses whether (Current assets - current bills can be paid without selling inventory and other inventory or other illiquid current illiquid assets)/currer assets. A 1-to-1 ratio minimum liabilities should be targeted. Evaluate a company's capital structure and long-term potential solvency. Total liabilities/ Measures the degree to which the stockholders' equity Days payable Collection ratio of days it takes to collect receivables. The ideal situation is to get paid as quickly as possible. gel lliwzeyle bo Ratio Inventory turns COGS/average inventory outstanding Measures the number of times inventory is sold and replenished during a given time period. It measures the speed at which inventory is turned into sales. Measures the number of days it Description Formula Measures the average amount of daily Inventory/(COGS/365) inventory being carried. Measure a company's cash position. (Receivables + takes to convert inventory and inventory)/COGS receivables into cash. Measures whether a company can meet EBITDA/(interest + its debt service requirements. A 1.25 principal due on debt) to-1 ratio minimum should be targeted. Days inventory carried Cash flow ratios Cash flow cycle Cash flow debt coverage ratio Valuation ratios Measure returns to investors. Price/earnings (P/E) Measures the price that investors are Price of stock/ ratio willing to pay for a company's stock for earnings per share each dollar of the company's earnings. For example, a P/E ratio of 8 means that investors are willing to pay $8 for every dollar of a company's earnings