Question

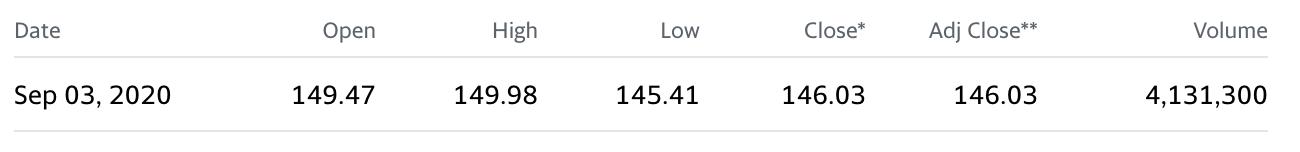

Using Target's closing data from September 3, 2020, answer the following questions: 6. You are bullish on Target Inc. You purchase 100 shares of Target

Using Target's closing data from September 3, 2020, answer the following questions:

6. You are bullish on Target Inc. You purchase 100 shares of Target stock at the market price using $8,000 of your own money and some additional funds, which you borrow from your broker at an interest rate of 6% per year.

(a) What is the holding period return of this buy on margin if the price of Target stock increased by 10% over the next year?

(b) What if Target stock price increased by 1%?

(c) If the maintenance margin requirement is 35%, how far can the price of Target stock fall before you get a margin call?

(d) Your friend is also bullish on Target stock and she purchases 100 shares of Target stock at the market price by using $10,000 of her own money and borrow the rest from her broker at an interest rate of 6% per year also. Answer (a), (b) and (c) above for your friend.

(e) Compare your answers to all the questions above and relate to the amount of money borrowed in your and your friend's investment.

Date pen High Low Close* Adj Close** Volume Sep 03, 2020 149.47 149.98 145.41 146.03 146.03 4,131,300

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer 6 COSH OF ShaHes 14603 X 10 14603 Amount barrowled 21...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started