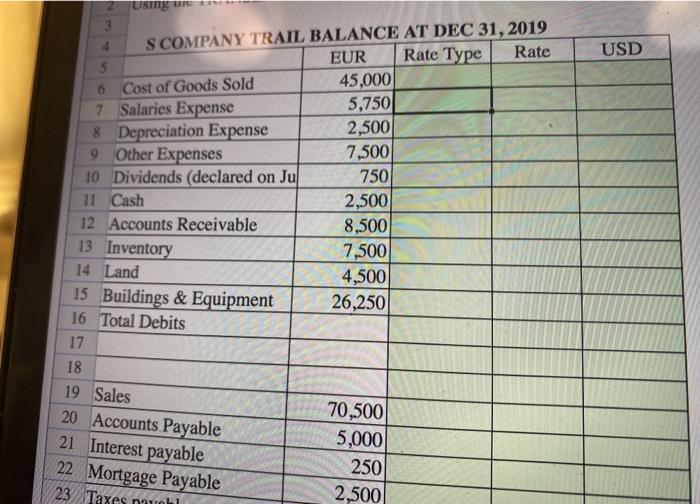

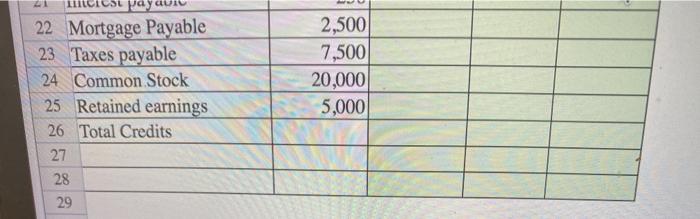

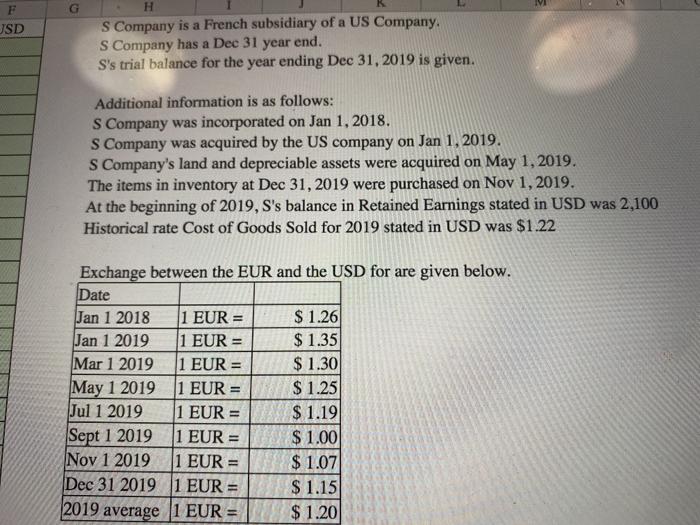

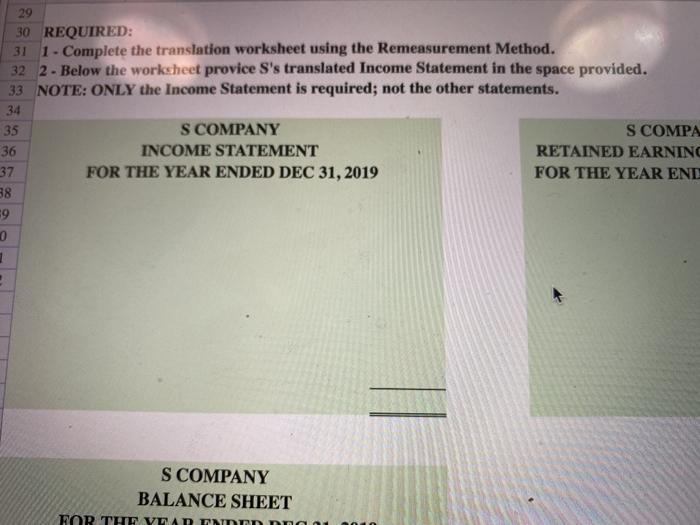

Using the 4 USD 3 S COMPANY TRAIL BALANCE AT DEC 31, 2019 EUR Rate Type Rate 5 45,000 6 Cost of Goods Sold 7 Salaries Expense 5,750 8 Depreciation Expense 2,500 9 Other Expenses 7,500 10 Dividends (declared on Ju 750 11 Cash 2,500 12 Accounts Receivable 8,500 13 Inventory 7,500 14 Land 4,500 15 Buildings & Equipment 26,250 16 Total Debits 17 18 19 Sales 20 Accounts Payable 21 Interest payable 22 Mortgage Payable 70,500 5,000 250 2,500 23 Taxes natal 21 22 Mortgage Payable 23 Taxes payable 24 Common Stock 25 Retained earnings 26 Total Credits 27 28 29 2,500 7,500 20,000 5,000 F JSD H s Company is a French subsidiary of a US Company. s Company has a Dec 31 year end. S's trial balance for the year ending Dec 31, 2019 is given. Additional information is as follows: S Company was incorporated on Jan 1, 2018. S Company was acquired by the US company on Jan 1, 2019. S Company's land and depreciable assets were acquired on May 1, 2019. The items in inventory at Dec 31, 2019 were purchased on Nov 1, 2019. At the beginning of 2019, S's balance in Retained Earnings stated in USD was 2,100 Historical rate Cost of Goods Sold for 2019 stated in USD was $1.22 Exchange between the EUR and the USD for are given below. Date Jan 1 2018 1 EUR = $ 1.26 Jan 1 2019 1 EUR = $ 1.35 Mar 1 2019 1 EUR = $ 1.30 May 1 2019 1 EUR = $ 1.25 Jul 1 2019 1 EUR = $ 1.19 Sept 1 2019 1 EUR = $ 1.00 Nov 1 2019 1 EUR = $ 1.07 Dec 31 2019 1 EUR = $ 1.15 2019 average (1 EUR = $ 1.20 29 30 REQUIRED: 31 1 - Complete the translation worksheet using the Remeasurement Method. 32 2 - Below the worksheet provice S's translated Income Statement in the space provided. 33 NOTE: ONLY the Income Statement is required; not the other statements. 34 35 S COMPANY S COMPA 36 INCOME STATEMENT RETAINED EARNING 37 FOR THE YEAR ENDED DEC 31, 2019 FOR THE YEAR END 38 59 0 2 3 S COMPANY BALANCE SHEET FOR THE YEAR ENDID Using the 4 USD 3 S COMPANY TRAIL BALANCE AT DEC 31, 2019 EUR Rate Type Rate 5 45,000 6 Cost of Goods Sold 7 Salaries Expense 5,750 8 Depreciation Expense 2,500 9 Other Expenses 7,500 10 Dividends (declared on Ju 750 11 Cash 2,500 12 Accounts Receivable 8,500 13 Inventory 7,500 14 Land 4,500 15 Buildings & Equipment 26,250 16 Total Debits 17 18 19 Sales 20 Accounts Payable 21 Interest payable 22 Mortgage Payable 70,500 5,000 250 2,500 23 Taxes natal 21 22 Mortgage Payable 23 Taxes payable 24 Common Stock 25 Retained earnings 26 Total Credits 27 28 29 2,500 7,500 20,000 5,000 F JSD H s Company is a French subsidiary of a US Company. s Company has a Dec 31 year end. S's trial balance for the year ending Dec 31, 2019 is given. Additional information is as follows: S Company was incorporated on Jan 1, 2018. S Company was acquired by the US company on Jan 1, 2019. S Company's land and depreciable assets were acquired on May 1, 2019. The items in inventory at Dec 31, 2019 were purchased on Nov 1, 2019. At the beginning of 2019, S's balance in Retained Earnings stated in USD was 2,100 Historical rate Cost of Goods Sold for 2019 stated in USD was $1.22 Exchange between the EUR and the USD for are given below. Date Jan 1 2018 1 EUR = $ 1.26 Jan 1 2019 1 EUR = $ 1.35 Mar 1 2019 1 EUR = $ 1.30 May 1 2019 1 EUR = $ 1.25 Jul 1 2019 1 EUR = $ 1.19 Sept 1 2019 1 EUR = $ 1.00 Nov 1 2019 1 EUR = $ 1.07 Dec 31 2019 1 EUR = $ 1.15 2019 average (1 EUR = $ 1.20 29 30 REQUIRED: 31 1 - Complete the translation worksheet using the Remeasurement Method. 32 2 - Below the worksheet provice S's translated Income Statement in the space provided. 33 NOTE: ONLY the Income Statement is required; not the other statements. 34 35 S COMPANY S COMPA 36 INCOME STATEMENT RETAINED EARNING 37 FOR THE YEAR ENDED DEC 31, 2019 FOR THE YEAR END 38 59 0 2 3 S COMPANY BALANCE SHEET FOR THE YEAR ENDID