Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the 2022 annual report for Shopify Inc., Calculate the following ratios for the current and prior period with excel: a) Working Capital Ratio b)

Using the 2022 annual report for Shopify Inc., Calculate the following ratios for the current and prior period with excel:

a) Working Capital Ratio

b) Qucik Ratio

c) Profit Margin

d) Price to earnings ratio

e) Debt equity ratio

f) Return on assets

g) Return on equity

State the formulas used and show all supporting work. If any ratios are not relevant, please explain why.

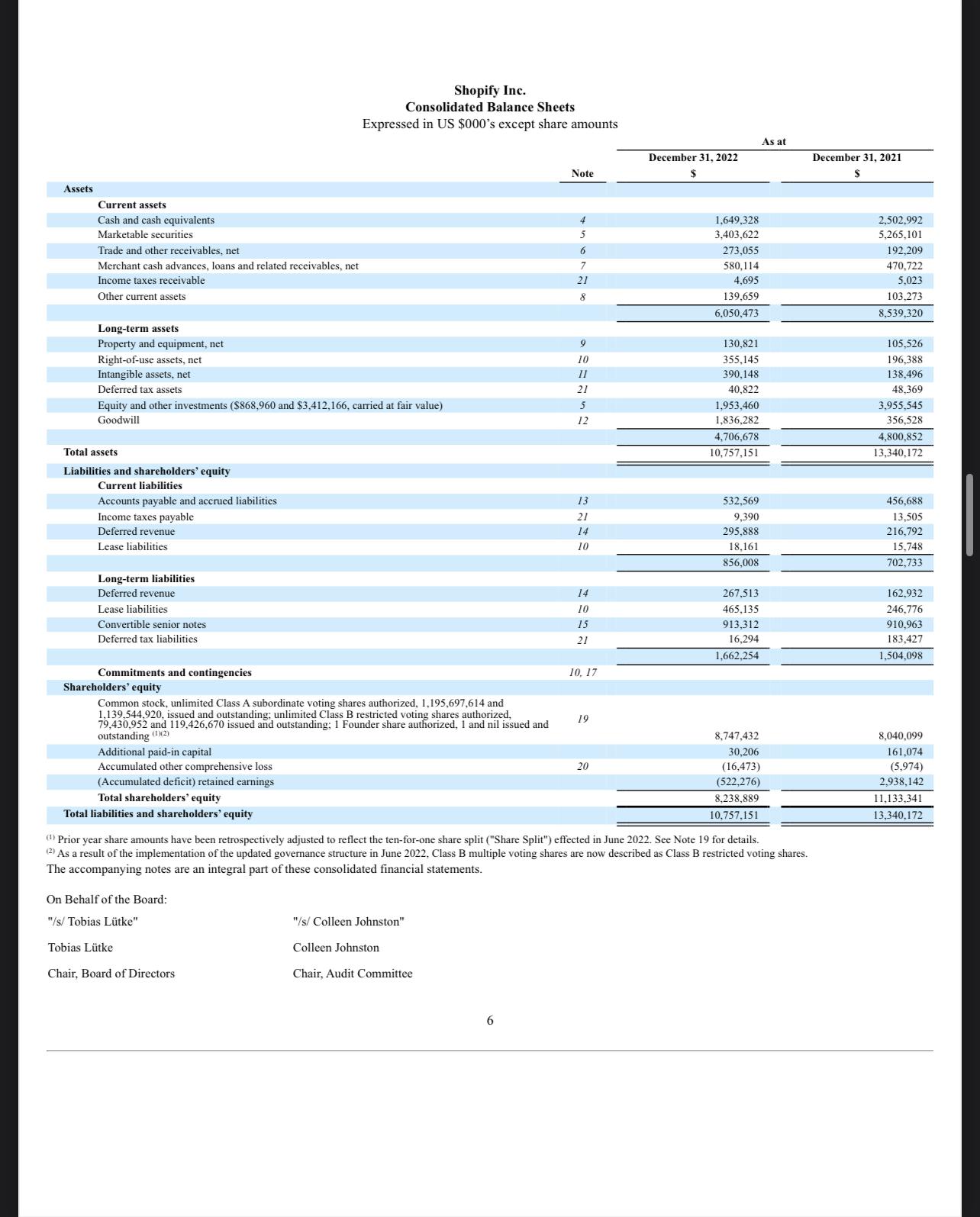

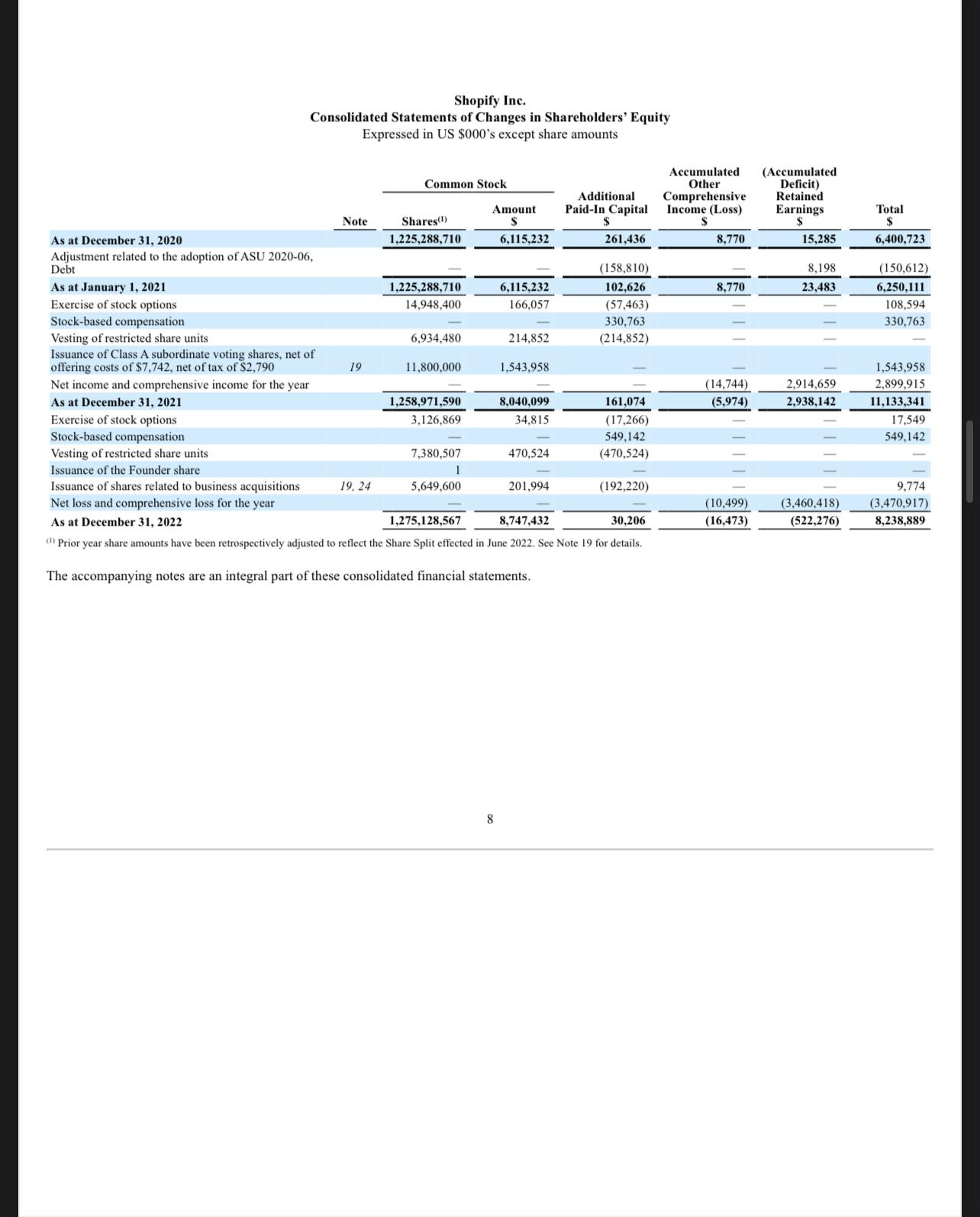

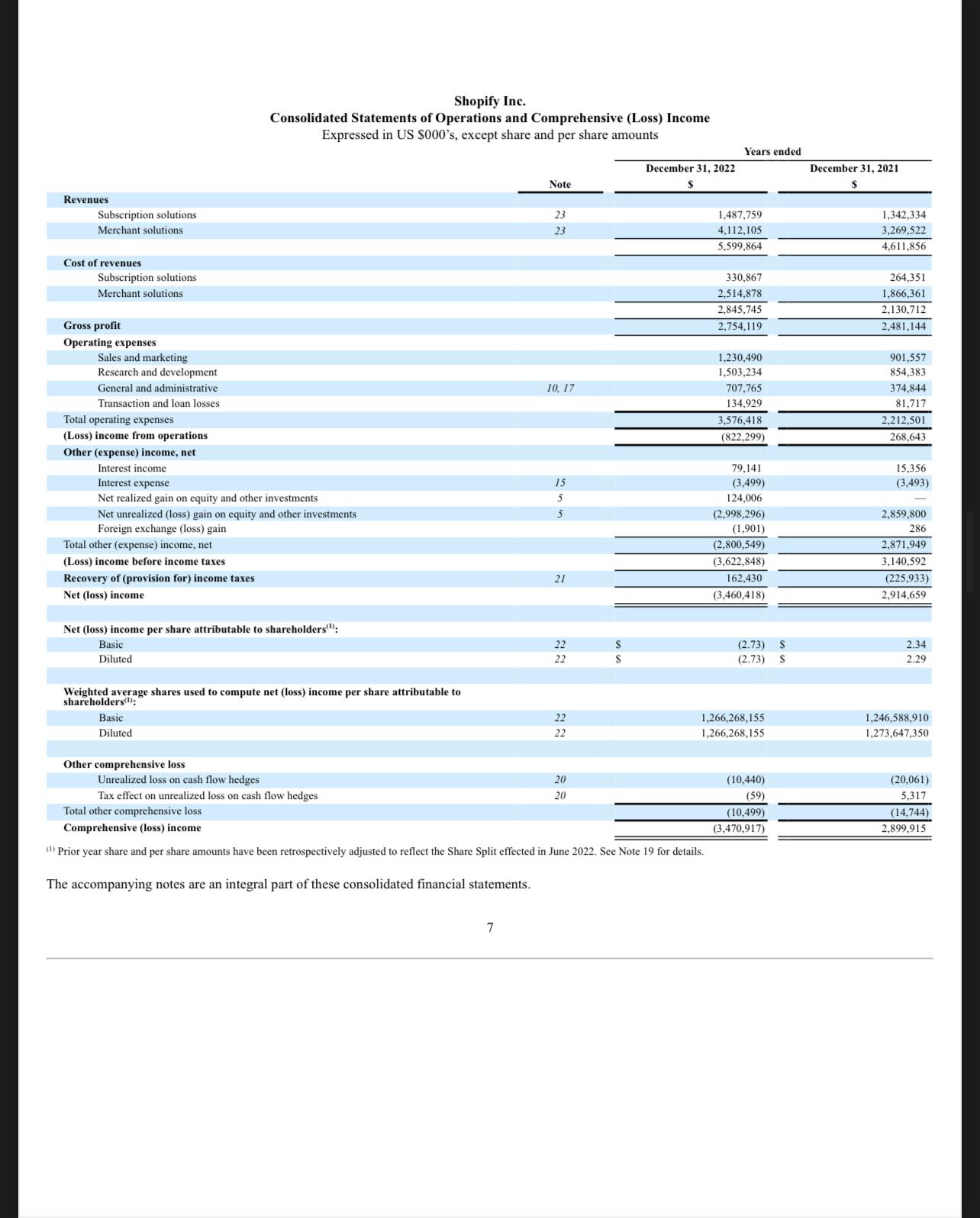

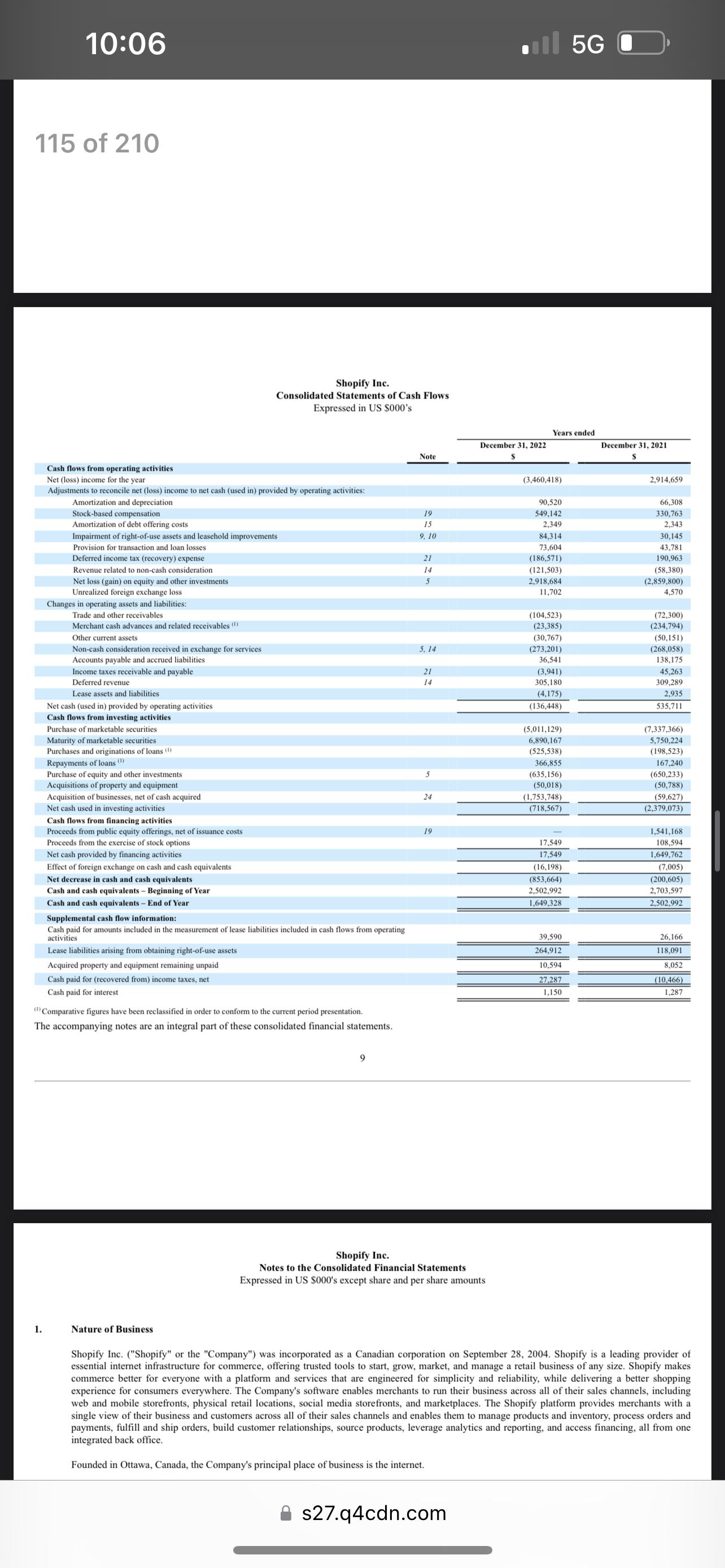

Assets Current assets Cash and cash equivalents Marketable securities Trade and other receivables, net Merchant cash advances, loans and related receivables, net Income taxes receivable Other current assets Long-term assets Property and equipment, net Right-of-use assets, net Intangible assets, net Deferred tax assets Equity and other investments ($868,960 and $3,412,166, carried at fair value) Goodwill Total assets Liabilities and shareholders' equity Current liabilities Accounts payable and accrued liabilities. Income taxes payable Deferred revenue Lease liabilities Long-term liabilities Deferred revenue Lease liabilities Convertible senior notes Deferred tax liabilities Commitments and contingencies Shareholders' equity Common stock, unlimited Class A subordinate voting shares authorized. 1,195,697,614 and 1,139,544,920, issued and outstanding; unlimited Class B restricted voting shares authorized. 79,430,952 and 119,426,670 issued and outstanding; 1 Founder share authorized, 1 and nil issued and outstanding (12) Additional paid-in capital Accumulated other comprehensive loss (Accumulated deficit) retained earnings Total shareholders' equity Total liabilities and shareholders' equity Shopify Inc. Consolidated Balance Sheets Expressed in US $000's except share amounts On Behalf of the Board: "/s/ Tobias Ltke" Tobias Ltke Chair, Board of Directors "/s/ Colleen Johnston" Colleen Johnston Chair, Audit Committee Note 6 4 5 6 7 21 8 9 10 11 21 5 12 13 21 14 10 14 10 15 21 10, 17 19 20 December 31, 2022 $ 1,649,328 3,403,622 273,055 580,114 4,695 139,659 6,050,473 130,821 355,145 390,148 40,822 () Prior year share amounts have been retrospectively adjusted to reflect the ten-for-one share split ("Share Split") effected in June 2022. See Note 19 for details. (2) As a result of the implementation of the updated governance structure in June 2022, Class B multiple voting shares are now described as Class B restricted voting shares. The accompanying notes are an integral part of these consolidated financial statements. 1,953,460 1,836,282 4,706,678 10,757,151 532,569 9,390 295,888 18,161 856,008 267.513 465,135 913,312 16,294 1,662,254 As at 8,747,432 30,206 (16,473) (522,276) 8,238,889 10,757,151 December 31, 2021 S 2,502,992 5,265,101 192,209 470,722 5,023 103,273 8,539,320 105,526 196,388 138,496 48,369 3,955,545 356,528 4,800,852 13,340,172 456,688 13,505 216,792 15,748 702,733 162,932 246,776 910,963 183,427 1,504,098 8,040,099 161,074 (5,974) 2,938,142 11,133,341 13,340,172

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for the requested ratios with the supporting work shown a Working Capital Ratio Formula Current Assets Current Liabilities 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started