Answered step by step

Verified Expert Solution

Question

1 Approved Answer

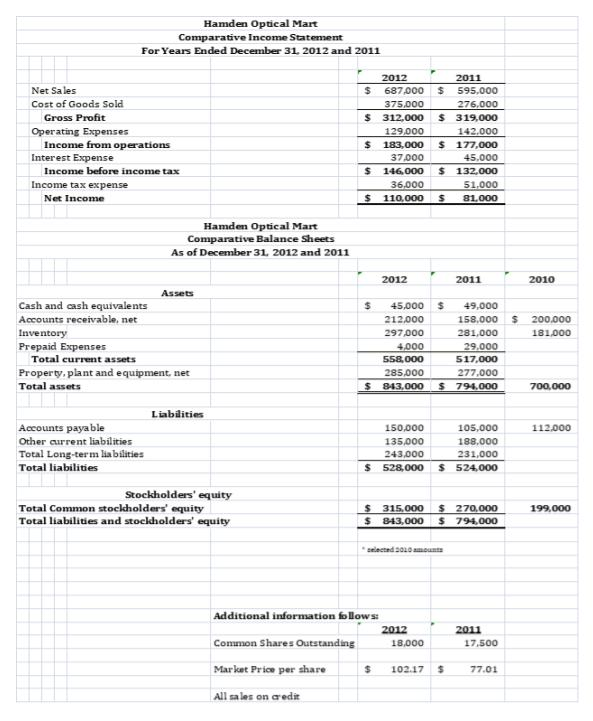

Using the above Financial Statements with a tax rate of .25, calculate the following: Asset Turnover Return on Assets Return on Equity Debt to Equity

Using the above Financial Statements with a tax rate of .25, calculate the following:

- Asset Turnover

- Return on Assets

- Return on Equity

- Debt to Equity

- Times Interest Earned

- Current Ratio

- Quick Ratio (Acid Test)

- Working Capital

- Days Sales Outstanding

- Days Inventory

Hamden Optical Mart Comparative Income Statement For Years Ended December 31, 2012 and 2011 Net Sales Cost of Goods Sold Gross Profit Operating Expenses Income from operations Interest Expense Income before income tax Income tax expense Net Income 2012 $ 687.000 375,000 $ 312.000 129,000 $ 183,000 37.000 $ 146,000 36,000 $ 110,000 2011 $ 595,000 276,000 $319,000 142.000 $ 177,000 45.000 $ 132,000 51.000 $ 81.000 Hamden Optical Mart Comparative Balance Sheets As of December 31, 2012 and 2011 2012 2011 2010 200.000 181,000 Assets Cash and cash equivalents Accounts receivable, net Inventory Prepaid Expenses Total current assets Property, plant and equipment net Total assets $ 45,000 212,000 297,000 4,000 558,000 285,000 $ 843,000 $ 49,000 158,000 281,000 29.000 517,000 277,000 $ 794.000 700,000 112.000 Liabilities Accounts payable Other current liabilities Total Long-term liabilities Total liabilities Stockholders' equity Total Common stockholders' equity Total liabilities and stocldholders' equity 150.000 135,000 243,000 $ 528,000 105,000 188.000 231,000 $ 524,000 199,000 $ 315.000 $ 843,000 $ 270,000 $ 79-4,000 selected 2010 Additional information follows: 2012 18,000 2011 7.50 Common Shares Outstanding Market Price per share All sales on credit $ 102.17 $ 77.01

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started