Question

Using the above company statements, please complete the ratio analysis below. What is the current Ratio for all years? (2.5 Marks )

Using the above company statements, please complete the ratio analysis below.

What is the current Ratio for all years? (2.5 Marks)

What is the Quick Ratio for all years? (2.5 marks)

What is the return on sales for all years? (2.5 Marks)

What is the Gross Profit Margin for all years? (2.5 Marks)

What is the Return on Investment for all years? (2.5 Marks)

What is the inventory turnover for all years? (2.5 Marks)

Using the inventory turnover from above, what is the Average Sale Period? (2.5 Marks)

Explain the difference between Managerial and Financial and the importance of both (2.5 Marks)

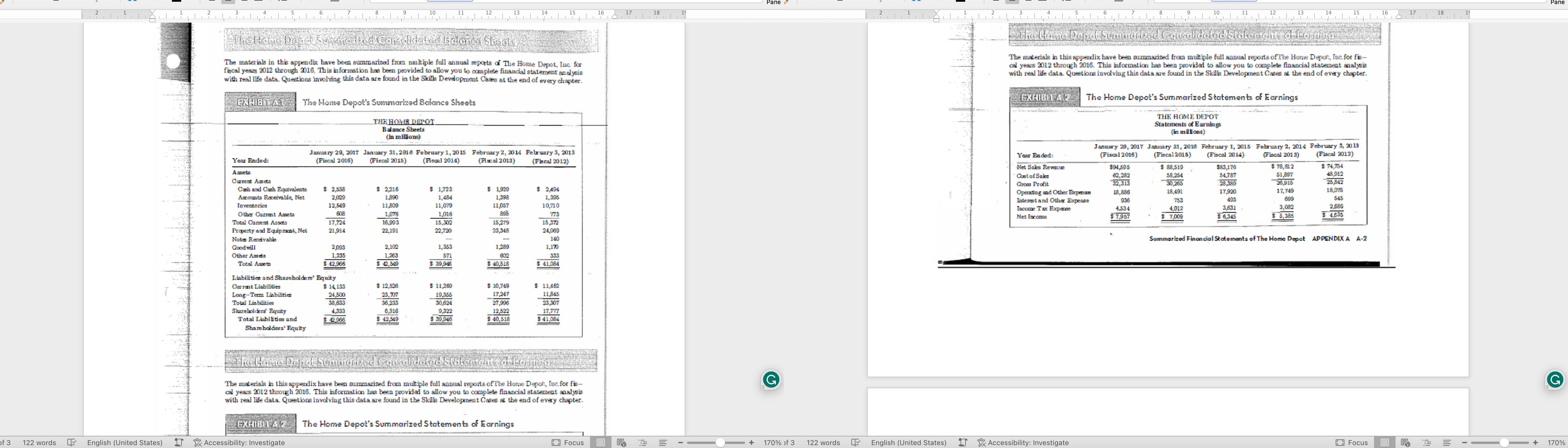

of 3 I 2 I 1 I I 122 words English (United States) 2 I 3 4 EXHIBIT A1 5 Year Ended: Assets Current Acts Cash and Cash Equivalents Total Annets Accounts Receivable, Net Inventories Other Current Amets Total Current Assets Property and Equipment, Net Notes Receivable Goodwill Other Assets Shareholders' Equity Total Liabilities and Liabilities and Shareholders' Current Liabilities Long-Term Liabilities Total Liabilities Shareholders' Equity EXHIBIT A.2 6 Accessibility: Investigate The Home Depot Surmonted Consolidated Balance Sheets, The materials in this appendix have been summarized from multiple full annual reports of The Home Depot, Inc. for fiscal years 2012 through 2016. This information has been provided to allow you to complete financial statement analysis with real life data. Questions involving this data are found in the Skills Development Cases at the end of every chapter. The Home Depot's Summarized Balance Sheets January 29, 2017 (Fiscal 2016) $ 2,538 2,029 12,549 608 17,724 21,914 2,093 1,235 $ 42,966 8 Equity $ 14,133 24,500 38,633 4,333 $ 42,966 THE HOMIR DEPOT. Balance Sheets (in millions) $ 2,216 1,890 11,809 9 1,078 16,993 22,191 10 January 31, 2016 February 1, 2015 (Fiscal 2015) (Fiscal 2014) 2,102 1,263 $ 42,549 $ 12,526 23,707 36,233 6,316 $ 42,549 $ 1,723 1,484 11,079 1,016 11 15,302 22,720 1,353 571 $ 39,946 $ 11,269 19,355 30,624 9,322 $ 39,946 12 $ 1,929 1,398 11,057 895 15,279 23,348 1,289 602 $ 40,518 13 February 2, 2014 February 3, 2013 (Fiscal 2013) (Fiscal 2012) $ 10,749 17,247 I 27,996 12,522 $ 40,518 14 $ 2,494 1,395 10,710 773 15,372 24,069 140 1,170 15 $ 41,084 $ 11,462 11,845 23,307 17,777 $41,084 The Home Depot Sumurarized Consolidated Statements of Logic The materials in this appendix have been summarized from multiple full annual reports of The Home Depot, Inc. for fis- cal years 2012 through 2016. This information has been provided to allow you to complete financial statement analysis with real life data. Questions involving this data are found in the Skills Development Cases at the end of every chapter. The Home Depot's Summarized Statements of Earnings Focus 16 17 18 ||||| 19 Pane G + 170% of 3 2 T 1 1 1 122 words English (United States) 2 3 4 EXHIBIT A.2 Year Ended: Net Saks Revenue Cost of Sales Grom Profit 5 Accessibility: Investigate 6 Operating and Other Expensam Interest and Other Expense Income Tax Experse Net Income 8 January 29, 2017 (Fiscal 2016) $94,595 62,282 32,313 18,886 936 4,534 $7,957 9 The Home Depot Summarized Consolidated Statements of Loun The materials in this appendix have been summarized from multiple full annual reports of The Home Depot, Inc. for fis- cal years 2012 through 2016. This information has been provided to allow you to complete financial statement analysis with real life data. Questions involving this data are found in the Skills Development Cases at the end of every chapter. 10 The Home Depot's Summarized Statements of Earnings THE HOME DEPOT Statements of Earnings (in millons) $ 88,519 58,254 30,265 18,491 753 4,012 $ 7,009 11 12 $83,176 54,787 28,389 17,920 493 3,631 $ 6,345 13 January 31, 2016 February 1, 2015 February 2, 2014 February 3, 2013 (Fiscal 2015) (Fiscal 2013) (Fiscal 2014) (Fiscal 2012) $ 78,812 51,897 26,015 17,749 699 14 3,082 $ 5,385 15 $ 74,764 48,912 25,842 18,078 545 2,686 $ 4,535 Summarized Financial Statements of The Home Depot APPENDIX A A-2 Focus 16 17 18 19 Pane G + 170%

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Financial Ratio Analysis Current Ratio The current ratio is a measure of a companys ability to meet its shortterm obligations It is calculated by dividing the companys current assets by its current li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started