Answered step by step

Verified Expert Solution

Question

1 Approved Answer

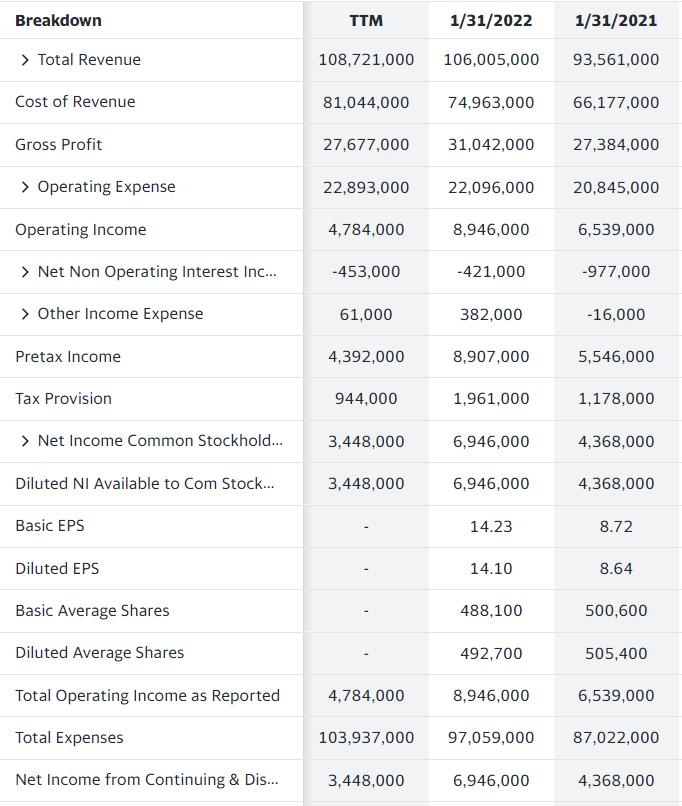

Using Targets--TGT 2021 annual report balance sheet and income statement please compute Targets: Current Ratio- Quick Ratio- Inventory Turnover- Days Sales Outstanding (DSO)- Debt Ratio-

Using Targets--TGT 2021 annual report balance sheet and income statement please compute Targets: Current Ratio- Quick Ratio- Inventory Turnover- Days Sales Outstanding (DSO)- Debt Ratio- Times Interest Earned- Net Profit Margin- Return on Common Equity- Based on the above calculations, how would you assess the financial strength of the company?

Breakdown > Total Assets > Total Liabilities Net Minority Int... > Total Equity Gross Minority Inte... Total Capitalization Common Stock Equity Capital Lease Obligations Net Tangible Assets Working Capital Invested Capital Tangible Book Value Total Debt Net Debt Share Issued Ordinary Shares Number 1/31/2022 1/31/2021 53,811,000 51,248,000 40,984,000 12,827,000 26,376,000 12,827,000 2,747,000 -174,000 12,171,000 16,467,000 12,171,000 13,772,000 12,794,000 36,808,000 471,274 14,440,000 471,274 25,976,000 26,547,000 27,120,000 14,440,000 2,429,000 631,000 13,772,000 15,109,000 11,813,000 500,877 500,877

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Current Ratio 186 Quick Ratio 139 Inventory Turnover 872 Days Sales Outstanding DSO 296 days Debt R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started